Flutter Entertainment now owns the entirety of FanDuel, announcing on Thursday that it is buying out the remaining 5% stake from Boyd in a deal that values the market-leading operator at $31 billion.

Flutter will pay $1.755 billion for the remaining 5% of the business. This would suggest 100% of the shares would be valued at $35 billion. However, media giant Fox Corp holds an option where it could acquire an 18.6% stake in the operator at a set price, as long as it holds a U.S. license. When this option is accounted for, FanDuel is worth $31 billion.

That means FanDuel is worth more than 100 times its value in 2018, when Flutter acquired a 61% stake in what was then a daily fantasy sports operator for $158 million. It paid $4.18 billion to buy out the 37% stake held by investment consortium Fastball in 2020, meaning that in total Flutter has paid around $6.1 billion to obtain the entirety of FanDuel.

“Our acquisition of FanDuel in 2018 is one of the most transformational events in our group’s history,” FanDuel CEO Peter Jackson said. “I am really pleased to drive future value for our shareholders by increasing our ownership of FanDuel to 100 percent.”

Boyd will use the proceeds of the deal to pay down its debts.

“This transaction unlocks the tremendous unrealized value that our investment in FanDuel has created for our company,” Keith Smith, president and CEO of Boyd, said. “As a result, we are in a significantly stronger financial position to continue executing our strategy of investing in our properties, pursuing growth opportunities, returning capital to our shareholders, and maintaining a strong balance sheet.”

FanDuel saves money on market access

As part of the deal, FanDuel will also extend its market access partnership with Boyd, which allows it to use Boyd’s casino licenses to gain access to the legal sports betting market in states where partnership with a land-based casino is a requirement, until 2038.

FanDuel’s agreement to operate retail sportsbooks at Boyd’s casinos, however, will only last until “mid-2026,” after which Boyd will operate the books.

Flutter said the extension comes with “significantly reduced market access costs,” which will save the business $65 million a year.

Flutter said that those savings will help it to mitigate “both recent and future tax increases.” States like Illinois and New Jersey have recently increased taxes on sports betting. Jefferies analysts James Wheatcroft and David Katz noted that the savings should be almost exactly equal to the cost of the New Jersey tax hike.

‘Win/win for both companies’

Truist analyst Barry Jonas described the deal as “win/win for both companies” in a note to clients. He estimates that the $80-85 million in reduced interest costs from reducing Boyd’s debt profile would outweigh the lost market access revenue.

“We think investors had never ascribed much value to BYDs 5% FanDuel stake as the company trades at ~8x 2026 EBITDA [earnings before interest, tax, depreciation, and amortization] despite owning most of its real estate.

“Online EBITDA is expected to decrease by ~$50-55M in 2026 which would equate to $300M in after tax losses or -$4/share. That said, we think lower fees once the current agreement expired in mid-2028 were inevitable given changing market dynamics.”

He added that Boyd’s reduced debt could put share buybacks, special dividends, or acquisitions on the table.

Wheatcroft and Katz noted that the Fox option “will likely be discussed to a greater extent” now that there is a clear datapoint that suggests the option’s strike price is a discount compared to FanDuel’s market value. Under the option, Fox can buy the 18.6% stake for $4.5 billion. The figure will rise by 5% every year.

Shares in Flutter and Boyd both rose modestly on Thursday, when the deal was reported by Sky. Flutter gained 1.1% to $289.58, giving it a market cap of $51.1 billion. Boyd shares closed up 1.5% at $85.37, making the company worth $6.95 billion.

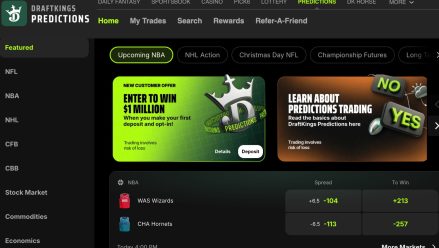

However, the big winners were shareholders in DraftKings. FanDuel’s biggest rival rose by 4.1% to $44.57 a share — valuing the business at $22.1 billion — as the deal suggested its shares were undervalued by comparison.