ESPN Bet owner Penn Entertainment has hit back at activist investor HG Vora, accusing its third largest shareholder of “value-destructive” and “short-sighted” decisions while doubling down on its digital strategy.

Penn and HG Vora have been engaged in a battle over the strategy of the business, which has not recovered from a share price collapse in 2021 and 2022.

HG Vora has called Penn’s online sports betting strategy into question. It wants Penn to stop committing resources to an online betting division that it says has failed.

“By nearly all relevant measures, the company is less profitable and less valuable than it was before the company embarked on its digital transformation,” HG Vora said in a recent press release.

The casino business bought media site Barstool in 2020 in order to launch Barstool Sportsbook but, after struggling to gain market share, it shuttered the brand and partnered with ESPN instead in a $1.5 billion deal.

The investment fund is particularly unsatisfied with the performance of Penn CEO Jay Snowden, who received $26.7 million in compensation last year. The fund argues he is responsible for the company’s digital underperformance. It has also pushed for more cash to be returned to shareholders.

HG Vora beneficially owns 7.25 million shares of Penn common stock. Only index funds giants BlackRock and Vanguard own more shares.

In January, HG Vora attempted to exert more influence over Penn — and potentially set the scene to oust Snowden by proposing new directors Johnny Hartnett, Carlos Ruisanchez, and William Clifford — to Penn’s board.

Penn agreed to nominate Hartnett and Ruisanchez, but it eliminated a third seat that would have been up for election.

Earlier this month, HG Vora sued Penn over that decision, arguing it “violated core shareholder rights.”

Penn calls HG Vora ideas ‘value-destructive’

On Thursday, Penn hit back with a letter that reinforced its digital strategy and slammed HG Vora.

“Over the course of our engagement, HG Vora has consistently made demands of the company that would have been value-destructive and that were short-sighted, short-term and self-serving in nature, demonstrated flagrant disregard for the views and directives of state gaming authorities, and rejected each of our reasonable offers to reach a mutually agreeable resolution,” Penn said.

“Given these actions, we believe HG Vora is intent on ensuring all three of its candidates are appointed to the board, regardless of their suitability and qualifications, and despite only two seats being available for election at this year’s annual meeting –– all at the expense of the company and its shareholders.”

Penn said its digital business is “already delivering results” and should be profitable –– at least, in terms of adjusted earnings before interest, tax, depreciation, and amortization –– this year.

“The board and management team continue to aggressively assess the progress in [Penn] Interactive in line with our strategic priorities, and the board maintains strategic optionality with regard to its investments in digital,” the letter said.

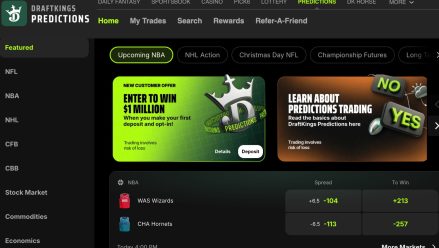

An announcement from ESPN earlier this week also suggested that both the Disney-owned sports media giant and Penn remain committed to the ESPN Bet venture, for now at least. ESPN unveiled a new $29.99-per-month streaming service, set to go live this fall, which it says will include betting and fantasy tie-ins.

In addition, Penn questioned the idea that HG Vora knew better than its management when it came to digital strategy. It claims the fund’s management “expressed enthusiastic support for the ESPN partnership” during a 2023 meeting.

Penn argues that HG Vora’s plan to return cash to shareholders with a buyback is “ill-advised” as it relies on not counting rent as debt and would require a pause in upgrades to a number of Penn’s casinos.

The letter comes just days after Penn reported slightly underwhelming first-quarter revenue figures of $1.67 billion. During an earnings call after the results announcement, Snowden noted that both his business and ESPN have the option to renegotiate or end their partnership in 2026 if they feel it isn’t working.

Penn shares were little changed in early Friday trading, continuing to hover around Thursday’s closing price of $15.87.