Hours after the final 5% of FanDuel was purchased by Flutter Entertainment on Thursday, pegging the gambling behemoth with a $31 billion valuation, Cesar Fernandez, the company’s head of government affairs in the United States, sat before a room of regulators and politicians at the National Council of Legislators from Gaming States (NCLGS) conference and tried to explain how spiking tax rates were strangling business.

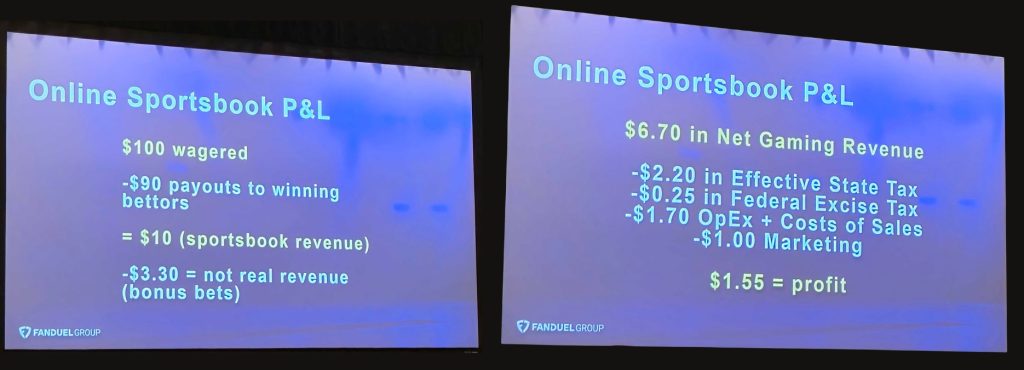

The argument came down to two numbers, one large and one quite miniscule:

- $5 billion, the amount FanDuel has paid in state taxes since the repeal of the Professional and Amateur Sports Protection Act (PASPA) in 2018.

- $1.55, the realized profit every sportsbook derives, he claimed, citing collective industry data, from every $100 wagered when accounting for promotions, taxes, marketing, and a myriad of other fingers in the proverbial pot.

“Let’s say that the public did 1 percent better and just won a little bit more than they do on average. And the state says, ‘You know what? Your tax rate may be too low. We’re going to just increase it 10 percentage points.’ This is what the [profit and loss] will take. We lose money,” Fernandez said.

Flutter said in a March earnings report that FanDuel — which controls 43% of the U.S. sports betting market — posted a profit of $162 million last year after absorbing a loss in 2023. And while Fernandez acknowledged that FanDuel and its competitors could reduce operational expenditures, the result, he said, wouldn’t be pleasant for the public.

“But these mitigation strategies are really condensed. … Fewer promotions, worse odds, which is not necessarily friendly to the consumer,” he said.

2025 has been a taxing year for gambling companies

Escalating gambling taxes has been a theme this year.

New Jersey is increasing its rates for mobile sports betting and iGaming from 13% and 15%, respectively, to 19.75%. Maryland’s tax on online betting increased to 20% from 15%. Louisiana’s rate will jump from 15% to 21.5% on Aug. 1, marking a compromise from the 30% some there sought.

On July 1, Illinois implemented a revolutionary per-wager tax on online sports bets, where sportsbooks will be taxed 25 cents for each of the first 20 million wagers and 50 cents beyond. Only DraftKings and FanDuel would have reached the higher fee rate last year.

In Illinois, sportsbooks have responded by adding surcharges to wagers.

Fernandez’s solution: Lore states should legalize online casino play and allow sportsbook operators to work with regulators and legislators to “really align on forecasting future revenue.” There’s currently a wide disconnect, he said, between the funds that lawmakers believe are available to them through higher taxes and those that are needed to sustain a business.

Fernandez said a state budget director told him earlier this year he hoped to raise $10 million by raising sports betting taxes. He responded by informing the director that $10 million could be accounted for simply from the growth FanDuel projected in the state, assuming the tax rate didn’t change.

“That growth rate was wildly off from what the state was actually projecting. So my ask is that we have a collaborative approach with the industry, which has invested millions of dollars in financial abilities to forecast future revenue,” Fernandez said. “And it’s a pretty good idea because we have to report our future guidance to Wall Street and whatnot.”

States, facing shortfalls, eye gambling pot

Matthew Oyster, the chief legal counsel of the Ohio Senate, said at the NCLGS meeting that he understood “breaking points” but presaged bigger asks from legislators in an era of federal budget cuts. He noted that while the sports betting industry did “an effective job” of initially convincing the Ohio legislature that as a “different species” of gambling it should be taxed at only 10%, a review later determined that level to be inequitable.

In 2023, Ohio doubled the tax rate for online sports betting to 20% but Gov. Mike DeWine still wants 40%. Budgetary targets figure to make sports betting a well-tapped resource in the future, perhaps burnishing tax revenue from casinos and the state lottery, which fund education and other state programs.

“The state was able to pass a balanced budget, including a state income tax reduction that would get Ohio to a flat tax in 2026 of 2.75 percent, which has been a big initiative of the General Assembly over the last 20 or so years,” Oyster said. “But the General Assembly and future governors, as Gov. DeWine is going to be term-limited out, may look to get Ohio to a 0 percent state income tax. And if that’s going to be the case, there’s going to be alternative sources of revenue that’s looked for. And naturally, I think … gaming seems to be ripe for an area to tax.”

That potentially includes filling what Oyster called a “multi-multi-million-dollar hole” if the state pursues a potential constitutional amendment that would eliminate property taxes.

Still, he understands there is the potential for a sportsbook exodus if a state taxes beyond the value of the market.

“I just think that there are a number of considerations and things that may happen that are specific to your state that may impact the way in which you view the need for the taxation,” he said. “If you’re a state like New York, you can get it at the 50-plus percent, or you can have a monopolistic market and put it at 51 percent, and the industry is willing to compete for that. But in other markets, you certainly want to find the right spot to sustain the market and generate the revenue.”

“Gaming seems to be ripe for an area to tax.”

— Ohio Senate Chief Legal Counsel Matthew Oyster

Taxing a vice industry is an easy avenue, said Brad Fischer, an attorney at the Orrick law firm who represents the Sports Betting Alliance (SBA), comprised of bet365, BetMGM, DraftKings, Fanatics, and FanDuel.

“Just because something is viewed as having a sin tax or [is] not necessarily within the general acceptable morality of other people does not mean that that thing is meeting business pressures,” he observed. “It is not given special durability because it used to be something illegal and therefore it can stand up to any type of taxation rate, it can stand up to any type of fee structure, etc.”

And even if not, he continued, the mindset among some legislators regarding gambling operators remains, “They’ve got it covered. They can earn their way out of this. And if they can’t, who gives a s***, because I don’t really like what they do anyway.”