Kalshi has listed its first player prop bets, allowing users to stake money on individual touchdown scorers in NFL games.

Bets on first, next, and anytime touchdown scorers — as well as players to score multiple touchdowns — are now listed on the Kalshi site for all Week 1 NFL matchups, seemingly going live at some point on Thursday afternoon. The new markets went up just in time for Thursday night’s season opener between the Eagles and the Cowboys.

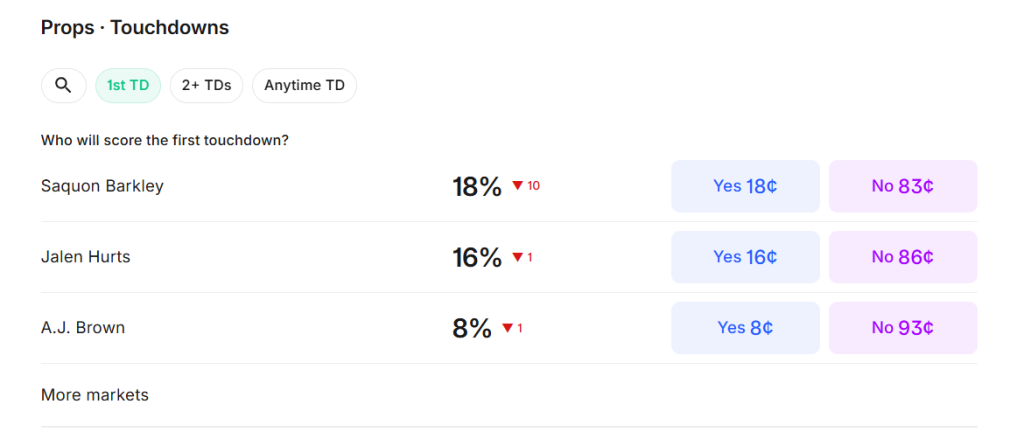

Outside of the season opening game, most of these markets have minimal levels of trading volume or liquidity so far. However, the order book for key Eagles and Cowboys players is much stronger, with “buy” and “sell” prices for both teams’ star skill-position players to score priced only one cent apart, and thousands of dollars worth of open trades available for bettors to take on both sides.

Currently, the only prop bets available are related to whether a player will score a touchdown, so betting is not available on yardage or defensive stats. Kalshi’s rulebook for the market also specifies that its touchdown markets refer only to the player who actually possesses the ball in the end zone, which is consistent with the grading of similar markets at traditional sportsbooks. For example, this means that a quarterback’s passing touchdowns do not count, as these are attributed only to the receiver of that touchdown pass.

Kalshi’s offering gets … more sportsbook-like

The move is the latest foray for Kalshi into markets traditionally occupied by sportsbooks.

The business self-certified to offer player touchdown props last month, at the same time that it self-certified to offer bets on point spreads and totals. Self-certification is a process by which a registered exchange tells the Commodity Futures Trading Commission (CFTC) that it plans to list a new type of market — if the CFTC doesn’t take action, the market is assumed to be allowed.

While the prediction market posted markets for spreads and totals for NFL preseason games within a day of self-certification, it didn’t put up any props at first. Player snap counts can be harder to project for preseason games, and big-name stars are less likely to have a significant role, so Kalshi may have opted to wait for the regular season for this reason.

Kalshi does not appear likely to offer prop bets on college players this season. A spokesperson told InGame last week that the prediction market has “no immediate plans” to offer college props. The NCAA has argued that prop bets on college players should be banned, citing player harassment and integrity concerns. Some states such as Ohio and Maryland have taken that advice, and do not let sportsbooks offer those markets.

Are parlays next?

With props now available, Kalshi may continue to expand its offering with parlays. On Tuesday, the prediction market self-certified to offer a new type of contract made up of multiple “component” parts, with payouts determined by multiplying the odds of its components.

The self-certification said Kalshi would list those contracts by the close of business Wednesday, but it has not done so yet. Kalshi does not always list contracts on the date mentioned on self-certification filings. For example, the filing for player touchdown markets said that these bets would go live on Aug. 18.

The exchange did offer pre-built parlays around the Oscars and Grammys, but has not yet offered any similar markets for sports.

The markets may not be a huge driver of activity unless they are also listed on Robinhood, which partnered with Kalshi earlier this year to offer sports event contracts within its app. Robinhood’s reach is vast: It is believed to have in excess of 10 million active users on its platform in the U.S.

Robinhood was responsible for the majority of trading volume on Kalshi during the second quarter of the year, and while it offers access to Kalshi’s football markets, a spokesperson told InGame that for now it is focusing on game outcomes. During the first week of the college football season, bets on spreads and totals made up less than 1% of Kalshi’s total NCAA football volume for the day, with the low takeup likely at least partly due to their lack of availability on Robinhood.

Kalshi regulatory status

Kalshi is regulated by the CFTC, and argues that its so-called event contracts are legally “swaps,” a form of financial product. The exchange first started offering sports event contracts in January, and these contracts — where users can stake money on the outcome of a sporting event — have grown to make up a majority of trading volume on the site.

States such as New Jersey, Nevada, and Maryland have argued that its products violate state gambling laws, but Kalshi says the federal Commodity Exchange Act means that only the CFTC has jurisdiction to determine if its contracts are permissible. Despite states’ efforts, Kalshi’s sports contracts are available in all 50 states.