Earlier this year, NASA scientists announced that they had calculated a 2.3% chance that an asteroid known as 2024 YR4 may collide with Earth in December 2032, causing untold destruction. For most people, this figure registered as a distant concern, while in the ranks of professional gamblers and probabilistic thinkers, well, 43-to-1 longshots do come home, pretty regularly actually.

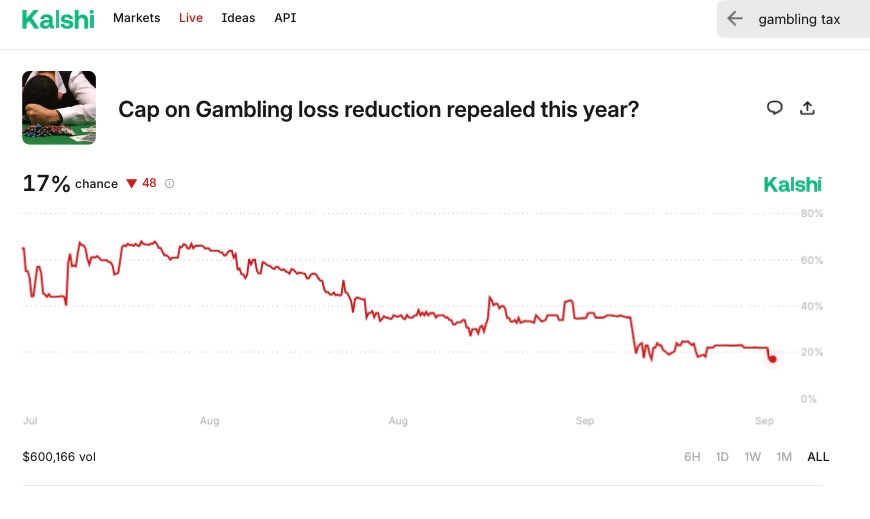

People in the U.S. who gamble professionally are once again sounding the alarm about a potential deep impact event. But in this case the wrecking ball is a man-made, fundamentally unfair tax policy threaded into the 900–plus page One Big Beautiful Bill Act (OBBB) passed under duress on July 4. It is set to go into effect in 2026, unless the bipartisan legislative effort to unwind the tax provision succeeds.

Yet, once again, the only cohort that seems consistently disturbed by the gravity of the threat is … professional gamblers, including sports betting, poker, and daily fantasy sports (DFS) pros operating on narrow margins, many of which have stated that the newfangled tax policy would force them to exit the regulated ecosystem, if not the gambling trade entirely.

“The threat emerges from the intersection of three critical factors: the industry’s dependence on high-value customers, the emergence of other platforms as viable alternatives, and the OBBB’s creation of phantom income taxation that makes regulated betting economically irrational for professional and sophisticated recreational players,” writes Adam Robinson, an Illinois-based sports bettor who is a board member of American Bettors’ Voice (ABV), in a paper calling the provision an “existential threat” that may “devastate the regulated model and state budgets.”

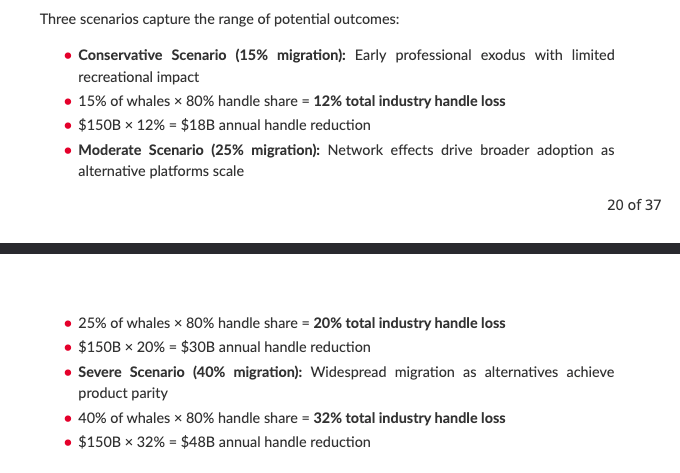

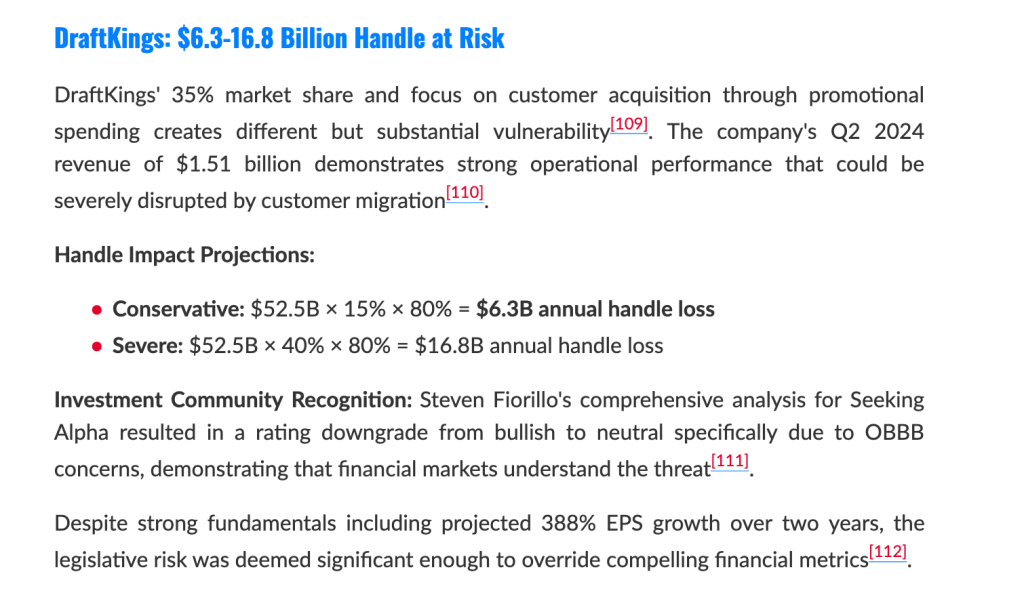

Robinson’s position paper, first reported on by InGame, tabulates three migration scenarios to illustrate the potential impact on the regulated market if high-volume professionals, and “high value” recreational VIP players (known colloquially as “whales”), take their bags and go elsewhere, namely, to federally regulated prediction markets, to offshore sportsbooks, or simply out of the gambling realm entirely.

Loss Limitation Could Devastate the Regulated Model…and State Budgets

“The extreme concentration of sports betting handle creates a mathematical framework for projecting industry impact from customer migration,” writes Robinson. “With 10% of bettors generating 80% of handle, relatively small percentage migrations of high-value customers translate to massive industry-wide disruption.”

The new tax policy at the heart of the controversy, designed to raise $1.1 billion for the federal government over eight years, barely qualifying as pencil dust, limits filers to deductions of 90% of actual gambling losses — as opposed to 100%, the previous threshold. The functional consequences includes absurdities such as “phantom income” scenarios, where bettors owe substantial taxes on money they never actually won.

“The provision becomes even more punitive in break-even scenarios,” Robinson explains. “A bettor with $100,000 in winnings and $110,000 in losses — a $10,000 net loss — would still owe taxes on $1,000 of phantom income under the new rules. They pay taxes while actually losing.”

Ultimately, the financial projections for the operators and state regulators are stark: Conservative scenarios project $18 billion in annual handle loss, while severe scenarios exceed $48 billion — representing up to one-third of the entire regulated sports betting market.

Undercurrent of uncertainty

The migration numbers ought to be alarming for gambling firms and state regulators who may soon preside over cratering revenue totals, yet, a sense of uncertainty abounds, and that has led to something resembling paralysis or inaction. We can be reasonably sure at least that edge- and margin-minded pros will ship out to friendlier waters.

“This paradox — that sportsbooks’ least profitable customers are their most valuable market participants — mirrors dynamics across gambling and financial markets where sophisticated players extract profits while providing essential liquidity, price discovery, and ecosystem credibility that attracts the recreational majority who generate actual revenue,” writes Robinson.

(Disclosure: the author of this article is formerly a member of the ABV’s advisory board who stepped down from the board in December 2024.)

But as for the recreational VIPs at the foundation of the revenue pies for the U.S. online sports betting duopoly of FanDuel and DraftKings? It’s unclear how many, or how few, of these types are filing their taxes in such a way that contemplates gambling losses and wins.

It’s a delicate ecosystem, and we’re on track to find out what happens when you meaningfully change the water temperature, eliminating much of whatever sharp money remains at the mainstream books.

“I think when looking at Adam’s argument, you need to look at it from a risk standpoint, not unlike the case of parachute cords,” said ABV CEO Richard Schuetz. “If your parachute cords are too strong, there is a bit of material wasted. If they are too weak, it is catastrophic. Given that, I believe that everyone in the betting ecosystem who wants a sustainable system should try to stop this tax change.”

Robinson explains that for sophisticated, high-income individuals already comfortable with investment platforms and tax optimization strategies, the regulatory arbitrage opportunity in shifting to prediction markets for betting (“trading”) on sports, becomes compelling. The prediction markets currently making hay in the sports betting realm, a separate source of pressure on incumbent sportsbooks and state regulators, are overseen by the federal Commodity Futures Trade Commission (CFTC). Under that regime, the tax treatment on wins and losses is different and more favorable.

“This regulatory classification creates critical tax benefits. Kalshi issues a Form 1099-B, the same form used by stock brokerages — treating contract settlements as trading income rather than gambling winnings,” Robinson writes. “This classification allows full deductibility of losses against gains, unlimited loss carry-forwards to future years, and potential offset against other investment income.”

Prediction markets are not the only safer haven, to be sure. According to an industry source who regularly interacts with high-volume recreational VIP bettors, “I can tell you straight away that a number of high-volume recreational bettors that I know are going more to offshore books now than ever before,” the source said.

Another source involved in the VIP business suggests that DFS and poker pros are much more likely to be adversely impacted than VIP sports bettors, in part due the way that entries and winnings are recorded in poker and DFS tournaments.

‘Dangerous game’

One of the main, potential disconnects in the equation and potential fallout scenarios is to what extent the regulated gambling operators, namely the biggest two recreational books, still rely on the sharpest market participants who traditionally have provided liquidity, price discovery, and ecosystem credibility functions.

Multiple sources familiar with the thinking inside DraftKings and FanDuel, consulted by InGame for this story, explained that they are supportive of efforts to reverse the impending tax change in the OBBB. They support Rep. Dina Titus’ efforts to pass the FAIR Bet Act and likewise the efforts of the main lobbying arm of the gambling industry, the American Gaming Association (AGA), to undo it as well.

But this alignment did not come right away.

“The AGA’s initial support for OBBB passage, followed by belated backing of repeal efforts, suggests industry disorganization that reduces the likelihood of successful lobbying,” observes Robinson. “The mixed messaging has complicated Congressional perceptions of industry unity on the issue.”

Furthermore, per sources, DraftKings and FanDuel are not certain that if left unchanged, the tax policy will have a material negative impact on their businesses. They believe that some of the migration to prediction markets would be happening anyway (the new tax policy may or may not accelerate that migration). Hence the rapid movement to get a seat on that vessel, which is also emblematic overall of the nature of threats confronting gambling operators who have had to contend with multiple storms this year all at once.

In other words, how much political capital are they willing to expend in an environment like this, where both the threat and upside is unclear?

“I really have only heard concerns from the sharp side of the world and gambling Twitter,” said Dillon Borgida, a vice president for VIP events and services at Underdog Sports. “I don’t think your average VIP has a clue this is happening, or maybe they have heard faint rumblings, but don’t think it applies to them. Generally speaking, I’d be surprised if there’s any material change to the way sports betting VIPs play.”

Elsewhere, professional sports bettor Chris Dierkes has recognized during this process that “people like myself might have miscalculated at the outset — the only people that file gambling taxes, correctly, are professionals. So this provision does not affect the customer base that makes FanDuel, DraftKings, MGM, Caesars, money. So, they don’t care.”

Dierkes says he understands that dynamic better now, but he cautions against sitting idle and leaving the OBBB provision unchanged: “It’s a dangerous game they’re playing,” he says.

“Suppose a very big VIP customer gets mixed up in this, he’s betting millions of dollars a year and losing millions of dollars a year, and say they gamble something like $100 million a year on DraftKings or FanDuel and they lose $7 million,” Dierkes explained. “And then unbeknownst to him, because of how his accountant has handled things, he actually owes a million dollars, even though he lost $7 million, because of the 90 percent provision. And the IRS comes after them for it.”

Dierkes believes that would become a very big, negative story that will break through because, who would want to gamble at a place where you can’t win, and even when you lose, you may even lose more come tax season?

Clock is ticking

Dierkes also notes that the current administration has reduced headcount at the IRS, meaning the risk of audits is likely to reduce even further. And this may incentivize less-than-honest or incomplete reporting.

One of the other mysterious threads running through this conversation is the notion that a tiny little clause woven into the OBBB during the congressional process of reconciliation and responding to some quirky fiscal requirements was not quite an act of budget-balancing ignorance, but rather, maybe an instance of satisfying two objectives with one rock.

Many in the industry have suspected that persons associated with Kalshi, or stakeholders sitting on some prediction market upside, pushed for the inclusion of the OBBB gambling tax provision, knowing how it might accelerate a migration away from traditional state-regulated sportsbooks.

And what is an article discussing prediction markets without mentioning that Donald Trump Jr. is both a strategic advisor to Kalshi and an investor in Polymarket, which is poised to soon re-enter the U.S. as a CFTC regulated exchange?

There remains as much risk as there is uncertainty in all of this. Who is bluffing, and who is wearing blinders? And who wants to own the creation of a provision that imposes a false tax — a tax on money where no gain was ever actually realized?

There are still 98 days left in the year to untangle this big, beautiful mess sown by this tiny tax clause.

“Adam writes that this could have dramatic implications for the betting world,” said Schuetz, “but with all the distractions currently taking place, this tax change may be overlooked by much of the betting ecosystem — and that could be a significant miss.”

Sponsor InGame and reach thousands of industry professionals every month. Your support keeps our reporting and data free for readers — and gets your brand seen where it matters. Email [email protected] for more information.