Pennsylvania Gaming Control Board Executive Director Kevin O’Toole has sent a letter to the state’s congressional representatives in the House and Senate about sports betting prediction markets and the “significant threat” they pose to the state’s gaming marketplace.

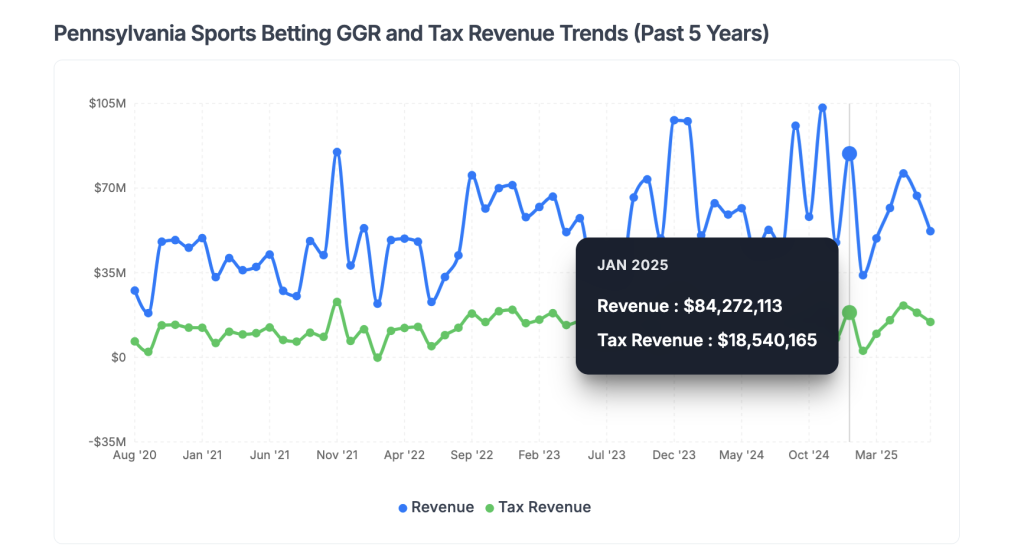

The Keystone State is a top 10 market nationally for monthly sports betting handle and one of just four in the post-PASPA era to surpass $40 billion in wagering. O’Toole’s statements put Pennsylvania on a growing list of states that are issuing warnings or are currently active in some sort of litigation against prediction markets offering sports wagering.

In his letter dated Oct. 3, O’Toole claims that since sports prediction markets “operate under the assertion that they are financial derivatives” and not subject to state gambling laws, they pose a “direct threat to the comprehensive regulatory system that Pennsylvania, and many other state jurisdictions, have meticulously constructed for gaming.”

PGCB-Ltr-to-CongressOne such operator of prediction markets, Kalshi, has been active in the courts filing lawsuits against state gaming regulatory agencies. It filed a lawsuit Tuesday in U.S. District Court for the Southern District of Ohio against the state’s Casino Control Commission and attorney general seeking preliminary and permanent injunctions against actions, claiming the OCCC threatening the licenses of vendors who may do business with Kalshi was potentially detrimental to its business and beyond the OCCC’s purview.

O’Toole’s letter comes on the heels of warnings sounded by the Michigan Gaming Control Board last week about operators potentially jeopardizing their licenses by offering sports event contracts. The Arizona Department of Gaming issued similar warnings to state-regulated sportsbooks against partnering with prediction markets in September.

The problems with the CFTC

O’Toole does not single out any specific prediction market in his letter, which is addressed to Pennsylvania’s 17 representatives in the House and to the state’s two senators, John Fetterman and Dave McCormick. Rather, the PGCB executive director took aim at the Commodity Futures Trade Commission (CFTC) and its methods in overseeing prediction markets federally.

In citing Murphy v. NCAA — the case leading to the 2018 PASPA ruling — O’Toole explained how legalizing sports betting was “historically a matter left to individual states.” But the CFTC’s policy of self-certification for prediction markets “directly undermines this state authority.” O’Toole called the process “a backdoor to legalized sports betting, operating parallel to, but outside of, the state-regulated system, and without strict oversight.”

He called this strategy “one of regulatory arbitrage” in which prediction markets do not contend with background checks, licensing fees, state taxation, mandatory compliance with rules for consumer protections, responsible gaming, and integrity monitoring. In using a classification of financial derivatives, O’Toole argued prediction markets are “looking to sidestep these crucial state-level requirements.”

O’Toole further added the “CFTC regulates a system that allows wagers on events that a single person can control — something the PGCB would never allow for fear of manipulation of the market and a cascading loss of confidence in the integrity of the system.” He added that it would take the CFTC “years” to create regulatory oversight, but it would also “create a redundancy for a system that already exists and works exceptionally well.”

The power of imposing penalties

O’Toole said one of the PGCB’s most crucial powers is the “ability to penalize the operators should they not live up to the strict and necessary statutory and regulatory requirements the operator agreed to upon for licensure.” He argues that a prediction market operator who “self-certifies” would never be subject to such penalties and noted even the CFTC seems gunshy about administering such penalties. O’Toole pointed out the federal body wrote in an industry guidance document that it had not “made a determination whether any such contracts involve an activity enumerated or prohibited” under the Commodities and Exchange Act as of Sept. 30.

He said that if prediction markets are able to “successfuly carve themselves out of the ‘gaming’ definition,” the potential would exist for a “parallel wagering ecosystem where bets on sports outcomes occur with significantly less oversight regarding potential match-fixing or the exploitation of insider information.”

O’Toole continued: “Even worse, the parallel tracks risk confusing patrons who engage in these markets by utilizing the veneer of a highly-regulated market when, in reality, their markets are more akin to the ‘wild west.'”