Polymarket has revealed the fee structure for its new U.S. site – with dramatically lower costs than rival Kalshi, at least initially.

Polymarket has not yet launched its U.S. site, instead offering a “global” site which does not allow U.S. users to trade. However, Bloomberg reported last week that the prediction market is eyeing a launch in late November.

According to a fee schedule posted on Polymarketexchange.com, the prediction market’s U.S. site will operate with a flat fee of 0.01 cents per one-dollar contract traded. That equates to a 0.01% fee. Polymarketexchange.com is a site that hosts a number of documents related to exchange rules or CFTC filings, and replaces the former QCEX.com site where Polymarket had previously published updates.

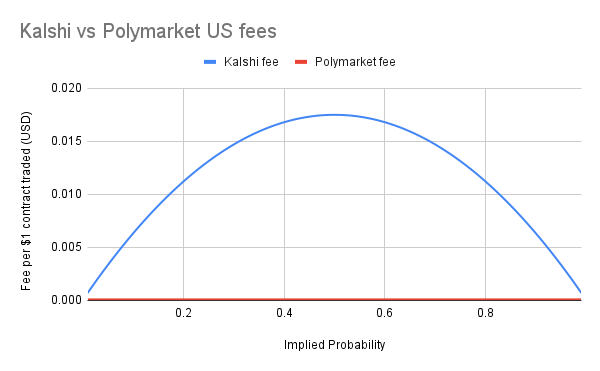

The flat fee is a different format to Kalshi’s fee structure, as Kalshi fees change depending on the odds of the contract. On Kalshi, fees as a percentage of contract value are lower for extreme favorites or underdogs, and higher for bets that are closer to 50/50 shots.

On average, Kalshi’s fees work out at around 1.2% of contracts traded, or more than 100 times higher than Polymarket’s 0.01% fee. That would mean that on $100 worth of contracts, a consumer would pay a 1-cent fee on Polymarket vs. an average $1.20 on Kalshi.

Even for bets with an implied probability of 99% or 1% – where Kalshi’s fees are closest to Polymarket in price – Polymarket’s fees would still be around one-seventh of Kalshi’s. For a contract with 50% probability – for example, a typical point spread bet – Kalshi’s fees would be 175 times higher than Polymarket’s.

It’s not clear whether the low fees on Polymarket will last, or if they are intended as an introductory pricing system in order to bring more customers to the platform.

Polymarket’s global exchange – which does not accept customers from the U.S. – does not currently charge fees. It’s very unlikely that this will continue to be the case.

Will shutdown slow Polymarket relaunch?

Polymarket has been eyeing a U.S. relaunch since it bought QCEX – an exchange that was already registered with the Commodity Futures Trading Commission (CFTC) – in July.

The government shutdown may complicate the launch process for Polymarket U.S.

In order to list new contracts, Polymarket must first self-certify them. However, the CFTC has not been processing self-certifications during the shutdown, and instead has taken the position that the self-certifications are stayed until it resumes full activity.

Polymarket submitted new contracts for self-certification on Oct. 1, just after the shutdown started.

It is not clear whether Polymarket is anticipating the shutdown to be over by late November or if it plans to go live regardless by that date and attempt to force a policy change from CFTC Acting Chair Caroline Pham. InGame understands Pham wished to see self-certifications continue when she worked at the agency during previous shutdowns.

Record week for Kalshi

While Polymarket continues to sit on the sidelines, Kalshi experienced a record-breaking week last week, boosted in part by a dramatic extra-innings World Series Game 7, as well as a high rate of college football upsets and close NFL games.

Total volume on the exchange hit $1.25 billion in the seven days through Nov. 2, easily breaking records. Sunday volume topped $300 million for the first time, breaking a single-day record of $296.9 million that had been set on Oct. 5, after volume on Saturday fell just short of a daily record at $296.1 million.

Sports continued to dominate, making up 88% of volume during the week. However, it was also a strong week for non-sports trading, thanks in part to the October Federal Reserve meeting, and upcoming elections in Virginia, New Jersey, and New York City.

The total amount traded on non-sporting events during the week – $150.0 million – during the week was the highest total recorded outside of the 2024 election.

Kalshi made $14.2 million in fees over the course of the week. If that performance were to be repeated across a whole quarter, the business would take in more than $180 million in quarterly revenue.