A new wave of disruption and regulatory uncertainty is banging on the doors of the leading state-regulated online sportsbook incumbents, FanDuel Sportsbook and DraftKings Sportsbook, which together have claimed a 75% market share of betting volume and revenue in the nearly 40 states where they are currently operational.

The duopoly holds a nice hand today (although their market caps have taken a few body shots in recent months), but the strength of that dominant position in U.S. online sports betting may be more tenuous than ever, owing in part to a raft of sports betting scandals, the difficulty in containing them, and a potential corresponding backlash against proposition bets, as well as an increased tax burden effectuated by state lawmakers in Illinois and Ohio and several other jurisdictions. But the greatest threat is due to the incursion over the last year by prediction markets — onto the duopoly’s turf* and without any tax burden at all — via sports event contracts, ostensibly operating under the exclusive jurisdiction of federal governmental authorities.

“The emergence of sports prediction markets creates massive risk for FanDuel: if they stand down on entering sports prediction markets, they risk missing what may be the biggest shift in the industry since the repeal of PASPA,” writes Chicago-based researcher and semi-professional sports bettor Adam Robinson, a board member of sports betting advocacy group American Bettors’ Voice. “On the other hand, entering these markets could jeopardize their state-regulated business model.”

Robinson’s new paper, obtained by InGame, seeks to identify the point at which it would make economic and strategic sense for FanDuel (as an example) to shove its chips to the center of the table, call the regulators’ bluff, and enter the prediction markets arena — inclusive of sports events contacts — before such time that the courts and federal government offer total clarity on what is and isn’t lawful at the federal level.

“This legal uncertainty cuts both ways,” Robinson writes in “Calling the Bluff: FanDuel’s Break-Even Analysis for Sports Prediction Market Entry.” “Operators cannot confidently assume courts would strike down state license restrictions on federally regulated sports betting activity. But states cannot confidently assume courts would uphold such restrictions against preemption challenges. The standoff creates strategic ambiguity that favors the status quo until economics ultimately forces resolution.”

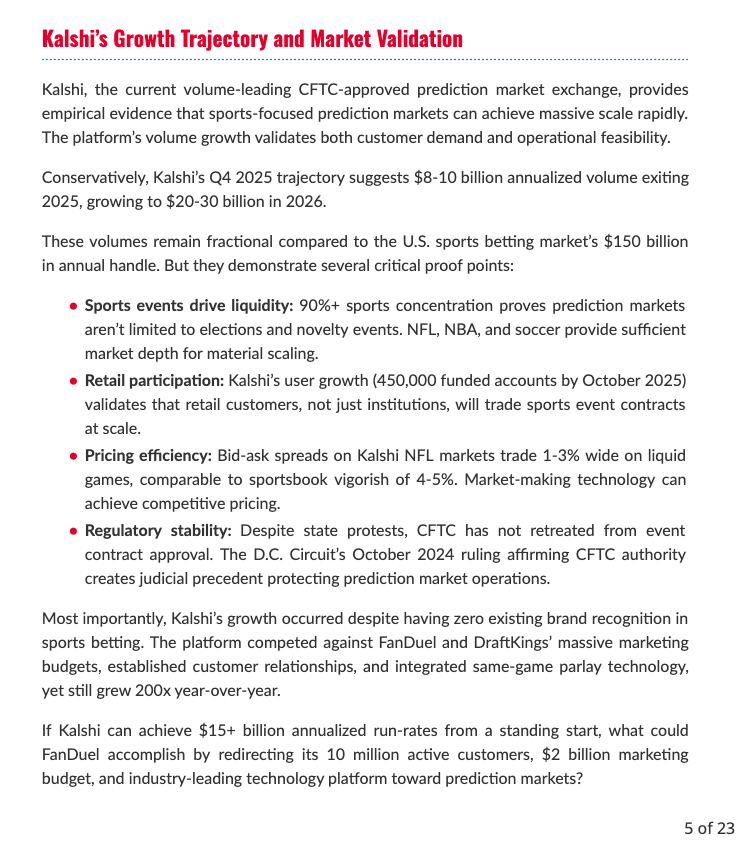

Per Robinson, the regulated sports betting industry as currently structured has 12-18 months remaining before prediction markets fundamentally reshape competitive dynamics, regulatory relationships, and profit pools.

“The only question is which operator moves first and whether states recognize the threat in time to compete through tax reduction rather than retaliate through license revocation.”

His prediction? FanDuel announces sports prediction market entry by June 2026. Continue on for a closer look at the analysis and moving parts.

(Disclosure: The author of this article is a former member of the ABV’s advisory board who stepped down from the board in December 2024.)

State of the game

Both FanDuel and DraftKings have been closely monitoring the rapid developments and growing volume around sports on prediction market platforms, and both have made preparatory moves. FanDuel in August announced a partnership with CME Group for a prediction platform, while DraftKings in October made the long-rumored acquisition of designated contracts market (DCM) Railbird Exchange. This gives them both a pathway to competing directly and on equal footing with Kalshi et. al.

Meanwhile, multiple states have either explicitly warned both FanDuel and DraftKings and all of their other licensees of potential consequences for pursuing this “regulatory arbitrage” pathway, i.e., allegedly circumventing state regulatory regimes and taxes. Some states have issued cease-and-desist orders to Kalshi and Crypto.com, another DCM offering sports event contracts. Some states have done both, and several including Nevada and New Jersey have advanced into litigation debating the legal theory underlying sports event contracts, which is rooted in the Commodity Exchange Act (CEA) and the Commodity Futures Trading Commission’s (CFTC) role in regulating the derivatives market and national exchanges.

Robinson’s position paper considers the present dilemma that FanDuel (parent company Flutter Entertainment) is now confronted with, which is partly a classic prisoner’s dilemma, when considering DraftKings’ strategic options as well.

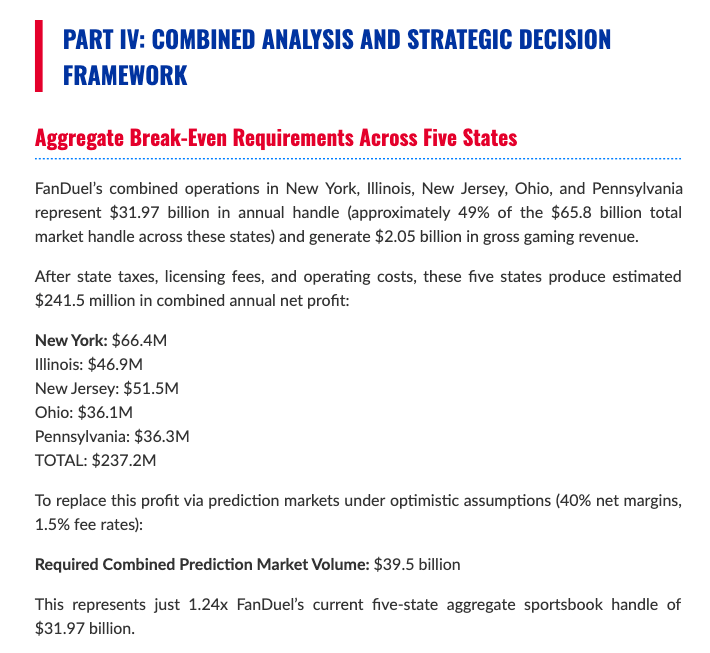

“The five states that have issued formal cease-and-desist orders or enforcement warnings — Arizona, Pennsylvania, Illinois, New York, and Ohio — represent $65.7 billion in combined annual handle, generating $2.7 billion in operator revenue and over $800 million in state taxes. All five states have made clear they view prediction markets as existential threats to regulated gaming revenues, worth defending through the nuclear option: license revocation.”

Let’s pull out that figure: The required combined prediction market volume necessary to achieve in the select states to replace the existing revenue, according to Robinson’s calculations, is $39.5 billion, which “represents just 1.24x FanDuel’s current five-state aggregate sportsbook handle of $31.97 billion.”

How these figures compare to what FanDuel (and DraftKings) are contemplating internally as they consider their options, well, you’re on your own answering that one.

“[Robinson] is a unique and refreshing voice in the gaming space, providing new and interesting insights,” noted ABV CEO Richard Schuetz. “The challenge becomes in what is known as the realpolitik of things, where established institutions and their financial interests are threatened. That is often a process that is harder to model and, therefore, harder to predict.”

Additional considerations and unknowns

Of course, there are several additional considerations not contemplated within Robinson’s paper here, partly out of necessity to illustrate an apples-to-apples comparison around sports events contracts and sports betting. One of them concerns fee revenue, discussed above in the excerpt from the paper.

The biggest “other” factor, in my view, is the status of the iGaming license in jurisdictions where state regulators question the suitability of the operator’s sports betting license. That’s because iGaming profits are larger and much more consistent and also are more guarded from seasonality than sports betting.

The matter of whether suitability and license revocation would apply only to sports or both sports and iGaming would become critical in those states authorizing regulated iGaming: New Jersey, Michigan, Pennsylvania, West Virginia, Delaware, Connecticut, and Rhode Island.

Of course, the question becomes, are state regulators prepared to sideline this kind of tax revenue generation?

On that point, while speaking mainly to the sports betting-generated tax, Robinson writes: “States cannot afford to drive major gaming operators out of their markets entirely. New York collected $1.07 billion in sports betting taxes in FY 2024-25¸ and losing FanDuel entirely (not just sportsbook, but potentially poker, casino, and DFS too) would create a budget catastrophe. States will bluster but ultimately accommodate.”

From there, Robinson expounds:

“The endgame: states renegotiate rather than retaliate. Once FanDuel enters prediction markets successfully, states will offer tax concessions to prevent further migration. New York may reduce its 51% rate to retain operators. Illinois may eliminate per-wager fees.”

“But these concessions will come too late. Once prediction markets achieve critical mass and brand recognition, the superior economics (zero state taxes, no customer limitations, favorable federal tax treatment) make the model dominant. States that reduced taxes to retain operators would simply slow inevitable industry transition, not prevent it. The question is not whether FanDuel and DraftKings will call the bluff. The question is when.”

It’s possible that the bluff call comes even sooner than Robinson is projecting. Or at least that we see an incremental step in that direction. In October, Bloomberg reported that CME will make available contracts “tied to sports games” before the end of the year, though it didn’t provide many specifics on what these will look like.

Even if FanDuel doesn’t offer sports event contracts itself, the contracts offered through a partner company could still pose a risk to its licenses.

A letter from the Ohio Casino Control Commission to sports betting licensees warned operators that even if they don’t offer sports event contracts in Ohio, partnering with a company that does so could jeopardize their operation in the state.

“Any business relationship between an Ohio sports gaming licensee (including its related entities or those under common ownership) with any entit(ies) offering or facilitating the offering of unlicensed sports gaming in Ohio calls into question the reputation of the licensee and the integrity of sports gaming in Ohio,” the letter said.

Robinson further expects that when FanDuel or DraftKings does make a move, the other will do so in tandem, or without much delay.

“The game theory strongly favors simultaneous or near-simultaneous movement,” he writes. “Neither operator can afford to let the other capture first-mover advantage in prediction markets, as sharp bettor and professional customer concentration means the first mover captures the most valuable 20% of the customer base.

“Expect FanDuel and DraftKings to announce sports prediction market entry within 3-6 months of each other. This approach minimizes regulatory ability to single out one operator for retaliation, and effectively ‘calls the bluff’ to terminate licenses. These states cannot afford to follow through on these threats.”

In this high stakes game of poker involving sports betting and iCasino giants, some serious action is coming. Soon.

*Actually, prediction markets handling sports trades/bets have extended beyond the duopoly’s turf and into fresh soil. Indeed, the likes of Kalshi, Crypto.com, and soon Polymarket US will have advanced into the coveted and well-populated California and Texas (not without legal challenges), where both incumbents have already spent ample resources attempting to gain market entry, facing opposition largely from Tribal interests.