Shares in FanDuel owner Flutter Entertainment plunged Thursday morning as the company revealed it was willing to lose up to $350 million on its prediction market product by the end of 2026.

On Wednesday, FanDuel announced that it planned to offer sports event contracts in states without legal sports betting when its prediction market goes live in December. The announcement came alongside parent company Flutter Entertainment’s annual results. In those results, Flutter revealed more about the cost of the prediction market product this year and next.

“At this early stage, we anticipate incremental EBITDA [earnings before interest, tax, depreciation, and amortization] costs of $40-$50m in Q4 2025 and $200m-$300m in 2026 with the majority arising in H2,” it said.

This EBITDA impact considers not just spending but also the revenue FanDuel would make from the product, meaning the total spend will be higher than the range of figures provided by FanDuel.

The earnings report added that the majority of the negative EBITDA impact will come in the second half of 2026. Given that the predictions product is likely to bring in more revenue during the NFL season, spend is likely to be concentrated in this period.

“We think that the figures that we have for next year will be back-end loaded, towards the start of the football season,” Flutter CEO Peter Jackson said on the company’s earnings call. “But we’ll invest where there will be paybacks. And we’ll know more as we see the product in the market.”

FanDuel to get 50% of predictions revenue

FanDuel will get half of the revenue from the prediction market product, with the other half going to its prediction market partner CME, the company also revealed in its earnings report. FanDuel will pay the promotional, sales, and marketing costs of the app, and CME will pay exchange-related costs.

FanDuel didn’t reveal what kind of fees it would charge for its prediction market product or how much revenue it expected to make. During September and October of 2025, Kalshi made a combined $85 million in fees. The prediction market appears set to make around $200 million in fees for the second half of 2025. Kalshi has a dynamic fee system that changes depending on the odds of the bet, with fees averaging out at around 1.2% of volume.

On the earnings call, Flutter CFO Rob Coldrake said the company hadn’t made any projections for 2027, but if it were still spending a large amount on its prediction market at that point, it would be because the product had been successful in 2026.

“We’re not providing any updated guidance for 2027,” he said. “We need to see how the investment next year plays through, but in my view it would be very good if we invest more than we’ve planned because then it’s showing returns.”

Regulatory cost also becomes clearer

The financial cost of getting involved in prediction markets is accompanied by a potential regulatory cost. Regulators in Arizona, Ohio, Illinois, New York, and Michigan have written letters warning licensees about getting involved with prediction markets, with some even warning that offering the product in another state or partnering with a company that offers them in another state could make a company unsuitable for a sportsbook license. FanDuel is licensed in all five states.

That regulatory cost became more real when the Nevada Gaming Control Board on Wednesday revealed that it had “accepted the surrender” of Flutter’s “Order of Registration” and any other licenses. It also announced DraftKings had withdrawn its license applications.

FanDuel operates one retail sportsbook in partnership with Boyd Gaming at the Fremont Hotel & Casino in Las Vegas, but is not licensed for digital betting. DraftKings does not operate in Nevada.

On Flutter’s earnings call, Jackson expressed confidence that the prediction market move was not putting the company’s licenses in other states at risk.

“We always said we wouldn’t do anything to damage our existing business,” Jackson said. “Nevada’s a little different because we don’t have a B2C [business-to-consumer] product there.”

Bettor-friendly NFL results hit earnings

The predictions announcement came alongside disappointing third-quarter results for Flutter, as bettor-friendly NFL results led to lower revenue and earnings.

Third quarter revenue came to $3.79 billion for the group as a whole, with $1.37 billion coming from FanDuel. FanDuel’s sports betting revenue declined year-on-year, by 4.8% to $783 million.

The group recorded a net loss of $789 million.

Flutter said it took a $45 million hit to earnings because of sports results in Q3. Results were even worse for the company in October, with the business taking an additional $205 million loss in that month alone. The Buffalo Bills’ Week 1 comeback against the Baltimore Ravens — which DraftKings had highlighted as its worst result ever — and a historically strong performance from favorites in Week 8 were likely among the contributors.

Because of those results — and the additional spend on prediction markets — Flutter cut its full-year EBITDA guidance. It now expects EBITDA to fall between $2.77 billion and $3.07 billion. It had previously expected earnings between $3.08 billion and $3.52 billion.

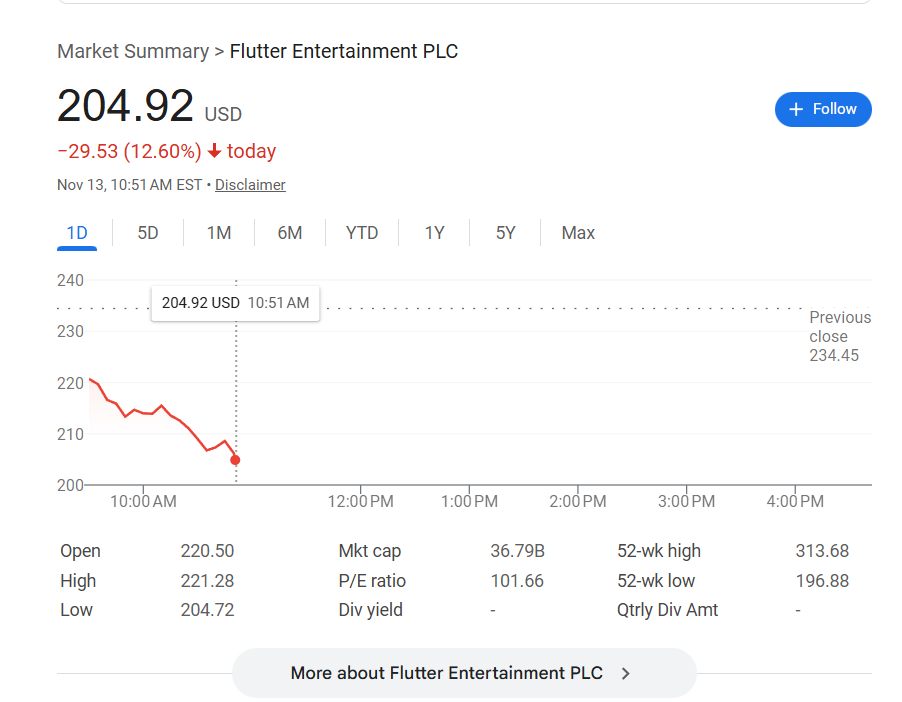

Major share price drop in morning trading

Flutter shares fell by as much as 12.6% to $204.92 Thursday morning, wiping $5.3 billion off of the gambling giant’s market value and continuing a major downward trend over the last 10 weeks. The shares have lost 35% of their value since late August, meaning Flutter’s market cap has declined by almost $20 billion over this period.

While prediction markets have played a role in the decline, with some of the most dramatic daily losses coinciding with major prediction market news, bettor-friendly NFL results and the prospect of dramatic tax hikes in the U.K. – Flutter’s second-largest market – have also contributed to the fall.

Following the results, Truist lowered its price target for Flutter from $335 to $305.

“With management exiting just one state (Nevada – which drives immaterial revenues to FLUT) in advance of launching FanDuel Predicts, we believe they have comfort that they won’t need to exit any other OSB markets,” Truist analyst Barry Jonas wrote in a note to clients. “That said, we’ll be monitoring other state regulator responses to this development — specifically states which have written letters to its licensees against sports contracts as well as states engaged in related litigation.”

There was read-across to rival DraftKings’ share price, too. DraftKings shares were down as much as 5.7% to $29.70, reversing what had been a recovery after the business announced that it would launch sports event contracts in “the coming months.” The shares are down 39% since late August, but still up 13% compared to the lows hit last Friday morning.