DraftKings launched its own prediction market — via a partnership with CME — Friday morning, offering sports contracts in 17 states and non-sports markets in several states in which the business already operates a licensed sportsbook.

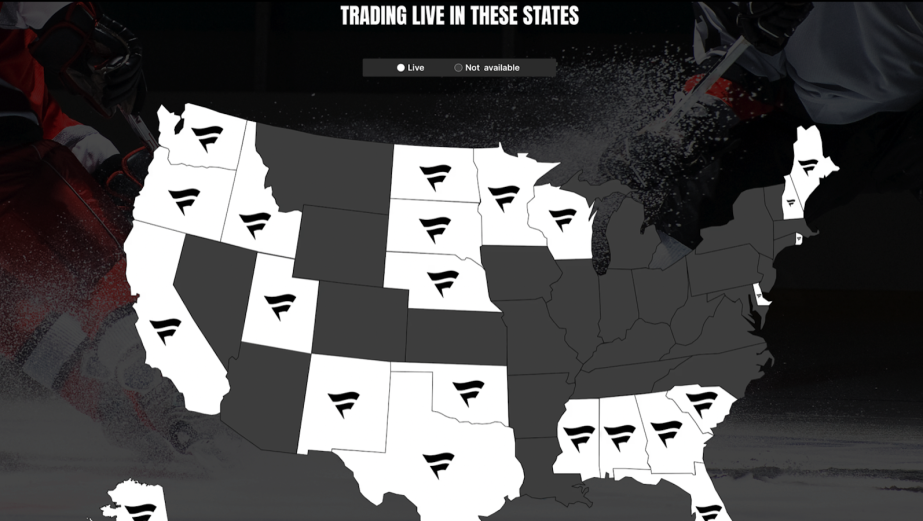

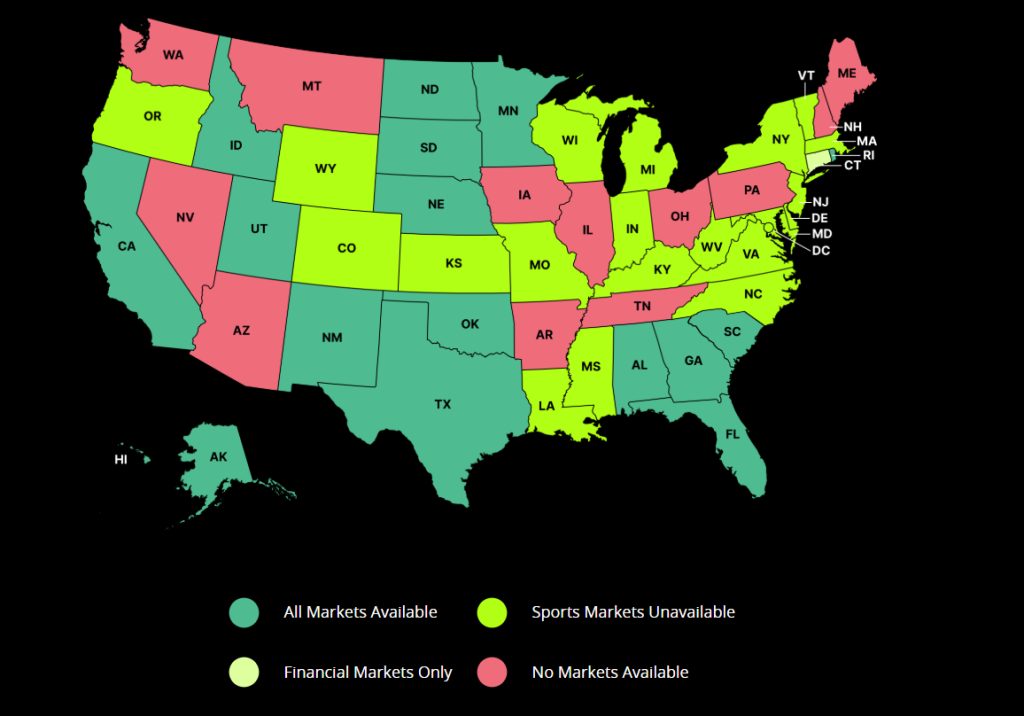

The DraftKings Predictions app — a separate app from the company’s sportsbook — is available in 38 states in total. Sports contracts are available in Alabama, Alaska, California, Georgia, Florida, Hawaii, Idaho, Minnesota, Nebraska, New Mexico, North Dakota, Oklahoma, Rhode Island, South Carolina, South Dakota, Texas, and Utah. In most of those states, sportsbooks are not legal, with exceptions including Rhode Island, where only the state lottery may operate a sportsbook, and Florida, where Hard Rock has a sports betting monopoly through the Seminole Tribe’s compact with the state.

The launch was first reported by Front Office Sports’ Ben Horney.

The launch comes amid pushback from states against prediction markets, with many regulators seeing them as a form of unlicensed gambling. In states such as Arizona, New Jersey, and Maryland, states have already tried to shut down sports event contracts from prediction markets like Kalshi and Crypto.com.

Regulators in states including Arizona, Ohio, Illinois, and Michigan have also warned licensed sportsbooks about getting involved with prediction markets, even telling operators that engagement with the product in another state or partnering with a company that offers them in another state could make a company unsuitable for a sportsbook license. DraftKings will not offer sports event contracts in any state where it currently holds a sportsbook license.

DraftKings CEO Jason Robins has said that conversations with regulators gave his business confidence that the path it was taking would not result in the loss of sportsbook licenses.

Last month, DraftKings withdrew its application for a license in Nevada, soon after announcing its plans to offer sports event contracts.

Despite this step, no version of the DraftKings Predictions product — not even the non-sports markets — is available in Nevada.

The other states in which no markets are available are Arizona, Arkansas, Iowa, Illinois, Maine, Montana, New Hampshire, Ohio, Tennessee, and Washington.

DraftKings and FanDuel to share liquidity?

Although DraftKings bought Railbird in October, which is registered as a designated contract market (DCM) and can therefore create and list its own contracts, the operator will instead use its status as an introducing broker (IB) to partner with commodities giant CME. CME is already partnered with FanDuel for its own prediction market, which is also expected to launch this month.

When DraftKings first announced plans to launch its prediction market, it appeared that offering Railbird’s contracts would be its main path to a predictions launch, but it also noted that it could partner with other exchanges. It received IB approval this month, officially allowing the business to partner with other exchanges.

The partnership with CME means that FanDuel and DraftKings appear set to share liquidity for their exchange, at least for now, meaning that the differences between “buy” and “sell” prices on the exchanges may be smaller than if the two had relied on separate DCMs. This is unlikely to be significant for the most popular markets such as NFL game winners, but could help boost activity for non-sports markets and — if the prediction markets choose to offer them — player props or parlays.

DraftKings Chief Product Officer Corey Gottlieb said in a Friday press release that the operator would use its existing partnerships with ESPN and NBCUniversal to promote its predictions app.

“DraftKings Predictions is a significant milestone and reflects our ongoing commitment to delivering products that tap into the passion of our customers,” Gottlieb said. “We will create an unparalleled customer experience, leveraging key strategic relationships like ESPN and NBCUniversal to provide an authentic, real-time product that moves at the speed of sports.

“Along with our operational footprint, marketing and analytics infrastructure and advanced in-house technology, we believe we are uniquely positioned to lead this space over the long term.”

Limited sports offering — for now?

As of launch, the DraftKings Predictions app offers a fairly limited sports offering, focused on major events. It allows for bets on game winners and against the spread for the NFL, NBA, and College Football Playoff, as well as game winners only for the NHL.

In terms of non-sports contracts, the app offers hour-long markets on commodities and indices like the price of gold and the S&P 500. CME CEO Terry Duffy had previously discussed FanDuel offering these fast-resolving markets, which arguably resembles a micro-betting version of stock day trading.

DraftKings said the launch of Railbird contracts “will broaden available markets” when it occurs.

The app also includes a “responsible trading” program, which DraftKings describes as an extension of its responsible gaming best practices.

DraftKings Predictions fees

The contracts include a one-cent fee for every trade, on top of fees offered by the exchange, DraftKings Predictions’ terms and conditions show. CME has its own one-cent fee per trade, meaning total fees are two cents per contract. The flat fee per trade structure means the value on bets on heavy favorites or underdogs tends to be lower than under a dynamic structure like Kalshi’s, with all winnings wiped out for trades at 99% odds.

It is not clear how much DraftKings will spend to promote the app in total, but analysts at Susquehanna expect spending in 2025 alone to come to $50 million, based on the company’s earnings projections for the year. FanDuel previously said it could lose $350 million on prediction markets by the end of 2026.