Massachusetts became the seventh state to top $100 million in monthly gross sportsbook revenue in the post-PASPA era Tuesday after the state’s gaming commission reported $102.5 million for operators in December.

The Bay State joins New York, New Jersey, Illinois, Ohio, Pennsylvania, and North Carolina in that select circle of states with a nine-figure revenue haul. In topping November’s short-lived standard of $97.3 million, revenue from Massachusetts’ seven mobile sportsbooks and three brick-and-mortar locations surged 73% from last year.

Operators had a collective hold of 12.1%, an improvement of 4.6 percentage points compared to closing out 2024. The $845.3 million handle was up 7.2% from a year ago but down 7.3% from November’s record wagering of $914.7 million.

The state was able to levy taxes on $98.5 million in adjusted gross revenue, re-directing $19.6 million to its coffers. That comes shortly after legislation that would increase the tax rate on mobile operators from 20% to 51% that was introduced last year was given an extension to March 6.

The $83.9 million in receipts for the first six months of the fiscal year is running $17.3 million ahead of last year’s pace. The $168 million collected in the 2025 calendar year was $37.8 million more than 2024.

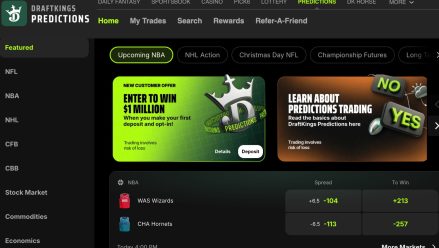

DraftKings dominant to close out year

Life continues to be good for DraftKings in its home state. The digital colossus finished 2025 with a record $54.5 million in gross revenue thanks to a 12.2% hold on $447.5 million handle.

DraftKings posted win rates of 12% or higher four times in the calendar year, and its $455.5 million in winnings represented a 32.5% increase from 2024. Its 10.6% hold for 2025 was up nearly 1.3 percentage points to help revenue outpace the 16.6% bump in handle to $4.3 billion. That was more than enough for DraftKings to maintain more than 50% of the mobile market share in Massachusetts.

FanDuel followed up its record $31.7 million effort in November with another $26.1 million to end the year. That marked the first time it topped $25 million in back-to-back months in the Bay State.

FanDuel crafted a 12.9% hold from $202.2 million worth of wagers as revenue climbed 34.3% despite a 16.3% downturn in action. FanDuel’s $241.6 million in winnings for 2025 was a 10% gain from last year and its 10.9% win rate for the calendar year was up two-thirds of a percentage point.

Fanatics pops in 2025

While DraftKings dominated the scene and FanDuel carved out a distant No. 2 spot, the other big news of Massachusetts sports betting in 2025 was Fanatics continuing its growth to emerge as a No. 3 option in a large market.

Fanatics nearly tripled its revenue in the Bay State in 2025, going from $20.2 million in 2024 to close to $59 million as its 8.8% hold for the year was an increase of more than 2.5 percentage points.

Handle more than doubled to $668 million, capped by its $79.2 million in accepted wagers for December. Fanatics’ 13.1% win rate to end the year was its best in any full month of wagering in Massachusetts, leading to its first eight-figure haul in gross revenue at $10.4 million. That was a near four-fold increase from December 2024.

TheScore Bet’s first month of operations succeeding ESPN BET largely maintained the status quo: A significant year-over-year bump in revenue with a downturn in handle. The Penn Entertainment-run sportsbook narrowly missed a 10% hold as it kept $2.4 million of $24.1 million wagered.

That was almost enough to keep year-over-year revenue flat for Penn as the $22.6 million in winnings was down 0.8%. While operator performance was up 1.4 percentage points with an 8.4% hold for the year, the $269.2 million handle represented a decline of close to 18%.