DraftKings will spend $400 million on prediction markets in 2026, a Wall Street analyst estimates, quantifying CEO Jason Robins’ pledge to “deploy growth capital” to attempt to become a winner in the vertical.

Joe Stauff, an analyst with Susquehanna International Group, wrote in a Tuesday note to clients that his team estimates prediction market losses will drag down DraftKings’ 2026 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) by $300 million. With the business spending another estimated $100 million on customer acquisition costs that are not included in the EBITDA figure, that means DraftKings will spend $400 million in total during the year, he wrote.

With that kind of spend, it could be a long time before DraftKings recoups its initial investment on prediction markets. In a shareholder letter accompanying the company’s 2025 earnings, Robins said the vertical will generate “hundreds of millions in annual revenue” in the years ahead, which suggests that a single year’s revenue — before even considering costs — years from now may be lower than its 2026 expenditure alone.

Stauff noted that investors may be wary of the spend because it will take time to tell whether or not it will pay off.

“DKNG’s higher prediction markets spend arrives at a time when investor trust/conviction is in short supply especially for a product where traction won’t be assessed until 2H26,” he said.

On an investor call following the company’s 2025 earnings last Friday, Robins did not provide details on how much the company expected to spend on DraftKings Predictions, but did say that the business conservatively assumed no prediction market revenue in 2026.

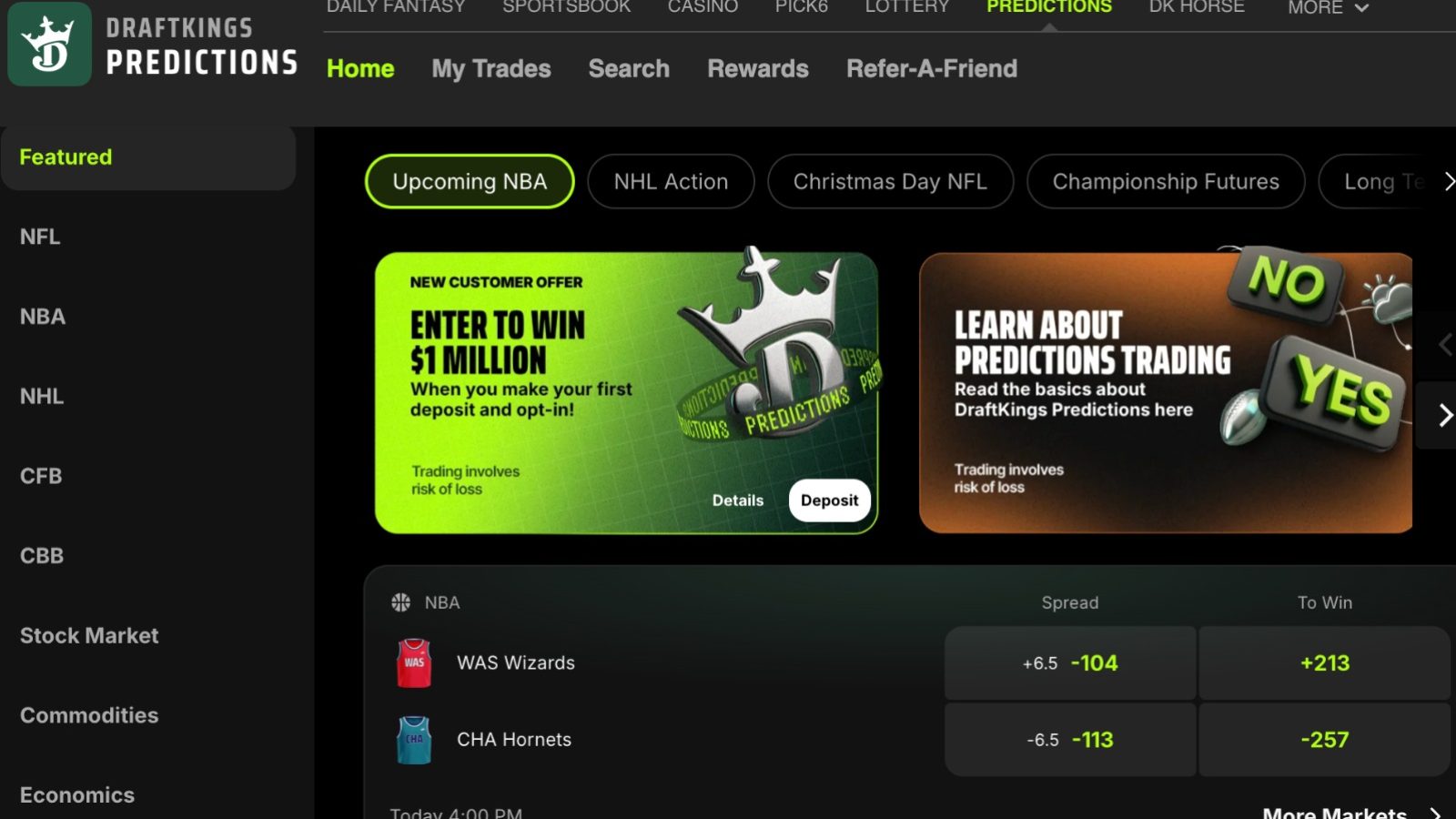

DraftKings Predictions went live in December, and currently offers users access to contracts from Crypto.com and CME. Although the business acquired Railbird, which is a registered exchange last October, it will not go live with the in-house product until the middle of the year.

In November, FanDuel owner Flutter Entertainment predicted an adjusted EBITDA loss of between $200 million and $250 million on prediction markets in 2026, but it may update those figures when it reports its 2025 results next week.

Polymarket and Kalshi’s spending is unclear, but both have raised over a billion dollars in funding rounds, and have been aggressive in their marketing.

A long-term winner?

In the long term, Stauff said that DraftKings could be a winner from the legal fight over prediction markets, as it could ultimately open the door to federal sportsbook regulation further down the line. This, he wrote, would allow the business to reduce operating costs.

“In the long-term battle of OSB regulation that PMs created (federal vs. state), we think most investors would conclude that if regulation moves to a federal level, bookmakers would be huge beneficiaries with ~30 points of OSB margin dropping to the bottom line,” Stauff wrote. “In the intermediate term, we see PMs as an entry level OSB product only where DKNG/FD will invest to build a user database in states (similar to DFS) before the state flips OSB legal.”

Despite noting the longer-term upside possibilities, Stauff dropped his price target for DraftKings from $44 per share to $33, mostly due to the higher prediction market spend. He added that his team believes the shares to be “washed out” after a huge sell-off Friday, which followed the company’s 2025 results and new 2026 guidance.

On Tuesday, DraftKings shares briefly hit another almost three-year low at $21.01, before recovering slightly. As of 3:00 p.m. ET, the shares were trading at $22.26, up 2.4% for the day. That still leaves them down more than 10% since the close of trading Thursday, and valued the business at $11 billion — the same as Kalshi’s valuation in its last funding round.

Stauff added that an ongoing bear market for software companies, mostly driven by the impact of AI, had likely impacted DraftKings’ share price, but said that DraftKings should not be lumped in with most affected companies as it is not “just a software layer between users and the product.”