South Carolina’s Senate Labor, Commerce, and Industry Committee Wednesday amended a bill that would legalize online sports betting, but laid the proposal over after an instructive and lengthy discussion about prediction markets. SB 444 got its first hearing since being introduced March 12, 2025, and it was clear that lawmakers still have much homework to do.

The advent of sports event contracts on prediction markets has complicated the legalization discussion in many states.

The bill calls for statewide mobile sports betting on college and professional sports, and would impose a 12.5% tax on operators’ adjusted gross revenue, and set the minimum age to bet at 18. The number of digital platforms would be limited to eight, while qualified operators must be live in five other jurisdictions. The legislation also calls for the creation of a new sports wagering commission to oversee sports wagering.

The committee heard testimony from operators offering legal sports betting — and prediction markets — in other states, and from several religious-based groups. The operators, including BetMGM, Caesars Sportsbook, and FanDuel were in support of the bill, and the religious-based groups were not. The committee also voted, 3-2, to add betting on the PGA and NASCAR as “qualifying operators” to the bill.

During the hearing, questions from senators ranged from those around guardrails around responsible gambling, how geofencing works, and the difference between traditional wagering and prediction markets. FanDuel Director of Government Relations Lou Trombetta found himself in a somewhat uncomfortable position when asked what the sports betting industry is doing about building a framework around prediction markets. FanDuel, licensed in 25 legal U.S. jurisdictions, launched FanDuel Prediction in five states, including South Carolina, in December.

In his response, Trombetta did not immediately reveal that FanDuel has a prediction product.

Prediction markets are “divisive, the gambling industry has been in flux … and the industry has taken different approaches,” he said, and then went on to explain that “instead of investing in shares of a company, you are investing in contracts of some future events occurrence.” While he was offering examples of weather or sports event contracts, Senator Sean Bennett noted that prediction markets previously were more focused on pork belly, soybean or corn prices.

“Several companies have, in, say, the last 14 months launched” sports event contracts that “have become wildly successful, these products in all states whether or not you legalize sports betting or not,” Trombetta said. “FanDuel has launched its own prediction markets, and we are in South Carolina. There is a dispute between which law really trumps here. There is a federal issue because prediction markets are regulated by a federal agency that has essentially indicated that they are open to allowing us. That conflicts with states’ rights to regulate gambling laws … From a company perspective, we were in a situation. so what do we do there?

“We prefer a licensed market, want to follow all the state laws we can … but while this legal issue is being figured out, we felt like we had to participate because we were missing out on this opportunity if ultimately it was going to be the wave of the future.”

Bennett pressed for an answer on how much the gambling industry is pushing back against regulators because, he said, “these are in your space.” Trombetta pointed to regulators sending cease-and-desist letters, as well as ongoing litigation between state and tribal regulators and prediction markets.

FOMO abound?

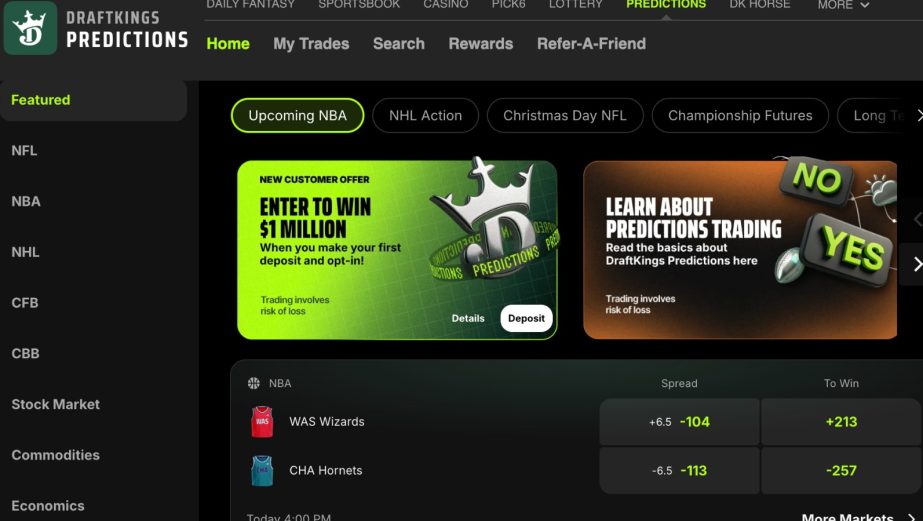

The testimony points directly to the chasm that prediction-only companies like Kalshi and Polymarket have created. Some state-licensed sportsbooks seem to be experiencing FOMO, and have crafted their own prediction products. DraftKings, Fanatics Betting and Gaming, and FanDuel — all tech-first companies — currently offer prediction products. Land-based casino companies Caesars and MGM do not, which both also offering iGaming platforms in several U.S. jurisdictions where permitted, have said they do not intend to enter that arena.

State legislatures across the country have been impacted by the rise of prediction markets, which are regulated by the federal Commodity Futures Trading Commission (CFTC) and are currently considered financial instruments. Gambling has traditionally been considered a states’ rights issue, meaning that a state legislature can legalize and regulate sports betting, but in the current climate, cannot do the same for prediction markets, some of which are operating in all 50 states.

At issue are the lack of stringent consumer protections, and states’ inability to reap tax benefits from the platforms.

Trevor Hayes, vice president of government affairs for Caesars, was the first to testify, and brought up the issue immediately. He said that he’s spoken with lawmakers about the illegal market “and that hasn’t seemed to resonate with you … but the new news is that there is an operator in South Carolina that is offering sports betting that is legal — prediction markets. Last month, Kalshi took over $10 billion in handle. They don’t seem to be cutting into our business where we are legal, so they are in places where [sports betting] is not legal. What I am trying to say is that sports betting is here. Do you want it regulated and taxed?”

That’s a question that lawmakers in Hawaii, which is also considering legalizing sports betting, is also considering. But given the landscape, in either case, it does not appear that state legislatures have the authority to license or regulate prediction markets operating under the purview of the CFTC.

It’s already been a long haul

Lawmakers also asked questions about how to keep illegal or unregulated operators out of their state. Hayes offered up that geolocation company GeoComply reports that there are 415,000 legal accounts in South Carolina, and that over the last year more than nine million location checks were noted from those accounts. The checks represent denied attempts at access.

Sen. Allen Blackmon, who said he views prediction markets as gambling, asked if GeoComply would block illegal activity, and Hayes clarified that the company can only chart legal companies with whom they partner. Blackmon then asked, “So, bad actors wouldn’t be playing by the rules set by the general assembly?”

Hayes replied, “Of course not, they are bad actors.” And then went on to ask how bootleggers were stopped from making and selling alcohol, and whether or not the legislature believes that consumers would rather spend their money with a licensed operator than an offshore one.

Asked how to stop the “bad actors,” Hayes testified, “We can offer incentives to folks that bad actors can’t, but right now, we can’t even do that.”

Separate from the illegal and unregulated operator discussion, Hayes and Trombetta touted the responsible gaming tools, tax revenue, and other benefits of the legal market. But on the opposition side, several faith-based groups spoke passionately about the ills of gambling overall.

Opponents, and at least one lawmaker, said that while legalizing might reap a financial benefit from the state, it would ultimately result in a big social cost. In addition, legalizing would be tacit approval from the state that gambling is acceptable. Dr. Tony Beam, director of church and community engagement and public affairs at North Greenville University said gambling “pulls people away from contributing to society.”

He also argued that legalizing currently illegal activity isn’t a solution.

“Are there prostitutes in South Carolina?” asked. “I’m sure there are, but I don’t think the way to solve it is to legalize prostitution.”