Sports betting stocks could have a big 2026, thanks mostly to the fact that “expectations are low,” meaning that even middling results could be a catalyst for share price growth, according to a note to clients from Citizens Analyst Jordan Bender.

The note, sent to clients Monday, follows a difficult year — and in particular, a difficult second half of the year — for sports betting stocks. FanDuel owner Flutter Entertainment ended the year down 16% after losing 30% in the final four months. DraftKings ended the year down 7.5% after falling 29% September through December.

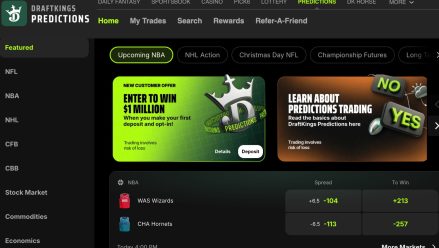

The rise of prediction markets appeared to play a major role in the decline, even though analysts are divided on the extent to which prediction markets may take business away from sportsbooks; some believe the new vertical will simply add to the size of the overall market. Customer-friendly sports betting results also played a role in the share price declines.

Stocks priced lower than usual compared to earnings

Bender pointed out that U.S.-listed sports betting stocks — FanDuel, DraftKings, Rush Street Interactive, Genius, and Sportradar — had an average market capitilization of 11.5 times their expected earnings for 2025. This, he noted, was less than their one-year average of 12.5x or their three-year average of 14.6x.

Those prices, Bender wrote, reflected low expectations, largely due to “regulation, competition, and game outcomes.” He said those “risk premiums baked into the stocks are over-penalizing the trajectory of the online gaming industry.”

At their current prices, Bender wrote that stocks may see an upside, even if companies just meet Wall Street expectations in their full-year results.

Few legalization opportunities

Bender added that a lack of legalization opportunities for sports betting or online casino in 2026 could mean that major operators look to cut costs.

“The efforts to legalize real money gaming in the remaining U.S. states appear to be taking time with legislators, albeit moving in the right direction, but we have taken a bearish view as we model no new states legalizing sports betting or iGaming; we now model Alberta launching in 1Q27,” Bender wrote. “The realization of slowing growth in 2026 and 2027 with no new legalization in the U.S. should push operators to flow more revenue to the bottom line through a more-efficient cost structure.

“A key theme looking forward could be a cost-cutting cycle for B2C operators to peel back investment associated with the heavy lifting done in recent years, particularly with AI investment, making companies more efficient now than ever.”

That, he added, could include reductions in headcount.

“We expect to see emphasis on shrinking sales and marketing budgets (i.e., Caesars’ exit of NFL marketing), rationalizing employee count, and working to reduce payment processing costs,” Bender wrote. “For example, revenue per employee for DraftKings and Rush Street (good proxies for U.S. online gaming) is just over $1M, while other online marketplaces like Airbnb, Uber, and Etsy, and FinTech companies like Block, Coinbase, and Affirm, generate revenue per employee well above these online gaming companies.”

‘Wild wild west’ for prediction markets

While prediction markets may eventually provide a catalyst for more states to legalize online sports betting, Bender said it was unlikely that this would happen in 2026.

“A common talking point is prediction markets will push states to legalize sports betting, which is the ultimate bear case for that vertical, but these processes take time, and education around sports betting in general is a work in progress,” he wrote.

Instead, he said 2026 would be the “wild wild west” for the emerging sector, with little oversight from states, the federal government, or other participants.

“Prediction markets should dominate the conversation through the first quarter before the sporting calendar slows materially during the summer before ramping back up into football season with all platforms live and willing to invest in customer acquisition,” Bender wrote. “We are living through the wild wild west with no proper regulation as companies across the gaming, media, and fintech spaces are trying to grab any slice of the pie at this point.

“The legal back-and-forth will continue to play out throughout the year, but we view this as the peak for the overall operating environment for sports betting contracts, with any proper regulation brought on by states, the federal government, or sports leagues as a catalyst to dampen the mass hysteria around the sector.”

Bender said “the largest bear case” for sports betting stocks would be if prediction markets also aimed to make their own versions of online casino games, but he said that this outcome was unlikely.

FIFA World Cup: Like another Super Bowl

Major sports betting operators will get a boost this summer from the 2026 FIFA World Cup, adding a marquee event to what would be an otherwise quiet period on the U.S. sports betting calendar.

Bender’s team estimated that the World Cup will bring in a $1.7 billion handle in the U.S. and $137 million worth of revenue during June and July, the equivalent of a Super Bowl. The event will also add to the bottom line, adding $25 million each to FanDuel and DraftKings’ earnings and between $1 million and $5 million for BetMGM, Caesars, Fanatics, Penn Entertainment, and Rush Street Interactive.

“Taking in all these factors, we estimate the World Cup will generate ~$1.7bn in handle, or ~$137M of gaming revenue during June and July (Figure 54), equivalent to Super Bowl last year, supporting a solid tailwind during a slow period of the year. From a financial perspective, DraftKings and FanDuel could generate ~$25M of U.S. EBITDA from the total event based on current market share assumptions, while BetMGM, Caesars, Fanatics, Penn Entertainment, and Rush Street could generate $1M-$5M (EBITDA) from the event.“

Reclusive billionaire ups Flutter stake to 15%

Meanwhile, documents filed by Flutter Monday show that reclusive billionaire Kenneth Dart upped his holdings in the betting giant again, and now has more than a 15% interest in the company.

The latest filing shows that Dart’s Cayman Islands-based investment company bought financial instruments that represent about $2 billion worth of Flutter’s shares, or 5% of the company. Filings show the company acquired a 5% stake in the company in September, before increasing its shareholding to almost 10% in early October, meaning Dart now controls the equivalent of a 15% stake in the company.

His total interest in Flutter is worth $6 billion, making him comfortably its largest individual shareholder. Only Vanguard, which manages investments for millions of customers, has a larger stake.

Dart’s business used financial instruments — such as options or swaps — rather than buying the shares directly. This means that Dart’s company’s direct shareholding is still less than 10% of Flutter, which keeps it under the threshold for licensing in most states.

Little is known of Dart’s motivations, as he rarely appears in public. However, he has also invested heavily into major tobacco businesses, such as British American Tobacco and Imperial Brands, and also is a major shareholder of live casino tech provider Evolution, suggesting a theme of investing in “sin” stocks.

Dart’s grandfather founded the packaging firm Dart Container, which owns the Solo Cup Company.

Flutter and DraftKings shares rise

Flutter and DraftKings shares started the year well, with Flutter up 2% to $223.05 and DraftKings up 26% to $36.57 as of 11 a.m. Monday.

Bender also upgraded his price target for Flutter, from $311 to $313.