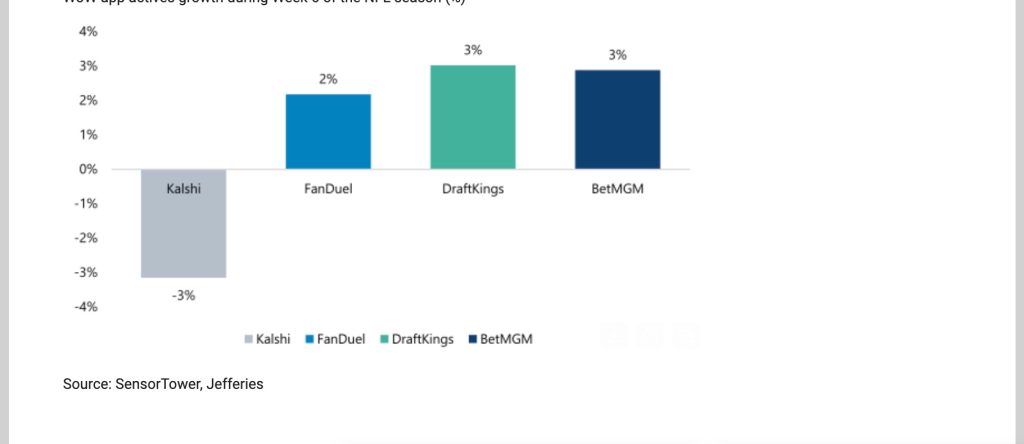

Kalshi’s market volume dropped for the first time during the NFL season in Week 6, Jefferies analysts shared in a note Sunday. The prediction market’s volume fell 5% for the week and 26% on the date of Sunday, Oct. 12. Additionally, according to the note, Kalshi’s “app actives” dropped 3% for NFL Week 6 and 12% Oct. 12. Jefferies’ analysts wrote that during the same time period, app actives for BetMGM, DraftKings, and FanDuel grew between 2%-3% for the week.

But Bank of America analysts wrote Monday that the dropoff may have been an “aberration” as they noted that volume was up 19% week over week for the first four days of Week 7. B of A reviewed data for games played between Oct. 16-19, and the data does not include Monday’s two night games. Analyst Julie Hoover said the uptick was due, in large part, to the “high drama” in Sunday’s New York Giants at Denver Broncos game, which ended with a 33-32 Denver win, in which the Broncos scored all of their points in the final quarter. About $64 million was bet on that game alone, which is “atypical,” Hoover said.

Kalshi is the biggest prediction market offering sports event contracts in the U.S., though Crypto.com and Underdog are offering a more limited selection of contracts. Polymarket appears poised to re-enter the market, though launch has been slowed by the government shutdown.

Kalshi product and pricing are also “inferior” to those of traditional sportsbooks, the Jefferies team of James Wheatcroft, David Katz, and Matthew Copeland wrote. In a direct comparison to Flutter, the parent company of FanDuel, the team looked at odds in 50 markets for the Oct. 9 Thursday Night Football (TNF) Philadelphia Eagles at New York Giants game. The Giants upset the Eagles. FanDuel offered better odds overall on 72% of wagers and 86% of touchdown markets. The average payout on touchdown markets was 40% higher on FanDuel — in particular, a $100 wager on the first touchdown scorer of that game paid out $1,600 on FanDuel, but $950 on Kalshi.

Traditional sportsbooks continue to offer a wider range of wagers, as well. For the TNF game, Kalshi offered markets on seven players to score two or more touchdowns while FanDuel offer 28 such markets.

B of A analysts project that traditional sportsbooks will report below-average hold for Week 7 because the favorites won in the three most heavily bet games during the four-day time period.

Kalshi sees growth in non-legal states

In reviewing data about where Kalshi is making inroads, the Jefferies team pointed to California as a key growth state.

“Since August, CA’s relative share of Kalshi traffic has grown substantially (from 13% to 17%) to become the single largest state, while the NY share has fallen (14% to 11%),” the team wrote. Looking at the bigger picture, Kalshi’s volume continues to grow most significantly in non-legal or “restricted” sports betting states. Jefferies includes Florida, where the Seminole Tribe has a monopoly on regulated betting with its Hard Rock Bet platform, as a restricted state. Data revealed that Kalshi’s traffic from those three states has grown to 28%, up from 25% in August, vs. a drop of 5% in the country’s three biggest regulated states, Illinois, New Jersey, and New York.

The three biggest sports betting platforms by market share have differing approaches to entering — or not — the prediction market landscape.

FanDuel has plans to launch a prediction market through a partnership with CME, which could begin offering sports event contracts with other partners before the end of the year. FanDuel does not currently have plans to offer sports event contracts.

DraftKings has not announced a prediction market plan or partner but it did submit a new application with the National Futures Association (NFA) in June.

BetMGM not planning prediction market

BetMGM CEO Adam Greenblatt said on the company’s third-quarter earnings call Oct. 14 that his company would remain on the sidelines.

BetMGM reported net revenue of $667 billion, up 23% against the same period last year, including a 36% increase in wagering revenue. Flutter is set to announce third-quarter earnings Nov. 12, and DraftKings has its call scheduled for Nov. 14.

The Jefferies analysts wrote they expect Flutter’s U.S. business to have a “small miss” in the third quarter, but still rate the company a buy with a price target of $380. Flutter closed at $251.86 Friday.