A policy analyst from the John Locke Foundation Monday had this to say about North Carolina lawmakers proposing to double the sports betting tax rate: “While tax increases typically deter economic activity, resulting in a smaller tax base, increasing the tax rate on sports wagering operators is likely to have a much smaller impact than typical,” analyst Joseph Harris told the Carolina Journal.

As the legislative season begins to wind down, lawmakers in Louisiana, North Carolina, and Ohio continue to consider major increases the sports betting tax rate in their states.

Louisiana lawmakers Monday moved forward the bill with the biggest increase — from 15% to 32.5%, which is the same amount that video draw poker machines at truck stops are currently charged. Introduced April 16, HB 369 passed out of the House Appropriations Committee, 20-1, Monday. For the bill to have a chance at becoming law, the House must send it to the Senate by June 9, and the legislature is set to adjourn June 12.

In Ohio, it would be the second time since wagering went live Jan. 1, 2023. And lawmakers in Illinois completely revamped that state’s betting tax structure in 2024, shifting from a 15% flat tax to a scale that charges the most prolific operators 40% of gross gaming revenue.

In North Carolina, the current rate is 18% and lawmakers are pushing to increase it to 36%. In Ohio, the tax rate started at 10% when betting was legalized. Gov. Mike DeWine pushed through a doubling of that six months after launch, and he’s now asking to double it again. That would make Ohio tied for fourth in terms of tax rate and North Carolina the fifth most expensive.

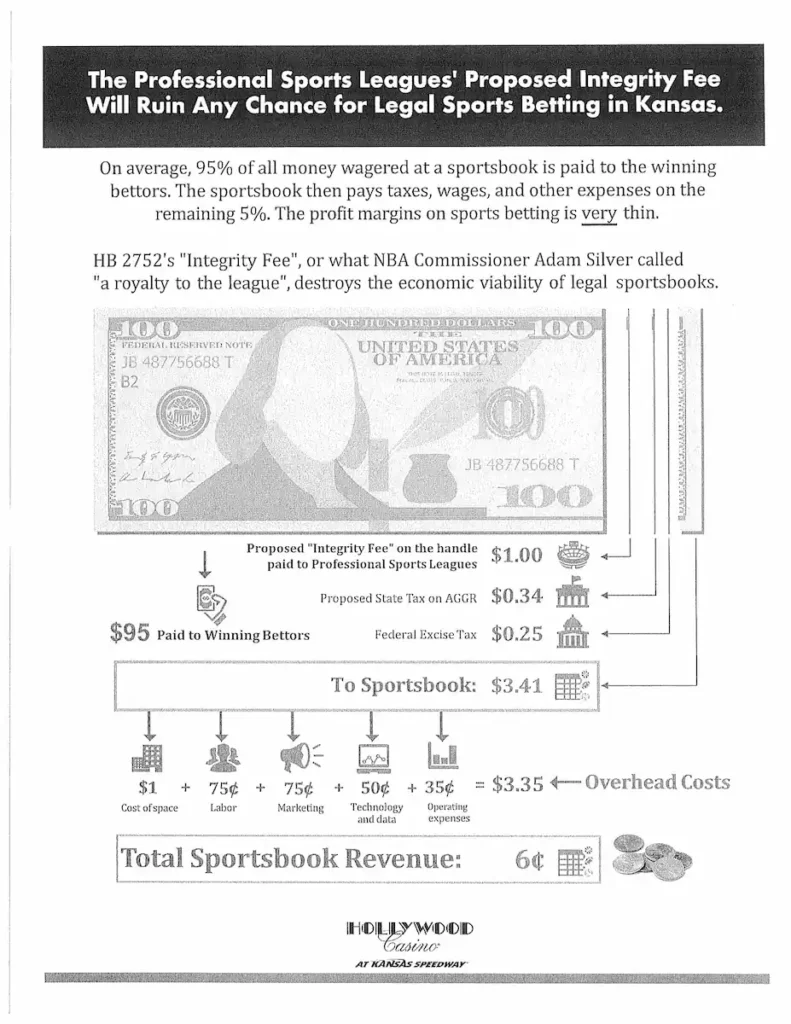

Operators generally look for a tax rate of 20% or less. And that number is up from when states began legalizing sports betting after the Professional and Amateur Sports Protection Act was overturned in 2018. The industry has long argued that while handle numbers often look outsized, revenue and profit are not. A lobbyist at a Kansas hearing in 2018 broke down what sports betting handle vs. revenue vs. profit look like:

Tax hike may mean price increase for bettors

But Harris said operators will find a way to manage a higher tax rate.

“Sports wagering firms already operate in three states that levy a 51 percent tax rate, making it improbable that the companies would close shop in North Carolina due to a 36 percent tax rate,” he said. “However, we can expect that the sports wagering operators would attempt to offset the tax increase by cutting costs and/or increasing prices.

“It is unlikely that increased wagering fees would do much to deter betting due to the addictive nature of gambling. As a result, doubling the tax rate on sports wagering operators is likely to nearly double the revenue the state collects from its sports wagering tax.”

New York is the only competitive market with a 51% tax rate. New Hampshire and Rhode Island both also charge operators 51%, but the wagering companies in those states have monopolies. Rhode Island lawmakers are currently contemplating opening the market to create more competition, and ultimately, more tax revenue.

Tax rates across the U.S. range from 6.75% in Iowa and Nevada to the previously mentioned 51%. Of the 40 live jurisdictions (this includes Washington, D.C. and Puerto Rico), nine have digital betting tax rates at 20% or more and 11 are at 10% or less.

Extra revenue earmarked for schools, sports

All of the bills proposing tax increases also propose to change spend revenue from sports betting differently.

In Louisiana, HB 639 would create the Supporting Programs, Opportunities, Resources and Teams (SPORT) fund, which would earmark money for Division I athletes at Louisiana universities, including LSU, McNeese, and the University of New Orleans. The Appropriations Committee, however, tied the bill to another that would place a flat, rather than graduated, tax on insurance premium impositions. It appears that the state would lose money should this bill pass, but make it up through a wagering tax increase. The wagering increase would only move forward if the insurance bill passes.

In North Carolina, the Senate has passed the budget bill that includes the tax increase, and it was received by the House Monday. Lawmakers aim to have a budget in place before the start of the next fiscal year July 1.

In addition to raising the tax, the language in the North Carolina budget proposal would also change how sports betting tax revenue is allocated, including sending funds to North Carolina State and the University of North Carolina, which currently don’t benefit from the wagering tax.

In Ohio, SB 150 is a stand-alone bill that would raise the betting tax to 36% from 20%. DeWine is pushing for an increase to 40%. Introduced March 18, SB 150 is in the Finance Committee. The bill would also create a sports venue redevelopment fund to be used to renovate or construct sports facilities in the state.