The Arizona Department of Gaming reported on Tuesday a monthly state-record 12.5% hold on gross sports betting revenue for June, completing a statistical data set that resulted in the highest monthly national hold of the post-PASPA era.

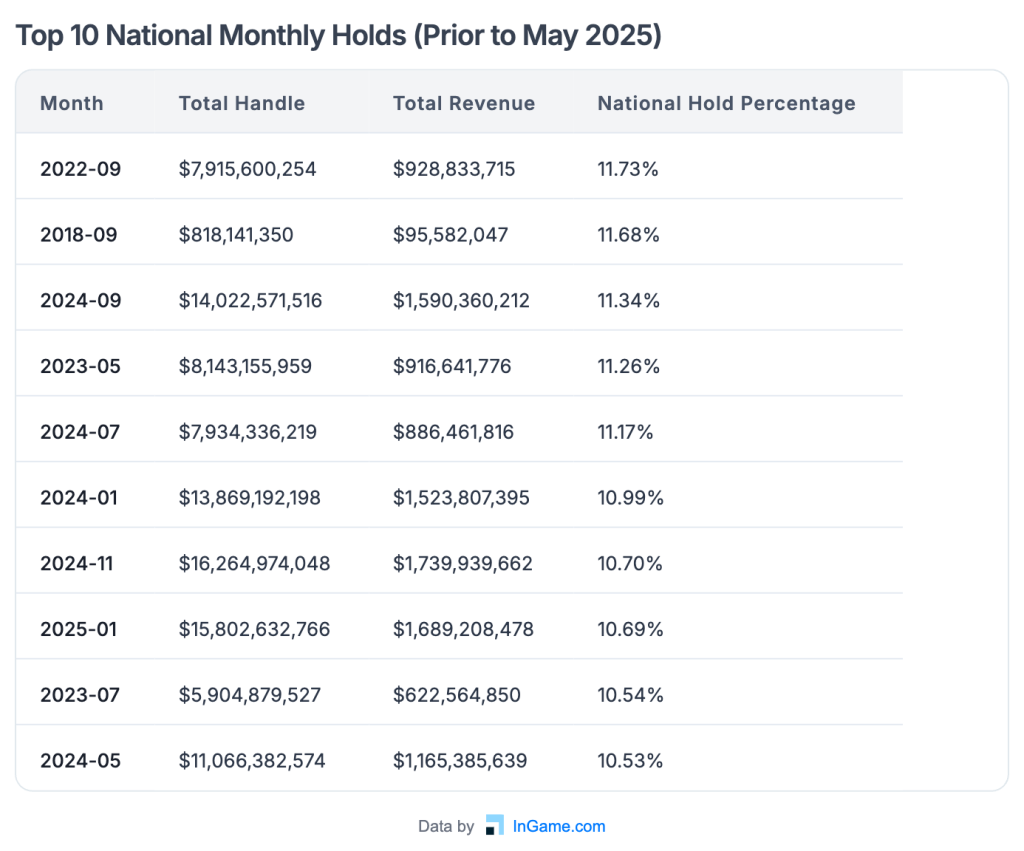

The 32 states and jurisdictions that publish commercial handle and revenue figures combined for a 12.42% hold in June, claiming close to $1.2 billion in gross revenue from $9.66 billion in accepted wagers. That win rate is nearly seven-tenths of a percentage point higher than the previous record of 11.73% established in September 2022, according to InGame Intel.

Nebraska does not publish monthly handle figures, and Tennessee does not collect operator revenue data since it taxes handle.

Arizona’s contribution to history was two-fold as the Department of Gaming also released May figures Monday. The $75.1 million in gross revenue from $707.1 million handle for May rounded out that month with a collective nationwide hold of 11.19%, good for sixth in the post-PASPA era as operators retained $1.38 billion of $12.37 billion wagered.

Grand Canyon State sportsbooks reaped $68.1 million in June from nearly $543 million worth of wagers accepted. The state collected $10.1 million in taxes from $100.8 million in adjusted gross revenue spanning the two months, and the $46.1 million in operator remittance for the completed fiscal year was up $4.9 million from the previous 12 months.

FanDuel, DraftKings lay the lumber

FanDuel cleared $50 million in combined gross revenue for May and June, and the 13.2% hold in June that resulted in $23.4 million was its highest win rate since reaching 14.2% in May 2024. The digital leviathan surpassed $875 million in all-time winnings in Arizona and has four monthly holds of 12% or higher in 2025.

DraftKings’ 12.3% hold in June was its highest in full-month action in Arizona as it kept $19.3 million of the $157.3 million worth of wagers accepted. Despite a 30% spike in year-over-year revenue, DraftKings came up short in a bid for its first three-month streak with at least $20 million in winnings.

BetMGM nailed down the final podium spot for revenue with $6.9 million thanks to a 12.9% hold on $59.3 million handle. That was its highest win rate since reaching 13.9% in July 2023.

While ESPN Bet counts down the days to the NFL season opener that will dovetail with ESPN’s full-scale integration with the league, its second quarter in Arizona was arguably its best. It finished with a record monthly haul of $5.2 million, slamming the betting public with an 18.5% hold on $28.3 million worth of wagers for June. It was the first time the Penn Entertainment-run sportsbook topped $2.4 million since December 2023, and ESPN Bet compiled a 13.9% win rate spanning April through June.

Fanatics continued its relentless promotional spend in the desert with an outlay of $2.6 million in June to rank third behind FanDuel ($5M) and DraftKings ($4.5M). Fanatics has lavished at least $11 million in credits and bonuses on bettors the last four months, with a reported $0 adjusted gross revenue (AGR) in March on a $2.2 million spend. It also kept pace with other operators in performance with a record 12.5% hold that resulted in $5.6 million in gross winnings from $44.5 million handle.

England-based bet365 rounded out the top five for handle in June with $32.2 million despite an all-time monthly low promotional spend of $712,237. It potted $2.8 million in winnings, while the near-$2 million AGR was an all-time monthly high.

Other Arizona notes

The figures from the last two months create a more clear picture of just how far Arizona sportsbooks have blown past their Nevada counterparts in terms of handle to become a top five market nationally. This comparison, though, always comes with the caveat that the Nevada business model still relies on significant in-person betting on the Las Vegas Strip.

Handle in Arizona for the completed fiscal year was $8.62 billion, surging 21% from FY 2024. In contrast, Nevada’s handle in the same period declined 0.9% to $8 billion.

Arizona sportsbook gross revenue growth lagged slightly behind handle at 16.2% growth to $759.1 million. The cumulative 8.8% hold for the last 12 months was more than one-third of a percentage point lower than FY 2024.