Caesars Sportsbook Monday sent a letter to Illinois customers alerting them that it will begin charging 25 cents per wager beginning Sept. 1. Caesars becomes the fourth sportsbook to announce that it will pass the state’s new per-wager tax directly to consumers. DraftKings, Fanatics Sportsbook, and FanDuel previously announced they will also impose surcharges beginning next month.

Five other sportsbooks — BetMGM ($2.50), BetRivers ($1), Circa Sports ($10), ESPN Bet ($1), and Hard Rock Bet ($2) — are addressing the new tax by introducing a minimum bet. Of the 10 live operators in Illinois, bet365 appears to be the only one to have not yet publicly addressed the issue.

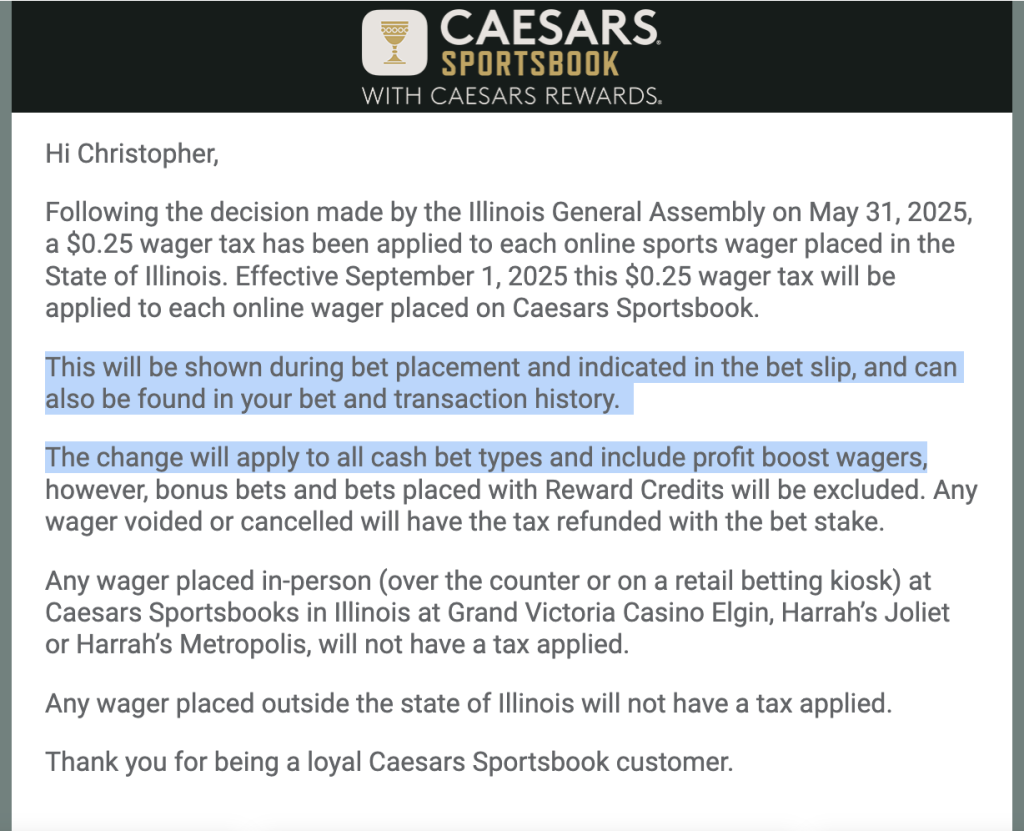

In the letter to customers, Caesars wrote, “This will be shown during bet placement and indicated in the bet slip, and can also be found in your bet and transaction history.”

The company will apply the surcharge to all digital “cash bet types and include profit boost wagers.” The state will only add the per-wager tax to digital bets, and Caesars was clear in saying that bets placed in person at any of its three retail sportsbook locations will not be subject to the new surcharge. It also wrote that bonus bets and bets placed using rewards points will not be subject to the surcharge. For voided or canceled wagers, the surcharge will be refunded to consumers when the bet is refunded.

Caesars already paying 25% on AGR

Caesars pointed to the new law as the reason for the surcharge. Lawmakers in May approved the first-of-its-kind tax, which went into effect July 1. According to the new law, the first 20 million bets accepted by any operator will be charged a 25-cent tax, and all bets over the 20 million will be subject to a 50-cent tax.

Historically, Caesars has taken well under 20 million bets per year in Illinois. The expectation is that DraftKings and FanDuel — the market leaders by revenue in Illinois and across the U.S. — will be the only operators to cross the 20-million bet threshold. Both are expected to reach that number for 2025 next month.

In a 12-month period, Illinois moved from charging a 15% flat tax on sports betting operators to implementing a sliding tax scale, ranging from 20%-40% for the most prolific operators. In FY 2025, Caesars paid a 25% tax on adjusted gross revenue.

In addition, the Illinois Gaming Board, per a July 10 letter, appears poised to tax operators on the surcharge, which amounts to double taxation, according to Adam Hoffer of the non-partisan Tax Foundation.