DraftKings (DKNG) is heading into its first-quarter earnings with a wave of analyst downgrades and against a background of mounting uncertainty about the prospects for the broader online sports betting (OSB) sector.

Two of the more closely followed firms on Wall Street, Jefferies and Deutsche Bank, have each taken a scalpel to their Q1 adjusted EBITDA forecasts, citing various pressures on the business.

While Jefferies remains optimistic despite reducing its Q1 expectations, Deutsche Bank is sounding a more alarmed tone, pointing to deeper structural concerns that may not fade with time.

Jefferies now expects Q1 adjusted EBITDA of $154 million, down from its prior forecast of $224 million, a 31% cut. That seems conservative in light of Deutsche Bank’s revised estimate, which projects Q1 adjusted EBITDA of just $113 million, a nearly 48% drop from its previous outlook of $216 million. These adjustments are more than just accounting tweaks; they reflect a growing recognition that macro and market-specific headwinds are dragging on performance more than anticipated.

According to Jefferies, the main culprit behind the downgrade is the disappointing performance during March Madness, particularly a weak hold percentage in the final week of the quarter.

Bigger picture — beyond March Madness

New York data showed hold fell to just 1.6% in that week, suggesting sportsbooks were unable to capitalize on the high-volume tournament in their usual fashion. In previous commentary, Jefferies hinted that such shortfalls raise broader strategic questions about how operators like DraftKings can manage hold volatility, especially in high-profile events where customer behavior may be more predictable.

However, Deutsche Bank sees the fixation on hold as a diversion from more pressing concerns. The team there believes the conversation has become too focused on short-term swings in hold percentage, calling it “dramatically overplayed” and even “disingenuous.”

While luck will always play a role in sports betting outcomes — unlike slot machines, the industry isn’t dealing with random number generators — the analysts warn that DraftKings’ high target for structural hold, 11% in 2025 compared to a 9.4% actual hold last year, means that luck is more likely to swing against the company than in its favor.

Indeed, Deutsche Bank notes that in five of the last six quarters, DraftKings has blamed hold volatility for missing adjusted EBITDA targets. In Q4 alone, the company missed estimates by $279 million.

The analysts argue that market watchers and investors should pay just as much attention to handle trends as they do to hold percentages. This is where things get murkier.

Handle growth appears to be sputtering. According to Deutsche Bank, the Q1 handle in DraftKings’ active states is expected to come in at around 13%, a figure that falls well short of the 17% needed to hit its 2025 revenue and EBITDA targets. To make up the difference, the company would need to see a meaningful acceleration in handle growth during the second half of the year, in tandem with increased engagement with its micro-betting offerings now powered by Simplebet. As Deutsche Bank put it, the growth needed to meet those targets is “heavily back-half weighted,” making the road ahead look steep.

DraftKings has yet to set a date for its Q1 earnings release, but the stakes are high. The company is guiding to full-year 2025 revenue between $6.3 billion and $6.6 billion and adjusted EBITDA between $900 million and $1 billion.

That implies a revenue growth rate of about 35% at the midpoint. Recent revisions from analysts at Citizens suggest that optimism may be fading, especially following a March Madness that saw all favorites advance — bad news for sportsbooks that make money when underdogs win.

Broader investor sentiment also appears shaky. The share price has reflected increasing concern over both sector-specific issues and macroeconomic headwinds, including fears of renewed inflation that could erode consumer discretionary spending — gaming included.

Other major banks are similarly cautious. CBRE noted that it remains “content but cautious” after reviewing the U.S. gaming landscape, while Morgan Stanley expressed concern over slowing handle growth, coupled with a “plateauing” of new market launches.

That’s an important trend: Much of the industry’s growth in recent years has been fueled by the expansion into new states, often accompanied by aggressive promotional spending. As fewer states come online and promos taper off, so too does momentum in customer acquisition and retention.

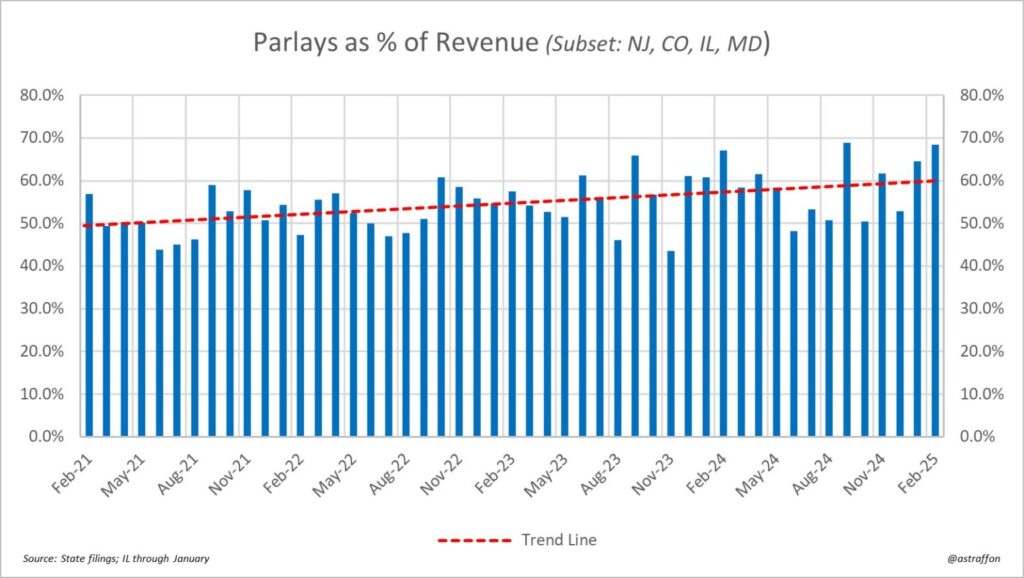

Handle and parlay growth

Morgan Stanley observed that OSB handle growth in existing markets slowed from a range of 23%-35% in the first three quarters of 2024 to just 15% in Q4 and about 13% year-to-date in 2025.

In states where OSB has been live since before 2021, growth is now down to just 5% year-over-year. This is in stark contrast to DraftKings’ 2025 guidance, which assumes revenue growth of 32%-38%, and FanDuel’s similar projections. The mismatch between projected revenue and slowing handle raises questions about how sustainable those expectations are.

Morgan Stanley identified several potential reasons for the slowdown. The lack of new state launches reduces the injection of promotional incentives that often drive short-term growth. Additionally, they pointed to slowing parlay growth, a crucial profit driver, and declining TV sports viewership, which could signal waning consumer engagement.

Despite all this, some long-term investors are reportedly scouting opportunities to enter high-quality names in the space, hoping the recent downturn presents a value-buying moment. However, most remain hesitant, worried that broader consumer headwinds are only just beginning to show themselves.

Meanwhile, the Citizens team warned that sports outcomes once again seem to be skewing toward bettors. All four No. 1 seeds advanced to the NCAA Final Four for the first time since 2008, a customer-friendly result that tends to hurt sportsbook profits. This echoes the end of the NFL season, which also featured bettor-favorable outcomes right before the end of a quarter. Citizens estimates that DraftKings may take a $149 million revenue hit and a $97 million adjusted EBITDA hit in Q1 due to these outcomes.

Citizens tried to strike a slightly more reassuring tone, suggesting the slowing handle trend is “in line” with expectations and shouldn’t be seen as a red flag. They also argued that online gaming as a whole is likely to remain relatively resilient even during periods of consumer weakness.

Still, the fears over both hold and handle are also badly timed given the sudden emergence of prediction markets as a competitor product. Notwithstanding the questions around what the volume figures represent — they aren’t analogous to handle — or indeed how much of that volume comes from regulated OSB states, a competitor for consumer attention may well be badly timed.

Citizens reported last May that DraftKings was champing at the bit to get involved in predictions markets, only for the company to subsequently apparently withdraw its application for a license to sell derivatives.

This suggests regulatory trepidation. But DraftKings’ business instincts may well overcome such wariness once the upcoming CFTC roundtable gives clarity to the situation, particularly should investors display any nervousness about handle trends.