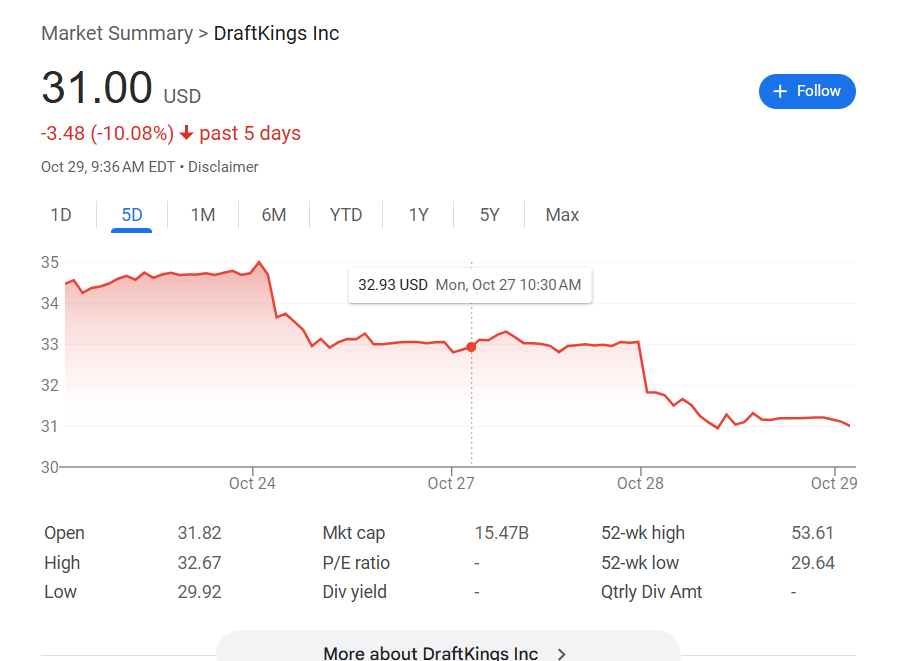

A mix of prediction market news, an NBA gambling scandal, and bettor-friendly NFL results combined to further batter shares in the two biggest companies in U.S. sports betting, with FanDuel owner Flutter and DraftKings losing another $4 billion in market cap over the course of three trading days.

The two sports betting giants saw their share prices fall by well over 20% in the course of two months, wiping a combined $21 billion from their valuations.

Prediction markets have played a major role in the decline of DraftKings’ and Flutter’s share prices during the time frame — with Kalshi’s launch of a build-your-own parlay feature leading to shares in both companies falling by more than 10% in a single day, wiping $7 billion off their combined values.

News related to prediction markets appeared to contribute to further declines on Tuesday. Before stock markets opened, Crypto.com announced a partnership with Trump Media and Technology Group that would allow Truth Social — the social media app founded by President Trump — to launch prediction markets.

DraftKings shares fell by 3.8% and Flutter by 2.8% when markets opened and continued to decline as the day went on.

Additional prediction market news was a cause for the shares’ further drop. After Bloomberg reported that Polymarket aims to relaunch in the U.S. next month, shares in both companies dipped again, leaving DraftKings down 6.8% for the day at its lowest point and Flutter down 3.1%.

NFL results hit sportsbooks again

The latest declines haven’t been entirely driven by prediction markets. NFL results this season appear to be more bettor-friendly than expected, leading to lower revenue and earnings for sportsbooks.

In September, DraftKings CEO Jason Robins flagged Week 1 NFL results as bad for his company’s bottom line and said Buffalo’s 41-40 comeback win against the Baltimore Ravens was the single-worst game outcome ever for the company. Analysts said the customer-friendly results appeared to continue through September, with Citizens analyst Jordan Bender estimating that results during the month cost Flutter around $130 million and DraftKings around $200 million.

Last week’s NFL results appeared to be bettor-friendly again, with a particularly high rate of favorites winning and overs hitting — outcomes that usually benefit gamblers.

Susquehanna analyst Joe Stauff noted that his company’s estimates for major online sports betting companies’ fourth quarter revenue were “at risk” after “unfavorable” October results.

Shares impacted by NBA scandal

Meanwhile, the Department of Justice’s arrest of 34 people, including NBA guard Terry Rozier, in two separate illegal gambling investigations also appears to have impacted both companies’ share prices.

Shares dipped last Friday morning when the arrests were first reported, likely due to concerns that negative headlines could lead to limits on certain types of bet or less integration between betting operators and sports leagues.

Stauff wrote that the NBA continues to back the legal sports betting industry, though.

Stauff pointed to “recent comments that Silver recognizes sports betting is part of the culture and strongly prefers legal operators to be able to find statistical aberrations to prevent ‘inside information’ trades.”

Shares in Flutter are also heavily affected by the outlook of its non-U.S. business. Expectations of a tax hike in the U.K., where Flutter is the country’s largest gambling company, are likely to have also played a role in the decline in the group’s share price.

Shares dip again Tuesday before recovery

At their lowest point, DraftKings shares were trading at $30.73, valuing the company at $15.3 billion. That’s a 12.3% decline since Friday morning, or down 36% in the space of just two months from August. The 36% decline equates to a loss of $8.6 billion in market cap.

DraftKings shares are close to a low of $29.64, reached in April when fears about the knock-on impact of tariff rises hit the share prices of almost all companies regardless of sector. If they sink through that potential point of support, the shares would be at their lowest since 2023.

The decline in market cap to around $15 billion puts the company right around the upper range of the valuation that prediction market Polymarket is reportedly seeking as it continues to eye new investment.

Flutter’s shares hit a low of $235.71 Tuesday before their own recovery, leaving them down 24% in two months, or 7.5% since Friday.

With Flutter being a larger company, that represents an even larger decline in market value – a loss of $12.9 billion.

Caesars shares plunge after weak results

Shares in casinos and sports betting giant Caesars Entertainment also plunged Tuesday after disappointing results. Shares were down as much as 12% to $19.42, valuing the company at less than $4 billion.

Bettor-friendly NFL results played a part in those results, though they were largely priced into the shares. The stock fall appears to be more related to weak visitor numbers in Las Vegas.