DraftKings launching its own prediction market before the end of 2025 was far from surprising.

But what was more of a surprise was that — when DraftKings Predictions went live Friday — the contracts themselves came from CME, the commodities giant that very publicly partnered with FanDuel to launch its exchange, rather than Railbird, which DraftKings bought in October.

DraftKings had discussed offering access to non-Railbird exchanges when it announced its predictions product, and earlier this month obtained introducing-broker status with the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), allowing it to route customers to other exchanges.

“We set up the business so it can be multi-exchange at its core,” DraftKings SVP for Predictions Jeanine Hightower-Sellitto told InGame. “Clearly Railbird offers a giant opportunity for DraftKings, but it doesn’t limit us from also connecting with other exchanges.”

A single business offering both an unaccustomed in-house exchange and access to an established exchange’s contracts is starting to look like a trend. Robinhood last month announced plans to launch its own designated contract market (DCM), but a spokesperson told InGame that there were no plans to move away from offering Kalshi’s contracts. Last week, crypto giant Coinbase partnered with Kalshi to offer its contracts, only to announce Monday that it acquired The Clearing Company — a startup that plans to build its own exchange.

But observers unused to the world of CFTC-registered exchanges may have been surprised that the Railbird product — which has been approved as a DCM since July — was not ready to go live when DraftKings Predictions launched.

Hightower-Sellitto said that there’s more work than many people might realize to bring a DCM live.

“We acquired Railbird in October and we are actively working to launch it in the near future,” Hightower-Sellitto said. “Launching an exchange is not a trivial experience, but we’re working to bring it live.”

DraftKings Predictions fees

The eventual Railbird launch may help with what Hightower-Sellitto describes as DraftKings’ “big plans for evolution of the product and new features.”

But another advantage of launching the Railbird exchange could be that DraftKings won’t have to pay the exchange any fees, potentially leading to better prices, or more profit for DraftKings.

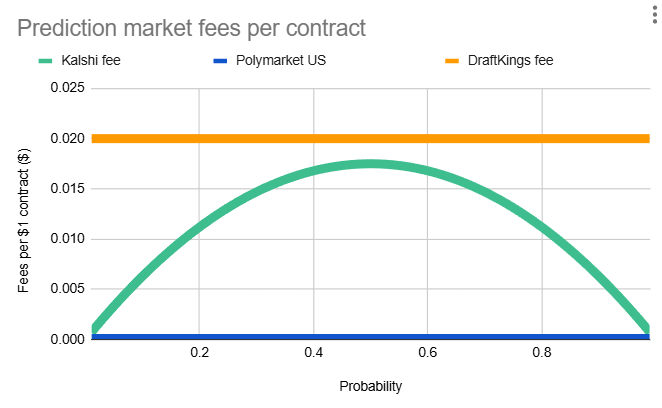

Right now, fees can be high at a flat two cents per dollar traded — one cent for DraftKings as a broker, and one for CME. For a bet at close to 50/50 odds, like most point-spread bets, the fee is far from burdensome. But for big favorites or underdogs, the impact can be much greater. A bet at 99% odds is a guaranteed loser unless the trader making that bet is getting some sort of reduced fees, as market makers on other exchanges do.

Will DraftKings operate as market maker?

That leads to the next question: Could DraftKings operate its own in-house market maker? Kalshi already does so — though the Kalshi Trading arm has attracted controversy at times – and Polymarket is exploring the possibility, according to Bloomberg.

DraftKings already invests plenty of money into trading, to figure out what odds it can offer to customers on its sportsbook. In theory, using those capabilities on the exchange too appears straightforward. For a product like a same-game parlay, if that ultimately ends up on the Predictions app, there are few organizations that would be better-equipped to put up lines for the market to take.

But will it happen?

“It’s an area of interest that we’re exploring but we haven’t made any decisions yet,” Hightower-Sellitto said.

Crossing the line

But Hightower-Sellitto said there’s another type of line that matters — the line between offering an entertaining market and a potentially irresponsible one. Last week, Kalshi’s decision to self-certify a market on the NCAA transfer portal — which it later said it had “no immediate plans” to actually take bets on — attracted controversy. With that in mind, are there any types of bets that DraftKings will not offer?

“We definitely have lines,” Hightower-Sellitto said. “We do have listing standards for predictions. We’re mindful of our media partners and league partners, and are just mindful of the overall impact of listing contracts that would impact our relationships.”

Going along with that is the operator’s decision to include its responsible gaming features on the predictions app, in a “Responsible Trading” hub.

DraftKings has also made efforts to stay on the right side of the line with tribes. Tribes in California and Wisconsin have sued Kalshi, which offers its event contracts on tribal lands, and Kalshi has argued that geofencing these lands would be extremely costly. DraftKings will not offer its predictions product on tribal lands.

“We absolutely respect tribal sovereignty in terms of those lands and we have geolocated our product so they are not available on tribal lands,” Hightower-Sellitto said.

Whether the tribes see that as enough, especially in states where tribes have had statewide exclusivity to offer certain forms of gaming, remains to be seen. Indian Gaming Association Conference Chair Victor Rocha wrote on social media site X that California and DraftKings “are at war” following the launch.

What if regulator reacts to out-of-state activity?

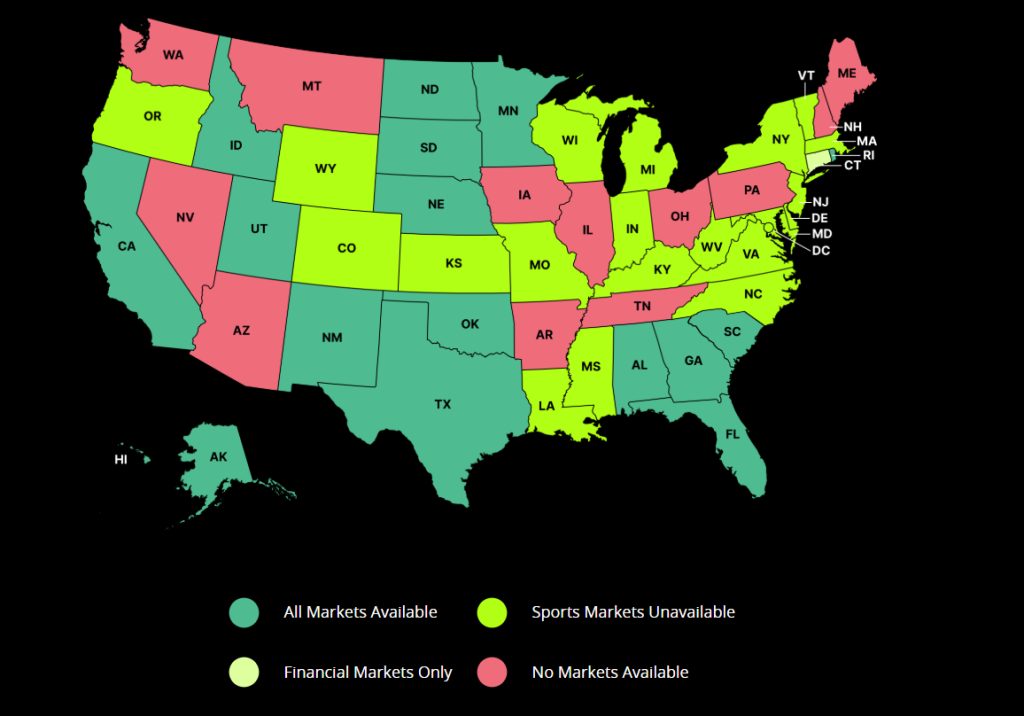

DraftKings has said that protecting its relationships with state regulators is important too. That has been a key reason why the operator chose to launch its prediction market in 38 states, and its sports event contracts in just 17, rather than making it all available nationwide.

“We’ve been really thoughtful about how we approach rolling out DraftKings predictions,” Hightower-Sellitto said. “We have the flexibility to launch the product on a state-by-state basis.

“We really want to make sure those relationships are at the forefront of our business.”

It’s clear that if DraftKings has to choose between its ability to offer prediction markets in a state and its sportsbook license there, it’s choosing the sportsbook license.

But what if it has to choose between its ability to offer prediction markets everywhere and a single sportsbook license?

Gaming regulators in states such as Arizona, Illinois, and Michigan have warned licensees that even offering sports event contracts in another state could be grounds to revoke a state sportsbook license.

And Arizona’s decision to revoke Underdog’s daily fantasy license shows that states may be serious about the idea of policing extraterritorial prediction market activity.

But the situation right now seems to be hypothetical for DraftKings. It doesn’t appear that any state regulator has told the operator to shut down its prediction market everywhere or lose its state license.

With that being the case, Hightower-Sellitto said she wasn’t going to take a stance now on what DraftKings might do if asked to choose between a single state license and its full prediction market offering.

“I think we would have to evaluate that if and when the time comes,” she said.

DraftKings may not have decided on the answer to some of the big questions about its prediction market product, but there’s one area where Hightower-Sellitto has a clear view: whether sports event contracts are betting.

‘It’s not sports betting’

“It’s not sports betting and there are different rules for prediction markets,” she said. “The market underpinnings are much more similar to a stock exchange than a sportsbook.”

That appears to be a step further from Kalshi co-founder Tarek Mansour. On Bloomberg’s Odd Lots podcast in September, Mansour said he “doesn’t have as much of a problem with the word betting,” to describe his product. He noted that the word is often used in traditional commodities trading to describe taking a position on the price of a particular asset.

It’s also arguably two steps further than what would be needed to argue for the product’s legality. Mansour and Kalshi’s lawyers are typically quick to point out that even classifying sports event contracts as “gaming,” never mind betting, wouldn’t necessarily mean that they can’t be offered.

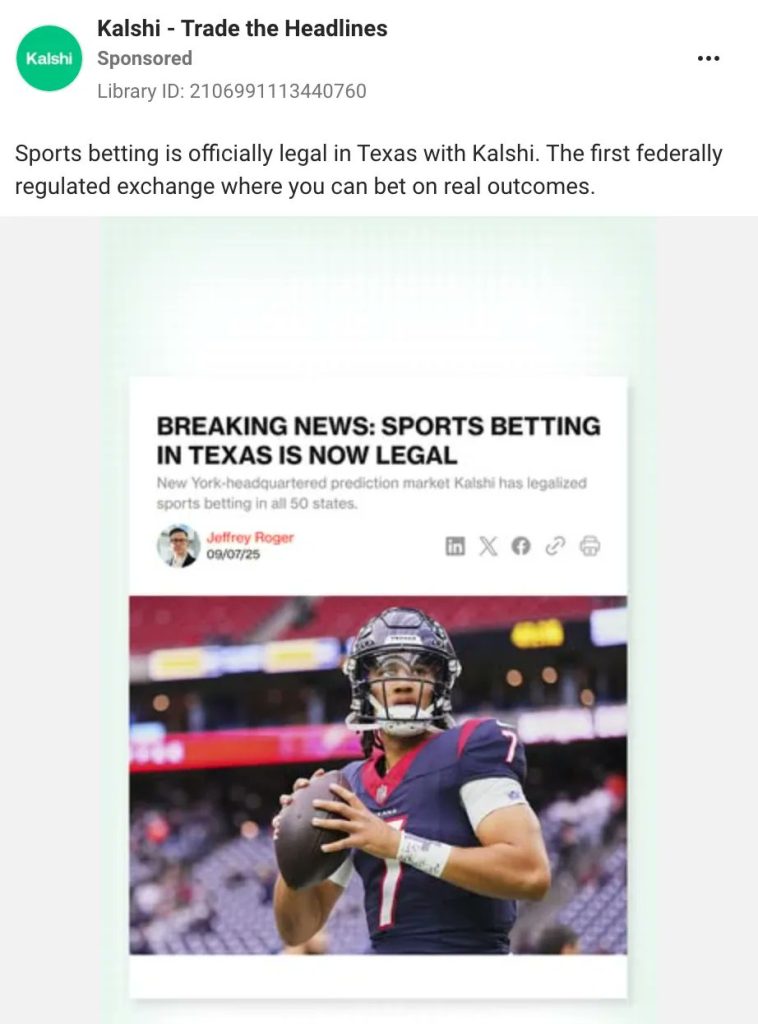

The stance that it’s not betting plays into how DraftKings will market the product: Don’t expect to see the words “legal sports betting” in an ad for DraftKings Predictions.

“We’re not marketing it as sports betting,” Hightower-Sellitto said.

But at the same time, Hightower-Sellitto notes that DraftKings approaches marketing very differently from the financial services companies she’s worked at in the past. When it wants to reach a mass-market audience, it is very effective at doing so.

“What’s pretty unique coming from a financial services background is our approach to marketing, which is different from a lot of companies in the financial services space,” she said.

“We do have a very data-driven approach to how we look at marketing. We have the technical know-how to do this, we have the tooling to market the product. That’s been a key part of our strategy.”

Will that approach bring success? The unanswered questions may linger, but DraftKings has the resources to be a major player.