CME and FanDuel’s prediction market offering will be based on contracts that are active for one hour each – a product that arguably resembles a micro-betting version of financial trading or stock day trading – CME Chairman and CEO Terry Duffy revealed.

Duffy appeared on an episode of Bloomberg’s Odd Lots podcast, recorded on Sept. 25 and released Thursday.

There, he shared new details about what the FanDuel/CME prediction market offering would actually look like. FanDuel revealed in August that it was getting into the world of event contracts through a joint venture with CME, which would apply for status as a registered futures commission merchant (FCM) with the Commodity Futures Trading Commission (CFTC). The companies will offer access to markets created by CME through its status as a designated contract market (DCM).

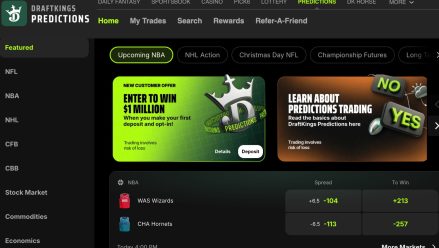

At the time, the betting giant revealed that the event contracts platform would focus on economic and financial indicators, like the S&P 500 or the price of gold.

However, Duffy’s description reveals a product that is much more gamified than a traditional financial product, with fast resolutions compared to most non-sports prediction market offerings.

“There will be a FanDuel Markets app, powered by CME,” Duffy said. “And then when you go in there, we’ll have three or four event contracts a day per asset class. The events will go on for approximately 60 minutes.

“It will be a 60-minute window where we say ‘Will the price of gold be above or below $3,700 an ounce [at the end of the window]?’”

Outside of key economic moments like when the Federal Reserve announces an interest rate decision or when new official data is released, the movement of a major commodity or financial index over the course of an hour is often close to indistinguishable from a random walk.

Kalshi — the largest regulated prediction market in the U.S. — already offers hourly markets on the price of certain cryptocurrencies and the S&P 500.

CME, FanDuel to have multiple market makers

Duffy also said that some of CME’s existing market makers – who already trade on contracts related to the same indicators – will trade on these markets.

“We have multiple market makers, whereas some of our competitors have a single market maker doing this,” he said. “At CME we have a lot of market makers and they will have access to these event contracts, and they will create the liquidity throughout the day. And we will incentivize them to provide deep, liquid markets.”

Duffy added that CME is open to offering sports through the partnership. The partnership will not include sports initially, and FanDuel has not given any indication that it intends to do so in the short term at least, particularly as state regulators argue that sports event contracts shouldn’t be considered legal.

“We’ll run three events a day for gold, three events a day for crude oil, three events a day for the S&P 500, for treasuries. And those are five-day-a-week markets,” Duffy said.

“And if in fact FanDuel wants to put sports up there, then that’ll be weekend events as well.”

Duffy says ‘regulation breeds credibility’

Duffy also said that he did not believe in an “anything goes” model of regulation, and instead said that making sure CME’s event contracts are properly regulated is important.

“Regulation breeds credibility, and if it’s not regulated to a point then it’s the wild west and somebody gets hurt. And that’s not something that I want to bring forward as the CEO and chairman of this company.

“We have to make the participants aware through education of what the rules of the road are.

“That’s one reason I’m doing this deal with FanDuel. I want to walk before we run here.”

He took what may have been a swipe at Kalshi, arguing that “there’s a lot of people going out with offerings before these questions have been answered or studied.”

Duffy also commented on political event contracts, which he said he does “not believe right now … are a good thing.” However, he hedged his view, noting that he could change his mind if technological progress allows for more safeguards, and that he didn’t want to say that CME would never list the contracts.

“The credibility of CME is very important to me, and that’s why I’m very cautious about offering these types of contracts,” he said.

Mansour: CFTC more active than it seems

Kalshi co-CEO Tarek Mansour also appeared on an episode of the podcast. That one was recorded on Sept. 25, and released Wednesday. There, he discussed the growth of Kalshi and its sports event contracts and said that his company has been engaging more with the CFTC behind the scenes than it may appear when it self-certifies new markets.

Self-certification is a process in which a DCM notifies the commission that it plans to list a new type of market. If the CFTC doesn’t step in to review or block the market, it may be offered, although it is not technically considered “approved.”

Mansour said that behind the scenes there is much more interaction with the CFTC for self-certified contracts that offer dramatically new product lines than observers might see.

Some new kinds of Kalshi products — such as bets on point spreads — went live less than a day after the prediction market filed for self-certification. Others — such as its new “build your own parlay” feature — took weeks between self-certification and launch, Mansour said.

“There’s self-certification, which is basically you file with the CFTC and they kind of like, if you file it and you haven’t engaged with them beforehand, they usually will basically block it,” Mansour said. “They’ll call you and say stop until we talk and then you do it.

“But now we’ve covered so much territory and we’ve built so much technology and kept the operations and the regulator in the loop that most new things that we do actually fit into a bucket that we’ve already done.”

He added that he doesn’t “think the CFTC is asleep at the wheel,” and instead said the regulator was aware of developments with sports event contracts.

“They have less staff but they have staff and the staff is aware of sports,” Mansour said. “It’s not like we showed up one day like, ‘Hey surprise, sports markets are here.’”

On Monday, the CFTC publicly referenced sports event contracts for the first time with a letter to regulated firms, just before a government shutdown limited its operations.

In the letter, the regulator said it has still not made a decision about whether the contracts are a prohibited product.

Mansour ‘shocked’ by NFL volume

Mansour also discussed the rise of sports on his platform. Event contracts on markets related to sports have made up more than 80% of Kalshi’s volume since the start of the NFL season, according to InGame analysis, and routinely make up over 90% of volume on NFL Sundays. Football traders have helped power Kalshi to weekly and monthly records in volume, with $2.86 billion traded in the month of September – more than the three prior months combined.

The business recently rolled out a build-your-own same-game parlay feature, which has had low volume so far but may allow Kalshi to grow its sports volume further.

“Volume on a Sunday is very, very big,” Mansour said. “I’m shocked, I’m still shocked. Every week, we do a forecast and we beat it.

“America likes the NFL – they like football more than expected.”

However, Mansour added that he didn’t think the dominance of sports was simply because people wanted to bet on sports more than they wanted to bet on non-sporting events. He said that the predictable schedules and frequent events in the world of sports help drive volume in a way that non-sporting markets can’t replicate as easily.

“There’s just a lot of scheduled events,” Mansour said. “But if you compare a one-to-one, like a game to basically anything that Trump does, Trump will win.”

This doesn’t appear to be true. Based on InGame analysis of Kalshi’s trade data, the exchange’s most popular 100 markets since Feb. 26, only nine are not related to sports. Of those nine, the top four are Federal Reserve decisions and the next five are elections. The top Trump-related market — concerning his speech to a joint session of Congress in March — was beaten by more than 100 sports-related markets.

Mansour also addressed whether he believed Kalshi’s sports event contracts are sports betting. He said that he was fine with the term “betting” — noting that it is often used in finance — but did not believe that they are gambling. “I don’t have much of a problem with the word betting,” he said. “I think gambling is sort of where I have a problem. When CME launched water futures three or four years ago, I remember the headline about how you can now bet on water.

“I guess the word betting is used very sort of loosely, but I would say two things. There’s sort of the legal question and there’s sort of the ethical, ‘Is this good for society?’ question.”

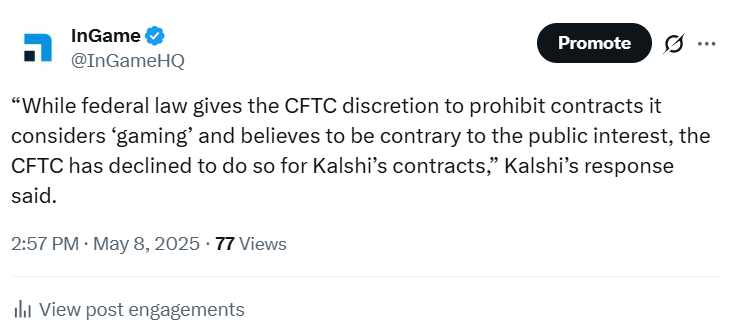

From a legal perspective, Mansour reiterated Kalshi’s argument that it doesn’t necessarily matter whether sports event contracts are “gaming,” because in the company’s view, gaming contracts are not actually unlawful.

The CEA says that “the Commission may determine that such agreements, contracts, or transactions are contrary to the public interest if the agreements, contracts, or transactions involve” gaming, war, assassination, terrorism, or illegal activity.

Kalshi’s lawyers point to the word “may” in that law, as opposed to a stronger word like “shall,” as proof that the law allows prediction markets to offer gaming as long as it’s within the public interest.

“The law is pretty clear,” Mansour said. “If you read the Commodities Exchange Act, there’s a two-prong test and it’s, ‘Is an event kinda related to war, terrorism, assassination violence or gaming?’

“And so you can fall under that category. We could debate whether this falls under gaming or not and there’s actually quite a bit of debate there.

“And then the second test, which is, ‘If it does fall under this category, the CFTC can make an explicit determination that is contrary to public interest.’, So there is that sort of second standard.”

‘This is just better’

Mansour then appeared to argue that Kalshi’s product was within the public interest because be believes it is better for consumers than a sportsbook.

“I’m just a strong believer in markets,” he said. “Like I think a market-based model for these markets is better than the over-the-counter sportsbook model because the odds are better. Anyone can be a price bidder, they don’t have to be a price taker.

“And the results show the percentage of people that basically lose is closer to 50/50. That’s just not the case in a traditional sportsbook.

“And I think that’s the sort of argument that wins it long term, which is like, this is just better. You get better prices, more transparency and the ability to, basically participate in a way that you can’t in a traditional model.”

Trader DRW ‘highly likely’ to get involved

Another episode of the podcast, recorded the same day and released Monday, featured Don Wilson, the founder of trading firm DRW — one of the biggest market makers in commodities.

Wilson’s company does not yet trade on prediction markets, he said, but it was “highly likely” that his business would get involved in non-sports markets.

On sports, he said, “it’s not necessarily a natural fit, but I don’t necessarily have a religious opposition to it.”

Financial trading giant Susquehanna International Group already trades on Kalshi as a market maker across both sports and non-sports markets.