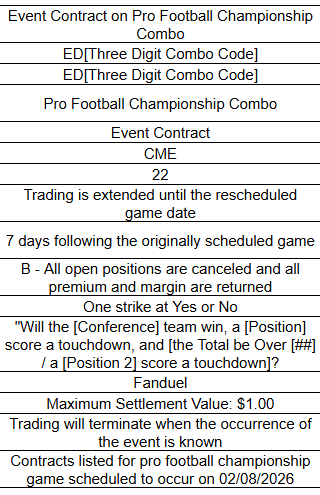

FanDuel Predicts and DraftKings Predictions look to be set to offer parlays on the Super Bowl — or “combos” on the “pro football championship” — as their prediction market partner CME self-certified a multi-leg football contract with the Commodity Futures Trading Commission (CFTC) Tuesday.

CME is a designated contract market (DCM), or exchange, that allows customers to buy and sell its event contracts by going through either FanDuel Predicts or DraftKings Predictions, both of which act as brokers. FanDuel is regulated as a futures commission merchant and DraftKings as an introducing broker.

Self-certification is a process where a CFTC-registered designated contract market submits documents to the CFTC to let the regulator know that they plan on listing a new contract. If the CFTC does not object before the contract listing time provided in the filing, the DCM is allowed to offer the contract, though it is not technically considered “approved.” All prediction market contracts have been offered via the self-certification process.

In the filing, CME said it planned to list the contract by Thursday. Prediction markets do not always list contracts on the day provided in self-certification filings.

The filing gives an example of a possible contract that would be permitted under the self-certification. That example shows the filing is intended for parlays, as it reads, “Will the [Conference] team win, a [Position] score a touchdown, and [the Total be Over [##] / a [Position 2] score a touchdown]?”

Filings for the contract list FanDuel as the “event source.” However, the same is true for all of CME’s sports contracts, including a number of contracts listed by DraftKings.

While FanDuel operates a joint venture with CME and appears set to keep offering CME’s contracts for the longer term, DraftKings’ partnership with the exchange seems to be more temporary. DraftKings acquired Railbird, which is also a DCM, in October and will transition its prediction market to use Railbird’s contracts at some point in the future, though the exact timing isn’t clear.

In its self-certification filing, CME wrote, “Other DCMs have listed substantively similar event contracts. The Contracts mirror those designs in economic substance and therefore raise no novel regulatory issues warranting disparate treatment.”

Can users build their own parlays?

It is not yet clear whether these parlays will be pre-built or if traders can build their own parlays by combining legs of their choice.

User-built parlays require a way of providing liquidity for each combination of legs that might be picked. Kalshi, which started offering user-built parlays in September, does this through a request-for-quotes (RFQ) system, where market makers can offer prices to traders once they build their bet. The complexities of the RFQ market-making process mean that market makers on parlays are virtually always larger institutional traders. The identities of the market makers for CME’s sports contracts are not currently known.

The filing comes days after Robinhood started offering access to Kalshi’s parlay bets, becoming the first broker to accept multi-leg trades.

When FanDuel announced plans to offer sports event contracts in November, parent company Flutter’s CEO Peter Jackson said that parlays would come in 2026.

CME also self-certified contracts on Olympic competitions, the Grammy Awards, and NHL point spreads Wednesday.