Fears about the impact of a proposed new tax in Illinois spread to Wall Street, as more than $3 billion was wiped off the value of the U.S.’s two largest sports betting operators Monday in early trading.

The proposed tax, introduced as part of Illinois’ budget for the 2026 fiscal year, would take the form of a 25-cent levy on each of the first 20 million wagers accepted by an operator during the fiscal year. For the volume of wagers beyond 20 million, the surcharge will be 50 cents. The budget bill is awaiting the signature of Gov. JB Pritzker.

For large operators such as DraftKings and Flutter (which operates FanDuel), the combination of the new tax and the state’s existing progressive tax system could be punitive. InGame estimates that when all taxes are included, FanDuel and DraftKings will likely be remitting payments in Illinois at a rate above New York’s 51% tax rate.

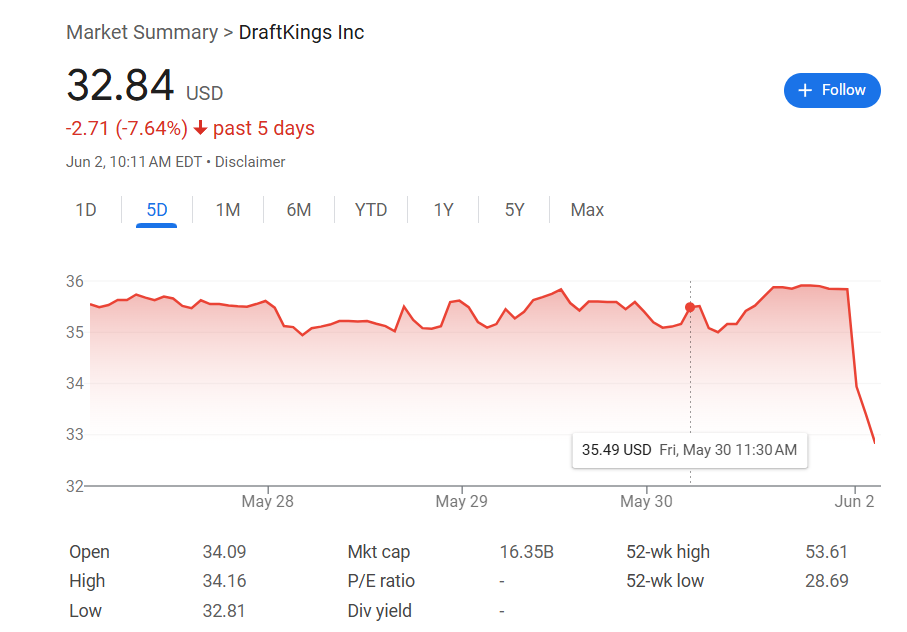

As markets digested the news, shares plunged. The surprise late addition of the new tax meant none of the impact had been priced in when trading ended on Friday.

DraftKings shares slid by as much as 8.5% to $32.84 in early trading, before a slight recovery to around $33.80. That’s enough to take $1.55 billion off the value of the business, leaving it valued at $16.35 billion.

In most respects, the loss in value only exists on paper. But if the price doesn’t recover, the decline could pour cold water on a rumored mega-merger.

DraftKings is among the businesses said to be thinking about buying European betting giant bet365. The family-owned bookmaker is likely to be valued at around $12 billion, according to The Guardian.

If DraftKings is interested in making a deal of that magnitude, the bulk of the payment will almost certainly come in the form of DraftKings shares, particularly given high borrowing costs.

But if shares are worth 8% less, as they were in early Monday trading, it may be trickier to make a deal, particularly with bet365 shareholders receiving almost half the shares of a new combined entity.

DraftKings shares closed at $33.73 on Monday, down 6% for the day.

Flutter shares fall, but less dramatically

Flutter Entertainment’s shares fared a little better than DraftKings, thanks mostly to its global exposure. Illinois represents a smaller percentage of its business than the state does for DraftKings, even though Flutter’s FanDuel is the market leader.

But Flutter shares were still down as much as 3.7% to $243.22, before they experienced a slight rebound. The fall wiped $1.65 billion off the global online gaming behemoth’s market cap.

The shares closed at $245.83, down 2.7% on the day.

Land-based gaming giants MGM, Caesars and Penn Entertainment – which own or co-own sportsbooks that are active in Illinois but hold a lower market share and wouldn’t be subject to the top tax rate – saw modest stock declines of less than 3%.

Impact is hard to mitigate

Analysts said the plunge could hit DraftKings’ earnings before interest, tax, depreciation, and amortization (EBITDA) by about 5%, or $70 million annually, before considering the impact of mitigations. The impact to Flutter’s U.S. earnings is likely to be slightly higher in absolute terms, or a similar share of its EBITDA.

But, in a note to clients, analyst Jordan Bender of the investment bank Citizens said the ability to mitigate the impact would be limited because taxes in the state are already high enough that many of the adjustments have already been made.

Bender estimates that FanDuel’s and DraftKings’ gross margins in the state are around 35-40%, compared to 25-30% in New York. This, he said, implies an “ability to mitigate a small portion of the impact” but suggests some of the cost will have to be passed on to customers.

“Overall, the tax is a negative and plays into our thesis that operators will use the eventual launch of prediction markets to divert players away from sports betting in higher tax states,” he added.

Analyst Joe Stauff of the trading firm Susquehanna predicted an impact on EBITDA of about $40 million after mitigations.

In 2024, DraftKings paid $1.66 billion in gaming taxes nationally on revenue of $4.77 billion.