FanDuel’s parent company Flutter Entertainment is “closely monitoring” the world of prediction markets and moving staff from abroad to examine the opportunity, but its bosses remain coy about exactly what the market-leading operator is considering.

Speaking as Flutter published its first-quarter results late Wednesday, CEO Peter Jackson acknowledged the rise of prediction markets and sports event contracts.

He cited Flutter’s experience in exchange betting through its Betfair exchange, which is available in most of the global betting giant’s international markets. Jackson added that the business has already moved some Betfair staff over to FanDuel to examine the potential opportunity in prediction markets.

“We are also closely monitoring the developments around futures markets and the potential direct and indirect opportunities for FanDuel to explore,” Jackson said. “We already operate what we believe is the world’s largest betting exchange, the Betfair Exchange, and we have vast experience in this space.

“We’re interested in the opportunity, and we’ve taken some of the team who have experience with this from Betfair and moved them into FanDuel to look at the opportunity.”

But Jackson and CFO Rob Coldrake were vague about what a foray into prediction markets could entail.

“We’re not going to walk through the details of how we’re going to attack prediction markets. There’s a bunch of different ways we could do it,” Jackson said.

Coldrake added: “There’s a number of routes to market that we could access quite quickly.”

Customer-friendly results continue

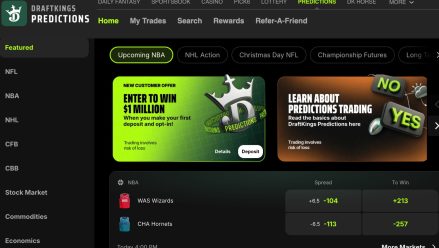

The launch of sports futures event contracts by prediction-market businesses threatens to cut into FanDuel’s leading market share in U.S. sports betting. However, Flutter did not give any indication that this was already happening.

On the other hand, bettor-friendly sports results have hit FanDuel’s bottom line. Unfavorable outcomes will cost the business $280 million in U.S. revenue, or $180 million in adjusted underlying profit for the year, executives projected. That impact factors in “recycling” of player winnings, meaning the initial cost without taking recycled winnings — when gamblers use their winnings to place bets they may not have placed otherwise — into account was likely even larger.

In particular, Jackson noted “an unprecedented number of winning favorites during March Madness.” The 2025 NCAA Tournament was among the chalkiest in modern history, with all four No. 1 seeds making the Final Four and none of the 16 highest-seeded teams losing in the first round.

It’s the second consecutive quarter in which sports results have had an impact on revenue. In the last quarter of 2024, the business, and industry as a whole, was hit by what it called “the most customer-friendly NFL results in 20 years.”

Flutter ‘extremely confident’ in pricing

Jackson was unconcerned by the impact of results, noting that industry-friendly sports outcomes come and go. Executives said the “structural” hold — the margin it expects on normal sports betting outcomes — is 14%.

“The nature of sports results means that over time, outcomes will naturally fluctuate around the average and it is these ups and downs that make sports so exciting and drive engagement,” Jackson said. “Precedent in our global markets shows that sport results can be seasonal but normalize in the long-term.

“Crucially we remain extremely confident in our sportsbook pricing and our ability to price each market based on its expected outcome. This means that over time, sports results, and therefore our gross revenue margins, will align to expected outcomes.”

Revenue for the first three months of the year came to $1.67 billion for Flutter’s U.S. business. The group as a whole brought in revenue of $3.67 billion for the quarter and turned a $355 million profit, an improvement from the loss made a year earlier, but still below Wall Street analysts’ expectations.

Flutter shares slipped in after-hours trading, down 3% to $237.