ForecastEx became the latest prediction market to offer sports event contracts when they quietly launched last month — and they are already dominating the platform in terms of volume on NFL Sundays.

Data reviewed by InGame shows that sports bets first became available via ForecastEx on Nov. 6, and the trades have grown to make up 80% of volume on the platform on Dec. 7.

InGame reported in October that ForecastEx, owned by Interactive Brokers, had become the latest prediction market to self-certify sports event contracts under the name “Success Forecast Contract.” It also self-certified one named “Definitive Statistical Success Forecast Contract,” which seems to allow the prediction market to list prop bets, but it does not appear to have offered these contracts to customers yet.

Despite the self-certification, ForecastEx Chairman Thomas Peterffy said in a Q3 earnings call later in October that the company “was not currently contemplating getting into sports betting.” It now appears that the company launched those exact markets weeks later.

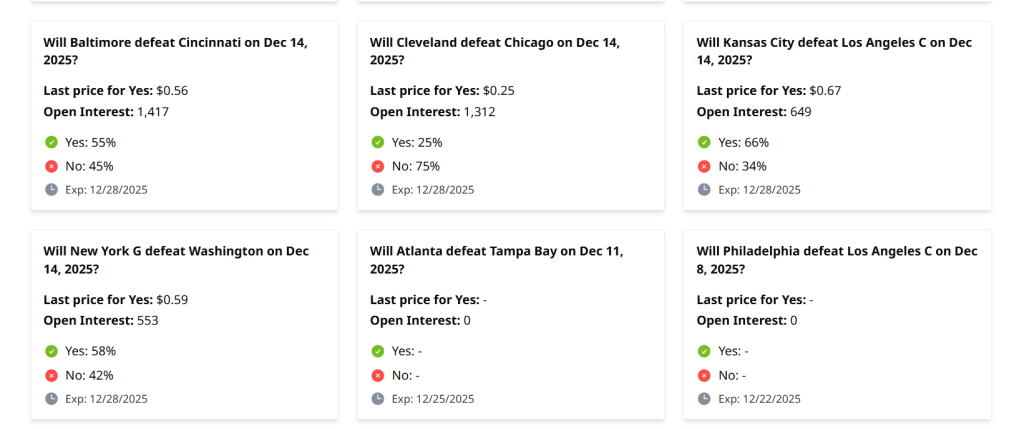

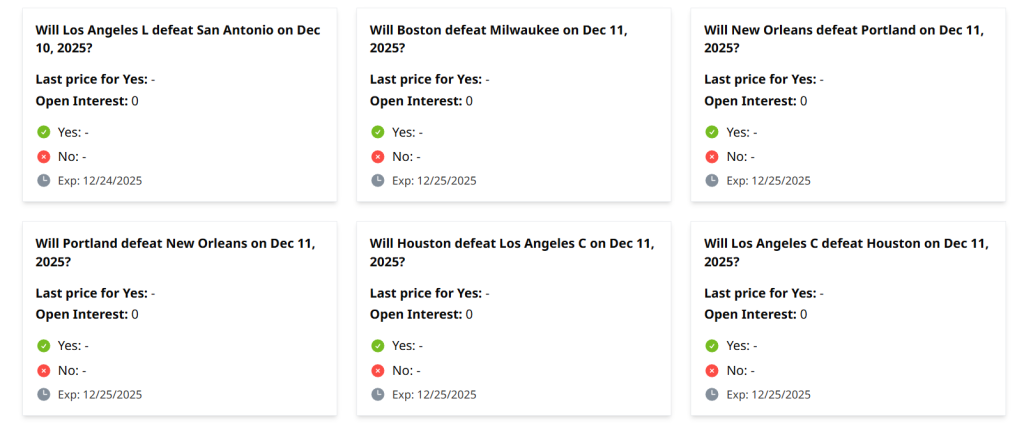

A “sports” tab is available on the ForecastEx website, offering bets on NFL and NBA games.

Volume and liquidity on the contracts are low, with some games — such as the upcoming Thursday Night Football matchup between the Atlanta Falcons and Tampa Bay Buccaneers — showing zero trade offers on either side.

None of the NBA games listed has any trading volume or open offers for trades.

ForecastEx’s data suggests that the contracts launched more than a month ago, on Nov. 6. Trading activity was low at first, and at times days — even Sundays — could pass without a single NFL trade.

However, volume jumped starting on Sunday, Nov. 23.

On that day, $1.2 million worth of NFL contracts were traded. A week later, the total soared to $9.5 million. On Sunday, Dec. 7, the amount was $8.6 million.

Those figures mean that NFL contracts are already dwarfing non-sports contracts on ForecastEx on Sundays and generating more trading volume than any day outside of elections.

Non-sports volume on ForecastEx can be volatile, especially on weekends, depending on what political or economic events may be coming up. On some days, millions of dollars worth of non-sports event contracts were traded, while on others the total was only in the tens of thousands.

The data does not appear to show any NBA trades despite NBA markets appearing on the ForecastEx website.

The data also show that every NFL trade has been on a game winner, and there is no sign of props, spreads, or totals on the ForecastEx website.

The quick rise of sports contracts to dominate ForecastEx’s offering in volume terms shows the continued popularity of contracts on sports, especially compared to contracts on non-sporting events.

ForecastEx lags behind Kalshi

Despite being early to the world of CFTC-regulated prediction markets, launching in August 2024, and having integrations with Robinhood, ForecastEx struggled to approach even a 1% share of the market before its sports launch. Even now, its volume of $10.8 million on Sunday was dwarfed by Kalshi’s $329 million.

ForecastEx advertises itself as offering no fees, but it “rounds up” the cost of a contract where two parties stake one dollar to $1.01, with this extra cent effectively acting as a fee. Adhi Rajaprabhakaran, writer of the Fifty Cent Dollars newsletter, has argued that this structure is “potentially ruinous,” as it would be “literally impossible” to buy a contract for one cent, unless a counterparty willingly chooses to make a bet that they know will not be profitable regardless of outcome.

A number of new entrants are soon to enter the prediction market space. FanDuel is set to offer new contracts made via a partnership with commodities giant CME, likely in the coming weeks. DraftKings is set to launch its own prediction market soon after its acquisition of CFTC-registered Railbird in October. DraftKings won approval from the National Futures Association last week to act as an introducing broker.