As state and tribal regulators battle in court with Kalshi, arguing in part that the upstart prediction market is or will cannibalize the bottom line for regulated digital sports betting operators, a Susquehanna analyst Tuesday wrote that the prediction market is instead “additive” to the landscape.

Joe Stauff wrote in an industry update that Kalshi did $1.25 billion of “comparable” online sports betting volume in September, versus about $15 billion for the nationwide regulated market.

According to its own reported trade data, Kalshi’s total volume in September was $2.86 billion. However, official volume figures are not a like-for-like comparison to betting handle, as prediction market volume counts both sides of every trade and counts cashing out of a bet as a further addition to volume. As a result, Susquehanna calculated the “comparable” figure, which estimates what Kalshi’s volume may look like in sportsbook handle terms.

Because Kalshi is currently the only national player with significant volume, Susquehanna treats the company as if it is the entire prediction market. Going forward, when Polymarket and other platforms launch, they would be included in the volume number.

The $1.25 billion is about 8% of total wagering handle, if Kalshi’s volume were added to regulated handle for September. Susquehanna also notes that it believes about 90% of Kalshi’s volume is from sports event contracts.

Stauff went on to write: “Bookmakers indicating that Kalshi/predictions markets are not affecting their businesses which assumes (1) no real encroachment in legal states and (2) large majority of predictions markets volumes coming from states where OSB (online sports betting) is illegal.”

As an example of prediction markets operating in non-legal sports betting states, when Underdog partnered with Crypto.com as a tech provider for prediction markets, it made the decision to roll out its offering only in certain states. There are 19 states in which online sports betting is banned, and Underdog Predict is now live in 14 of them, including California and Texas. It is also live in legal online sports betting states Arkansas and Rhode Island.

Susquehanna also called September NFL hold “un-favorable,” in large part due to “outsized adverse impacts on bookmakers” from two Sunday night games — the Buffalo Bills-Baltimore Ravens matchup in Week 1 and the Dallas Cowboys-Green Bay Packers game in Week 4.

Ark Invest makes big buy on DK dip

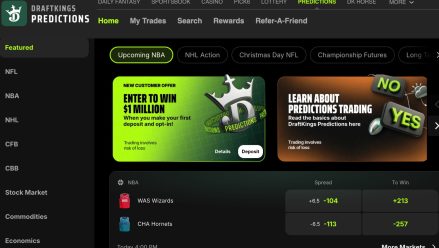

Seeking Alpha Thursday reported that Cathie Wood’s Ark Invest took advantage of the dip in DraftKings shares following the news of Kalshi rolling out same-game parlays in time for the two Monday Night Football games.

DraftKings stock dropped as much as 12.1% Tuesday, and is down more than 25% since the start of the college football season. Ark Invest purchased 511,049 shares of DraftKings across three exchange-traded funds. Thursday morning, DraftKings was trading at $35.09. It opened trading Monday at nearly $42. The drop Tuesday took about $2.5 billion from DraftKings valuation.

FanDuel owner Flutter also took a hit after the Kalshi same-game parlay news, and its stock dropped as much as 11%. Flutter opened the week trading at $283.15, and Thursday afternoon was trading at $250.80. The drop represents a loss of about $5.5 billion in market cap.