A Kalshi lawyer who said that if event contract traders “lose their shirt, that’s on them” is the latest candidate that the White House is reportedly considering for the role of chair of the Commodity Futures Trading Commission (CFTC).

Semafor reported Tuesday that Josh Sterling, a lawyer at Milbank who has represented Kalshi in its cases against the states of Nevada, Maryland, and New Jersey, would take over the CFTC chair after Brian Quintenz’s nomination stalled. The report says the White House is vetting Sterling, who also worked at the CFTC between 2019 and 2021, for the role.

Sterling’s NCLGS comments

To those in the sports betting world, Sterling is widely known for his comments at the National Council of Legislators from Gaming States (NCLGS) Summer Meeting in July.

Sterling was dismissive of the idea that a prediction market like Kalshi would bear responsibility for customers facing excessive losses.

“People are adults, and they’re allowed to spend their money however they want. And if they lose their shirt, that’s on them,” he said. “I mean, that would be obvious, right?”

Representing Kalshi, he has made clear that he believes sports event contracts offered by CFTC-registered exchanges are a legal financial product. He has also made clear that he believes only the CFTC can determine whether a contract should be listed and rejected the idea that courts must determine whether sports event contracts have enough economic impact to be considered swaps.

“I don’t think that the courts decide any of that,” he said at NCLGS. “There is no economic line-drawing around these contracts at all. It’s not for courts to substitute their judgment about what is speculation or what’s hedging or what’s too much speculation.”

Another candidate with Kalshi ties

Sterling would be another candidate with clear ties to Kalshi besides Quintenz, President Trump’s initial choice for the role. Quintenz’s hopes of being nominated appear to be all but gone now that new candidates are being vetted.

Quintenz is a Kalshi director and shareholder. While he has pledged to step down from his board role and divest his shares if he becomes CFTC chair, he faced conflict-of-interest questions after emails showed his chief of staff asking existing commission staff for information related to applications for CFTC-registered status, which may concern Kalshi rivals.

Quintenz’s nomination appeared to stall after two Trump donors, twins Cameron and Tyler Winklevoss — who founded crypto exchange Gemini — reportedly lobbied against his selection.

Though Quintenz’s nomination has not yet been withdrawn, Sterling is now the fourth candidate to be linked to the role in the past week. On Friday, Bloomberg reported that Michael Selig, chief counsel to the Securities and Exchange Commission’s (SEC) crypto task force, and Tyler Williams, counselor to Treasury Secretary Scott Bessent on digital asset policy, were candidates for the position.

On Monday, crypto newsletter Brogan Law reported that Paul Atkins, chair of the SEC, was also being eyed for the role. Appointing Atkins would appear to raise legal questions as the Securities Exchange Act of 1934 — the law that created the SEC — says “no commissioner shall engage in any other business, vocation, or employment than that of serving as commissioner.”

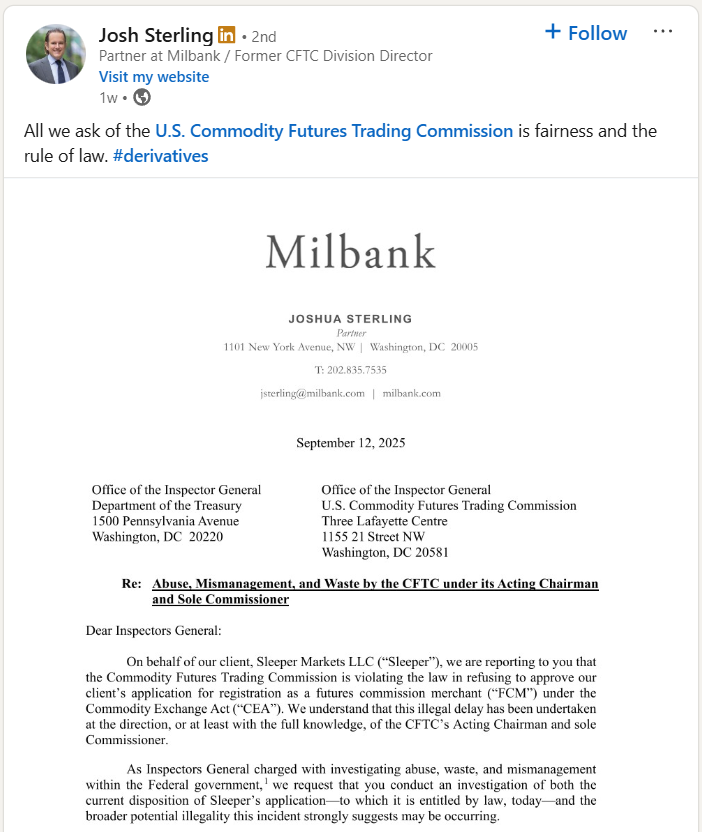

Sterling involved in Sleeper CFTC complaint

Sterling has worked with other businesses regulated by the CFTC or hoping to gain CFTC registration.

Earlier this month, he wrote a letter to the Office of Inspector General – the organization that oversees other federal bodies – on behalf of fantasy app Sleeper, accusing the CFTC of breaking the law by “refusing to approve” its application to become a futures commission merchant (FCM). As an FCM, Sleeper would be able to partner with exchanges like Kalshi and list their contracts.

Sleeper has an active application with the National Futures Association (NFA), a key prerequisite to becoming an FCM. The letter claims that the NFA was “prepared to approve” Sleeper’s application in August, but “CFTC staff instructed” the NFA staff not to do so.

It goes on to allege that the CFTC’s reasons for doing so were “unspecified concerns by the Commission about certain event contracts that are or will be listed on a designated contract market that is unaffiliated with Sleeper.”

Tribes file brief in Crypto.com-Nevada suit

Elsewhere in the world of prediction markets, a group of 10 tribal organizations and 24 federally recognized tribes filed an amicus brief last week to join the case between Crypto.com and the state of Nevada.

Crypto.com, which was the first CFTC-registered exchange to offer sports event contracts, sued the state of Nevada in June after the state tried to enforce a cease-and-desist to get the sports contracts shut down. Crypto.com’s legal arguments have been similar to those offered by Kalshi, which won an injunction in April to at least temporarily block the cease-and-desist from being enforced.

Brief-Interested-Parties-Newland-IGRA-CA-v-Kalshi-Sept-15-2025Crypto.com’s sports event contracts gained more attention earlier this month when fantasy giant Underdog announced a partnership with the exchange, allowing customers to buy and sell Crypto.com’s sports event contracts via the Underdog app in 16 states. Underdog is officially considered a “tech provider” to Crypto.com rather than having any official CFTC-registered status.

The new brief filed by the tribes argues that Crypto.com’s sports contracts would significantly impact both tribal revenue and sovereignty and that therefore they are affected by the case.

“The Tribal Amici all have a shared, strong interest in this case because of its potential to have a significant impact on their or their member tribes’ rights regarding gaming on Indian lands, as well as Indian gaming and tribal governmental revenue as a whole,” the brief said.

In the brief, the tribes argue that sports event contracts are a form of “Class III Gaming” – the most tightly regulated form of gaming, which includes sports betting – under the Indian Gaming Regulatory Act (IGRA), and therefore cannot be offered by non-tribal entities on tribal lands, or within states where tribes hold the exclusive rights to offer Class III games.

It adds that the Commodity Exchange Act – the law governing CFTC-registered exchanges – “does not preempt” IGRA, as the law makes no mention of doing so.

“It is axiomatic that ‘Congress … does not alter the fundamental details of a regulatory scheme in vague terms or ancillary provisions—it does not, one might say, hide elephants in mouseholes,’” the brief said, quoting a 2001 opinion by Supreme Court Justice Antonin Scalia.

As a result, the tribes said, “Crypto.com tramples upon established federal Indian policy by usurping the rights of tribes to regulate gaming on Indian land and benefit from such gaming” and urged the judge to deny the exchange’s motion to block Nevada’s injunction.

A group of tribes and tribal organizations had previously filed amicus briefs in two lawsuits involving Kalshi – one against the state of New Jersey and one against Maryland.

The counsel for the tribes includes Brian Newland of Powers Pyles Sutter & Verville P.C., who was previously Assistant Secretary of the Interior for Indian Affairs and chair of the Bay Mills Indian Community. Newland’s Department of the Interior role put him in charge of reviewing tribal compacts between 2021 and 2025.