Kalshi’s new same-game parlays may have brought in less than $2,000 in fees for the prediction market on their first day of trading, but they helped wipe almost $7 billion off the market values of the two biggest companies in U.S. sports betting.

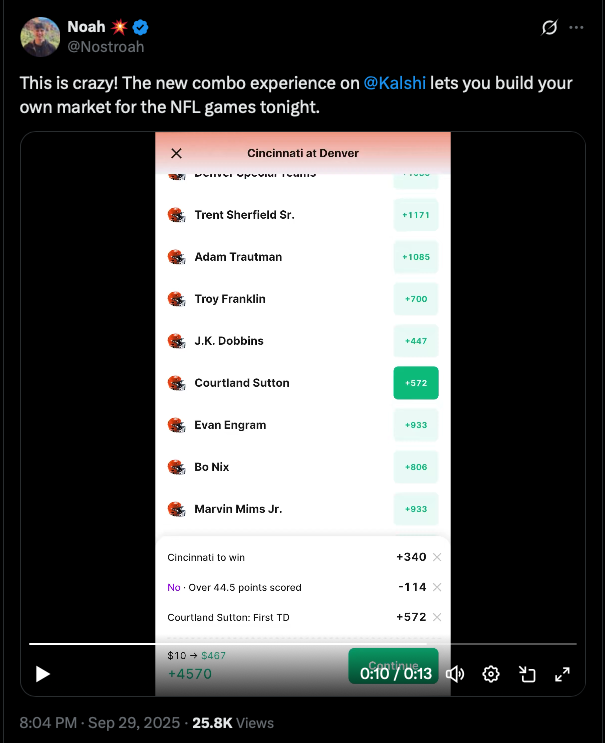

The prediction market rolled out a “build your own” parlay product on Monday afternoon, just ahead of the dual Monday Night Football matchups between the Dolphins and Jets and the Bengals and Broncos. The product launch comes four weeks after Kalshi first self-certified to offer multi-leg bets. The prediction market launched some pre-built parlays before the NFL season opener, but rollout of those bets had been limited since then.

A Kalshi user can select different bets — such as a game winner, a player to score a touchdown, or total points — to make up legs of the parlay. It is then sent out to certain other users on the Kalshi exchange as a “request for quotations,” asking them to give a price to the opposite side of the parlay. In practice, the deals are priced by institutional market makers — large-scale traders who typically receive rebates or other incentives for offering odds on certain bets.

In pure volume or revenue terms, the immediate impact of the new product was not large. Trading data shows that customers traded $255,757 worth of same-game multi-variable contracts Monday, giving Kalshi $1,762.01 in fees.

In total, there were 1,229 recorded trades involving multi-leg parlays — though Kalshi’s trade data can sometimes break up a single transaction into multiple trades — concerning 175 different combinations of events. The median trade came with a 16% probability of occurring, the equivalent of +525 odds.

The name of each parlay combination in Kalshi’s trade data is a seemingly random collection of letters and numbers, meaning the legs that made up popular parlays cannot be seen. However, one same-game parlay was the subject of 21 different trades.

At sportsbooks in states that report parlay data, multi-leg bets — including both same-game and multi-game parlays — make up more than half of revenue and around a quarter of handle, according to Casino Reports data.

At Kalshi, the trades made up around 0.2% of volume — the closest equivalent to handle, though the comparison is not like-for-like — and about 0.15% of fee revenue.

However, first-day uptake was likely to only show a small fraction of Kalshi’s potential volume and fees from the feature.

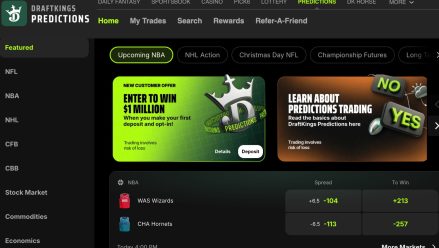

The new feature was made available without prior advertisement only hours before the games in Miami and Denver kicked off, and then appeared to no longer be available once the games started. The feature also did not appear to be available via Robinhood, which offers its users access to Kalshi contracts, and is responsible for more than half of its volume, according to figures announced by its CEO Vlad Tenev Monday.

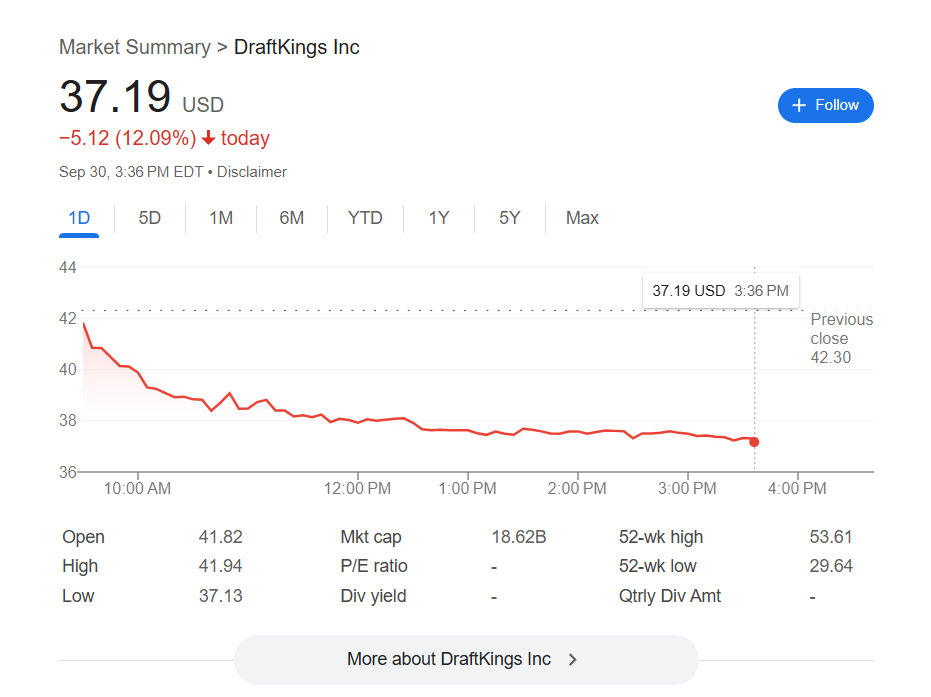

Flutter and DraftKings shares plunge

Sensing the significance of a new challenger offering a version of sportsbooks’ most lucrative product, equities markets were spooked.

The growth of same-game parlays at sportsbooks like DraftKings and FanDuel has played a major role in the success of the two market-leading operators, with the high-hold products pushing betting margins at both sportsbooks above 10%.

If Kalshi’s same-game parlay proves popular, it may be able to offer the same products with dramatically better odds than FanDuel or DraftKings, with a potentially dramatic impact on both companies’ profits.

DraftKings shares plunged by as much as 12.1% to $37.19 Tuesday morning, valuing the business at $18.62 billion. That fall put them down by almost 23% since the start of the college football season at the end of August.

Tuesday’s decline knocked $2.5 billion off DraftKings’ market capitalization, and the decline since August has taken more than $5.5 billion from the value of the company.

DraftKings shares closed at $37.40, down 11.6% for the day.

FanDuel owner Flutter Entertainment lost as much as 11% to $252.09. It has lost 19% since late August. As a larger company, the loss in market cap terms was greater than at DraftKings — the plunge on Tuesday took $5.5 billion off the company’s value, leaving it worth $10 billion less than its value in late August.

Flutter shares closed at $254.00, a 10.3% one-day decline.

Shares in Flutter are also affected by non-U.S. events as the business operates around the globe. The prospect of a new gambling tax hike in the U.K. — the company’s second-largest market after the U.S. — likely contributed to the fall as well.

The combined $7 billion taken off the value of DraftKings and Flutter is more than double the share-price impact of Illinois’ shock tax hike in June.