Prediction market Kalshi’s new formula for “maker fees” doesn’t work out as a significant fee increase on the whole, but is likely to mean higher payments for those using the platform to bet on sports, especially major U.S. pro sports leagues, InGame analysis shows.

Kalshi changed its maker fees on July 1, after notifying users of the upcoming change on June 26.

“Maker fees” apply only on selected markets. They cover market-making trades, where a bettor sets a price and waits for a counterparty to take the other side of the bet. On the majority of Kalshi’s markets, these fees do not exist, in order to incentivize users to set prices.

However, for certain events — usually among the most popular markets and ones where institutional market makers are active — Kalshi applies a “maker fee” for customers that offers a trade and wait for another bettor to match it. These fees are typically lower than the fees for “takers,” who bet at a price that has been offered by a “maker.”

Maker fees tend to represent a balance between Kalshi’s desire to encourage more liquidity on the platform and the need to generate revenue. As a result, the fees exist, but only on markets where Kalshi determines it can still see enough liquidity to encourage traders to bet, and they remain lower than “taker” fees.

Maker fees apply on Kalshi markets for NFL, NBA, and NHL games, as well as golf and tennis majors, and some non-sports markets such as those related to the economy.

Institutional market makers — large trading businesses that receive incentives from Kalshi to set prices — trade on many of Kalshi’s most popular markets.

Kalshi’s most notable institutional market maker is Susquehanna Investment Group’s sports arm. The exchange also has an in-house market maker named Kalshi Trading. These market makers often trade on both sides of the same market, acting something like a traditional sportsbook within the Kalshi platform.

These institutional market makers are offered a more favorable fee structure, though the exact terms are not known. As Kalshi’s trading data is anonymized, many of the trades analyzed likely involve institutional market makers, and so the figures cited here may not reflect Kalshi’s actual income from maker fees.

However, regular users may also place market-making trade orders if there isn’t an immediate opportunity to make a trade at their desired price or volume. These users are likely to be most impacted by maker fees.

Kalshi’s new maker fees

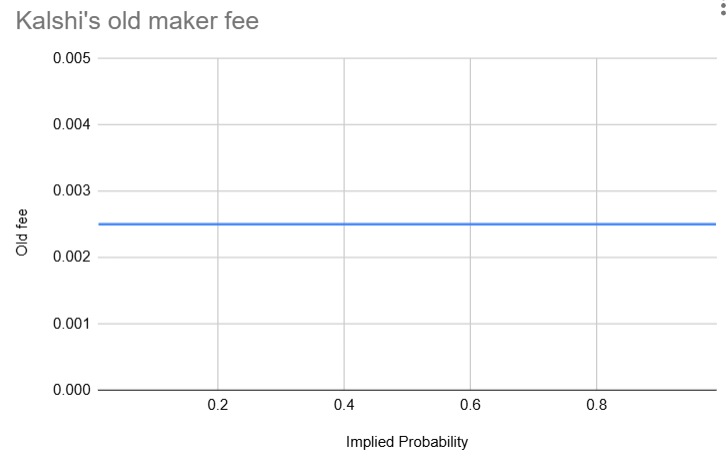

Under the pre-July 1 formula, users setting a price on a market where maker fees were in place had to pay a flat fee of 0.25 cents per $1 contract traded. In effect, this flat fee had a disproportionate effect on trades for extremely likely or extremely unlikely events. For example, a bettor trading exclusively on events with a 1% implied chance of occurring would be paying a quarter of their stakes in fees.

The distorting effect of the old formula had been criticized by some, such as pro bettor Rufus Peabody who noted that the system led to unusually high fees for golf tournaments, where bets with longer odds are common.

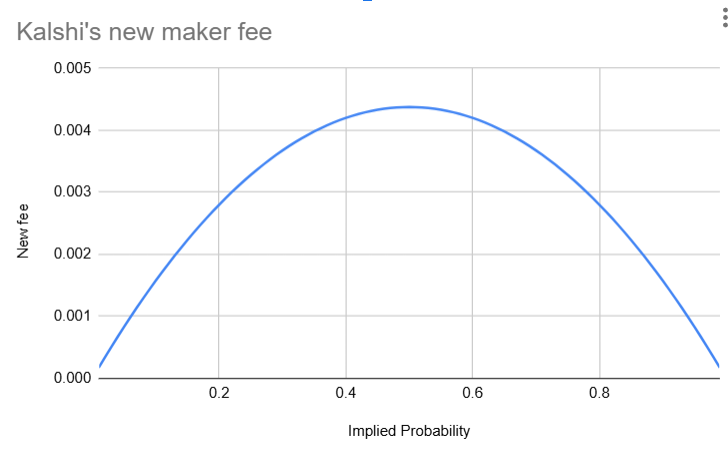

The new formula is a similar system to Kalshi’s fee schedule for normal trades. Fees are highest at close to 50% odds, but lower for events that are highly likely or highly unlikely to occur.

New maker fee = round up(0.0175 x C x P x (1-P))

Where:

P = the price of a contract in dollars (50 cents is 0.5)

C = the number of contracts being traded

round up = rounds to the next cent

The new system avoids putting extreme fees on any type of trade, but InGame analysis suggests that the new system may work out as a fee increase for those using Kalshi to bet on sports, especially major team sports. Sports markets are consistently the most popular category on Kalshi.

InGame analyzed more than 11 million trades, worth billions of dollars, covering the period from Feb. 26- July 6.

Over the 20-week period, the amount Kalshi would collect in fees is little changed whether the old formula or the new formula is used. Fees were slightly higher under the new formula, but the difference — the increase from $3.03 million to $3.06 million is negligible.

However, a clear difference can be seen between sports and non-sports markets. On non-spots markets, the new fee formula is more generous. However, on sports markets, the new fees are around 6.5% higher.

While golf in particular faced significantly higher fees under the old formula, and tennis and soccer produced similar fees in each system, major U.S. professional sports leagues appear to be most likely to face higher fees under the new system. In fact, fees for NBA, NHL and NFL markets are 15% higher under the new formula (though with the season still two months away, NFL trading volumes have been low so far).

Kalshi doesn’t yet impose market-maker fees for Major League Baseball, even though its website lists MLB games as among the events that institutional market makers trade on. If it did put maker fees on MLB trades, the new formula would lead to significantly higher fees than the old one.

The NFL is likely to be a major source of trading activity on Kalshi once the season begins. The exact trading patterns that will occur remain to be seen, but like other major U.S. sports leagues, overwhelming favorites and underdogs are not so common in the league of “any given Sunday.” That suggests fees would probably be higher under the new formula than they would be if the old one was still in place.

There’s no guarantee the new formula would remain more generous to non-sports traders either.

Many of the fees from non-sports trades come from markets related to the Federal Reserve, where recent decisions had been widely expected before meetings began. This may become less likely to be true going forward as interest-rate cuts become more likely. Past fees for trades related to cryptocurrency, economic data, and the stock market may not be predictive if levels of market volatility change.

A Kalshi spokesperson did not respond to a request for comment.