Sports betting operators in Massachusetts are decreasing bet limits for bettors with a “tendency” to win while increasing limits for those who lose, the Massachusetts Gaming Commission (MGC) revealed Tuesday in a meeting to discuss bet limits. And a consultant told the commission that opening the market to include prediction markets, exchanges, and sharp sportsbooks is the “best solution to the issue of limiting.”

The commission sent two data requests to the state’s seven operators earlier this year, and the results showed that in total, operators limit 0.64% of bettors. Of those, 12.7% are limited to 1% of “the default” and 82.4% are limited to 49% or less of the default. The default is the stake factor of a bettor who has not had their limit altered.

The MGC has been considering whether or not to restrict operators from limiting bettors for more than a year. The net result of Tuesday’s meeting was that staff will begin to research and craft regulations around bet limiting. The commission is specifically interested in considering a regulation that would require that bettors be notified that they have been limited and explain why. Commissioners said they believe bettors are often limited with no warning or explanation.

In addition, Commissioner Eileen O’Brien suggested reviewing advertising guidelines, “drilling down on the whys” of how people get limited, and also considering “when and how people get out of this [limiting] box.”

In discussing bet limiting, the MGC was clear in saying that it is concerned with bettors who are limited despite the fact that they are not taking advantage of the system.

“This is really about fairness, and when players aren’t taking advantage of the books, but yet they are limited, how are they able to get out of that ‘box,’ as Commissioner O’Brien artfully put it, and back into the regulated market,” Chair Jordan Maynard said.

The commission also agreed to get operator feedback on the issue.

Expect operators to push back

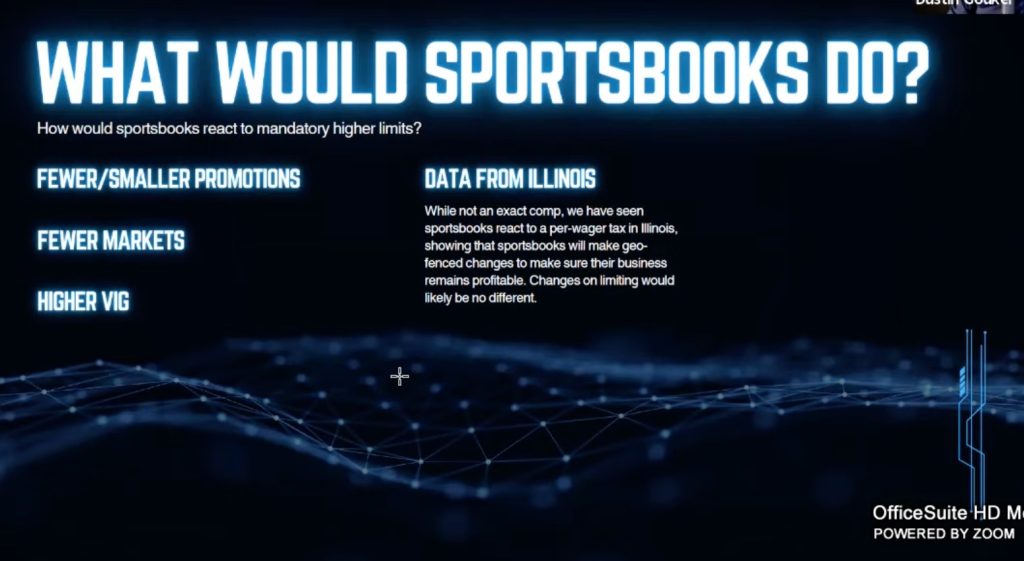

As part of the meeting, The Closing Line author and consultant Dustin Gouker (an occasional contributor to InGame) offered a presentation during which he was clear in saying that operators would push back on the limiting regulations, and suggested that the MGC instead consider opening the market to exchanges, prediction markets, and sharp sportsbooks.

Gouker said that operators would likely offer fewer markets, worse odds, and less promotions in a market that doesn’t allow them to limit. He offered the response to Illinois’ per-wager tax as an example. In that state, some operators are passing the tax through to consumers via surcharges, while others set minimum bet standards.

“Sportsbooks have shown they are willing to confront the reality of what is going on in front of them by changing what they’re doing in that state,” Gouker said. He said the comparison is not exact, but expects sportsbooks “to do something” and that the commission should expect some change if it chooses to regulate bet limiting.

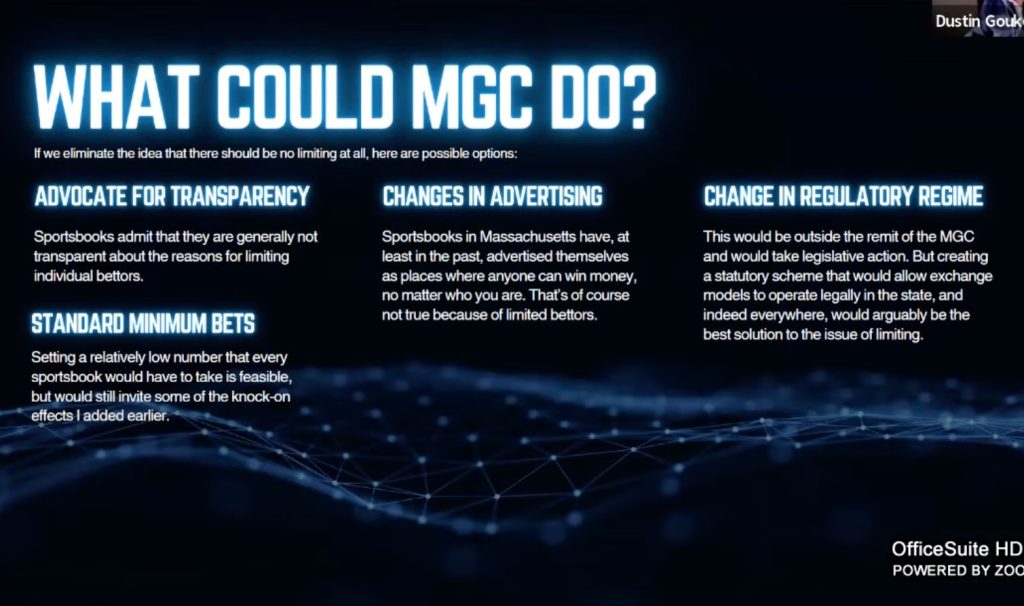

In his presentation, Gouker also suggested that the state legislature, the Massachusetts General Court, “allow exchange models to operate legally in the state.”

In essence, Gouker is recommending that the state create a law to allow prediction markets like Kalshi, and exchanges like Sporttrade. The state attorney general earlier this month filed a lawsuit against Kalshi for operating in the state. Prediction markets are currently regulated by the federal Commodity Futures Exchange Commission (CFTC) rather than the state. As such, prediction markets are not beholden to the consumer protections required by any state — Massachusetts has some of, if not the, most stringent consumer protections in the U.S. — and they do not pay taxes to the state.

‘This is how you solve the problem’

Massachusetts Attorney General Andrea Joy Campbell Sept. 12 filed a lawsuit in state court, the crux of which is that Kalshi is offering sports betting in Massachusetts, but is not beholden to the state’s strict sports betting laws.

Gouker said that exchanges are “fundamentally different” than traditional sportsbooks. So far, Kalshi, and Underdog — via a “tech-provider” partnership with Crypto.com — are offering prediction markets in many U.S. markets. Robinhood also offers Kalshi’s prediction markets. Underdog is not offering its prediction option in Massachusetts, though it is available in neighboring Rhode Island. Underdog is not a licensed sportsbook in Massachusetts, but is licensed to offer its fantasy sports product.

If the commission chooses to act on bet limiting, Gouker said changing the law to open the marketplace to exchanges and operators that take sharp action would also be imperative.

“This is the best solution to the issue of limiting,” Gouker said. “If you are going to do this, and it takes, obviously the legislature to get involved in this … This is how you solve the problem. We are seeing the problem solved for you by nationally regulated prediction markets. This problem, it may go away by way of the courts … but in one-to-two-to-three years, this may be the way the world is — we may have federally regulated prediction markets. If you sit here and say we’re going to have state regulated markets competing with this, then you need to change the regulatory regime: You need to allow exchanges, sportsbooks that take sharp action. This is the way forward.”

Gouker advocated for more choice in Massachusetts, pointing out that sharp bettors often go offshore, and prediction markets are “legal in 50 states as we sit here today.” He said that a prediction market “is one place that people are able to bet and not be limited.” He added that welcoming more, diverse platforms “is the [model] that you want” if the commission does not want bettors to be limited.

The MGC, including Gouker, also went into executive session to discuss sensitive operator-specific issues related to bet limiting.

From here, MGC staff will research and work on proposed regulatory changes, but no clear timetable for action was established.