The future of a cornfield in Iowa as a popular betting spot may be in jeopardy.

A digital sports betting ballot initiative backed by Nebraska’s Winnebago Tribe and the Horsemen’s Benevolent and Protective Association is in the works, multiple local media outlets reported Thursday. The proposal does not yet appear on the Secretary of State’s website as approved for signature gathering, and proponents say they will begin that process within a month.

Nebraska launched in-person sports betting in June 2023, and it’s available at several WarHorse Casino locations. But online betting is not available, and there is a quirk in Nebraska’s betting law that bans betting on the state’s college teams when they are playing at home. The solution for many from Omaha and Lincoln has been to cross the state’s eastern border into Iowa, where digital betting has been live since August 2019.

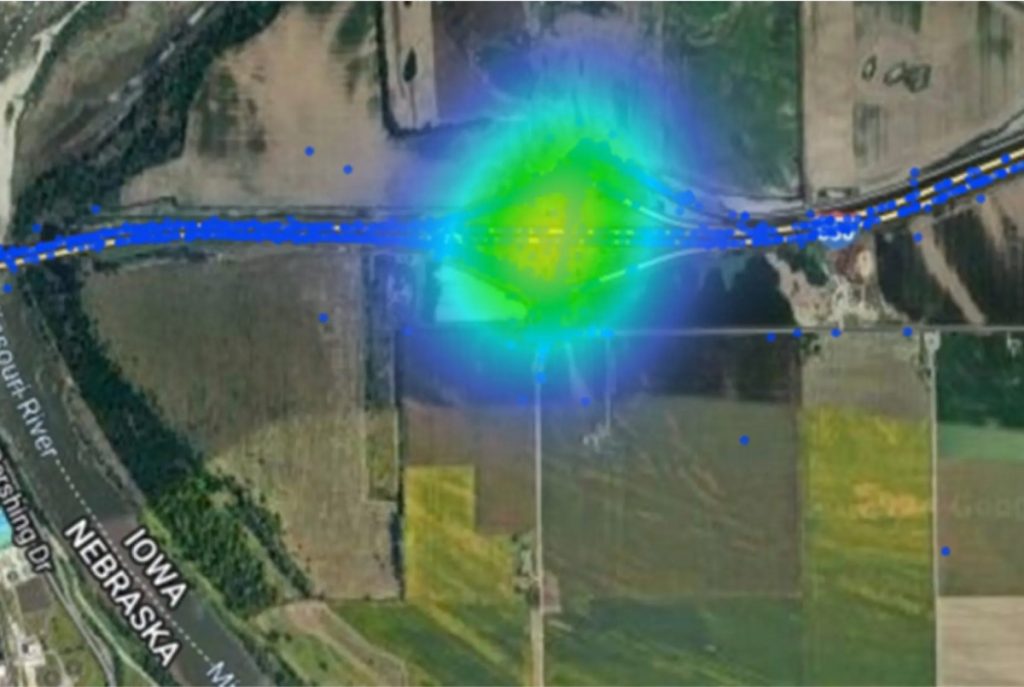

Geolocation service GeoComply has identified a cornfield as an unlikely betting hotspot.

During hearings on digital sports betting in March, GeoComply Senior Vice President Lindsay Slader testified that her company saw a 63% increase in the number of geolocation checks in Nebraska in 2024, including 3.9 million attempts last NFL season. Nebraska lawmakers considered a package of bills but none gained traction, and the proposed constitutional amendment was ultimately killed via filibuster.

At that time, lawmakers said they would support the idea of commercial operators bearing the cost of an initiative versus a referendum.

Proponent says ‘gaming platforms’ on board

Lynne McNally, CEO of the Nebraska Horsemen’s Benevolent and Protective Association and head of government affairs for WarHorse Casinos, told KLIN News that “our partners, some of the gaming platforms, have made the decision that we are going to get signatures to put the constitutional amendment on the ballot.”

In order to get on the ballot, proponents must gather about 120,000 valid signatures for a constitutional amendment and about 90,000 for supporting legislation — 10% and 7%, respectively, of registered voters. The signatures must include 5% of registered voters in 38 of the state’s 93 counties and are due to the state by July 2, 2026.

WarHorse Gaming, LLC, is a subsidiary of Ho-Chunk, Inc., which is the commercial arm of the Winnebago Tribe. Kambi operates the tribe’s sportsbooks, and no other commercial gaming operators are active in the state.

Tax benefit may not be as advertised

Nebraskans legalized sports betting in 2020, with 65% of voters approving a ballot measure. At the time, there was some question as to whether or not that initiative included digital betting. When lawmakers were tasked with interpreting the initiative and crafting a law around it, they decided it did not.

In 2020 and during this year’s legislative session, there was heavy opposition to legal sports betting from the anti-gambling lobby, and it’s likely that Lance Morgan, president and CEO of Ho-Chunk, Inc., overstated how much the state would benefit from digital wagering in terms of tax revenue. During this year’s legislative session, Morgan said the state could get up to $32 million per year in tax revenue based on a proposed 20% tax rate. But a fiscal note for LB421, the enabling legislation, projects far less — $9.2 million in 2026 and $20.4 million in 2029, the last year projected.

West Virginia has a population of 1.77 million people compared to two million in Nebraska. Neither state has a professional sports team, but both have avid college football fans. The tax rate in West Virginia is 10% and digital wagering has been live for six years. The state averages $5 million per year in tax revenue.

Since Nebraska’s first brick-and-mortar sportsbook opened in June 2023, public records showed as of April operators had reported $7.9 million in revenue and paid the state $1.6 million in taxes. In 2024, $53.6 million was bet and operators had revenue of $4.6 million.

Gambling tax revenue is earmarked for property tax relief.