Sports prediction market Novig — which currently operates a sports prediction market under a sweepstakes model — is exploring obtaining Commodity Futures and Trading Commission (CFTC) certification to launch real-money betting markets, its co-founder told InGame after the business announced it raised $18 million in Series A funding Monday.

However, the business believes that CFTC registration and the sweepstakes model may be able to go hand-in-hand.

The business became the latest prediction market to raise money in recent weeks, announcing via a press release that it had received $18 million in a Series A funding round led by Forerunner. Existing backers Y Combinator, NFX, Perceptive Ventures, and Gaingels also participated. Novig did not provide a post-fundraise valuation.

Forerunner is best-known for its health and wellness investments, having backed telehealth medication provider Hims & Hers and therapy app Headway, though it has also made moves in the finance space by investing in online bank Chime and money-management app Monarch.

Leading prediction markets Kalshi and Polymarket each announced major funding rounds last month. Kalshi was valued at $2 billion after a $180 million round led by Paradigm Operations, while Polymarket earned a $1 billion valuation after raising $200 million from a group led by Peter Thiel’s Founders Fund.

Past Novig investors include Paul Graham, who founded Y Combinator, and NFL legend Joe Montana.

Will Novig gain CFTC approval?

Novig currently operates across the U.S. as a sweepstakes operator. Users can play for free Novig Coins, or for Novig Cash, which can be redeemed for real money. Players can receive Novig Cash as a “bonus” when they buy Novig Coins, or as a reward for certain activities, such as logging in for five or more consecutive days.

However, it plans to pursue CFTC registration, co-founder and CEO Jacob Fortinsky told InGame. But Fortinsky added that being CFTC-approved and the sweepstakes model would not necessarily be “mutually exclusive,” though he didn’t offer more detail on how the two would work together.

Prediction market Kalshi has had success offering exchange-style betting on sports under its status as a CFTC-registered exchange. While states and tribes have argued that Kalshi is offering unlicensed sports betting, the CFTC itself – which Kalshi argues is the only entity with the right to determine if it is offering prohibited markets – has thus far not taken any action against the platform. The battle over the legal status of Kalshi’s sports event contracts has gone to the courts, with the platform suing three different states that have tried to shut down its sports markets, but so far they still remain available across the entire U.S.

Obtaining a CFTC license to operate as a Designated Contract Market (DCM) can be an arduous process. QCEX, recently acquired by Polymarket, applied for the status in 2022 before gaining approval in July 2025. Novig does not appear to currently have an application in process, according to the CFTC list of active applications.

CFTC registration could be obtained more quickly by buying an already-approved DCM, a step recently taken by Polymarket, which plans to return to the U.S. However, as traditional sports betting operators also consider the prediction market opportunity, the market for buying already-licensed DCMs could be competitive.

Novig is looking to build its business based upon sweepstakes law, which traditionally is used as a basis for promotions like McDonald’s Monopoly game, but has evolved with some operators devising a promotion involving two kinds of currency, including one that can be redeemed for real cash. Not all regulators see this as a “legal” method of doing business.

In June, the Arizona Department of Gaming (ADoG) sent out seven cease-and-desist letters to seven platforms that it described as “unlicensed and unregulated gambling operators, both within the U.S. and abroad,” including Novig, which the ADoG said violated state rules against peer-to-peer exchange wagering.

Novig’s no-commission model

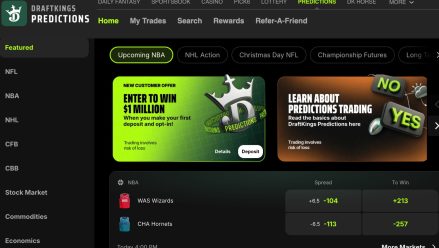

Unlike major prediction markets like Kalshi and Polymarket — which also offer betting on subjects such as politics, economic events and culture — Novig sticks entirely to sports. Its sports offering is more fleshed out than Kalshi or Polymarket, featuring player props and even parlays, which can be more challenging to offer within the exchange format.

The platform, as suggested by the name, also does not take commission on bets, which is the typical way in which a betting exchange makes money.

In a 2023 press release, Novig said that instead of commission, its revenue comes through three main streams: “institutional traders, data monetization, and internal market making.”

Polymarket also doesn’t charge commission, but it is believed it will eventually switch to a commission-based model after solidifying its market position.

Novig said it would use the money raised to “expand coverage to additional sports and deepen its presence in existing markets. … The company will also launch new features, including leaderboards, group contests, and head-to-head trading,” it added.

Novig said that more than 90% of the trades on its platform are currently “fully peer-to-peer,” as opposed to trades where one party is a market maker.

“What we’re building isn’t just sports predictions–it’s a true peer-to-peer market,” said Fortinsky. “We believe users deserve a system that rewards skill, reflects true supply and demand, and gives every fan a fair shot.