According to a study released in mid-January by payment solution company Paysafe, Americans favor credit cards as a way to fund sports betting accounts, and they won’t hesitate to switch platforms after a bad payment experience.

With a heavy focus on the World Cup, which study authors say should be a boon for online sports betting companies, the annual “All the Way Players Pay” poll revealed that 60% of those surveyed worldwide plan to bet during the World Cup, and 64% plan to place a wager on game days. Of those surveyed, 49% said they don’t follow soccer but still plan to wager on it.

This World Cup — which will be played in venues across Canada, Mexico, and the United States — will be the first in North America in 32 years. It’s set for June 11-July 19, with the final to be held in the U.S. In 1994, the idea of placing an online bet was, well, probably not even an idea yet. Consider that the World Wide Web had come into existence only four years before, Apple computers were clunky gray boxes, and mobile phones were the size of a brick and often mounted on a pole in a car.

That World Cup culminated with Brazil’s 3-2 victory via penalty kicks against Italy at the Rose Bowl. This time around, the final will be played across the country in New York — a state where online sports betting is legal and nearly every fan will have some kind of phone in their hands, giving them access to legal sports betting, including in-game betting. The iPhone, now ubiquitous, didn’t exist in 1994, but it will have celebrated its 19th birthday weeks before the World Cup final.

While soccer — or futbol, as the rest of the world calls it — still isn’t part of the fabric of American culture the way it is in Europe or South America, that 1994 World Cup paved the way for the 1996 debut of Major League Soccer, now in its 30th year and a fixture on the American sports scene.

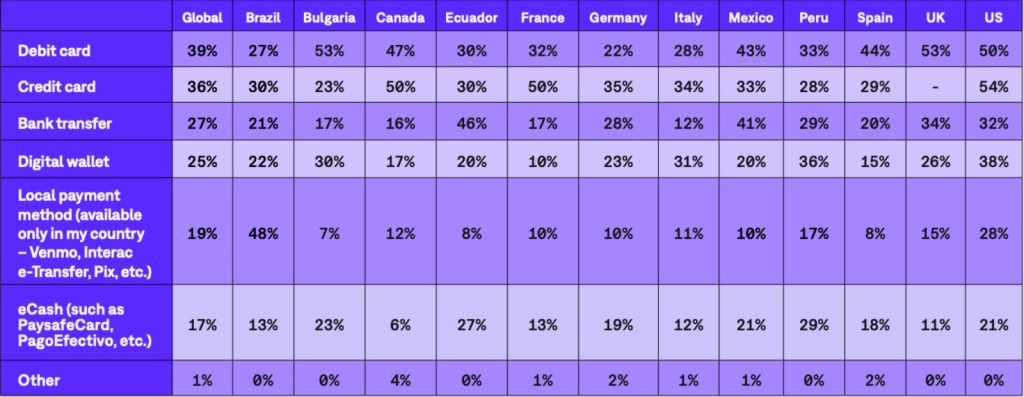

Globally, debit cards preferred

“All the Ways Players Pay” is an annual survey that looks at how gamblers fund legal betting accounts. Sapio Research polled 3,850 people of legal gambling age with an interest in the World Cup. Respondents in Brazil, Bulgaria, Canada, Ecuador, France, Germany, Italy, Mexico, Peru, Spain, the United Kingdom, and the U.S. were contacted by email in November 2025.

How players fund accounts varies by location. When asked “How do you plan to pay for your online bets at the World Cup?” 39% of respondents across the countries pointed to debit cards as compared to 36% who answered with “credit card.” Among those surveyed in the U.S., however, the preferred payment method is credit cards, with 54% selecting that answer. Half of U.S. respondents answered that they would use debit cards.

Sapio Research contacted U.S. bettors in Florida, Kansas, Massachusetts, New Jersey, New York, and Pennsylvania — all of those states except Massachusetts allow funding accounts by credit card. Eight of the 30 legal online sports betting states and two major operators don’t allow funding by credit cards, while lawmakers in several other states are considering banning the practice.

The other countries in which credit cards are the top payment method are Brazil, Canada, France, Germany, and Italy. UK residents are banned from funding accounts via credit cards, and 53% there answered that debit cards are the preferred payment method, followed by 34% who selected bank transfers.

In Canada, credit cards are preferred over debit cards 50%-47%, and in Mexico debit cards were the top answer at 43% followed by bank transfers at 41%.

A key piece of information revealed in the survey is that 88% of respondents said they would change sportsbooks over a “poor payment experience.” That number is even higher — 93% — in America and Ecuador.

“These findings emphasize the importance of offering fast, reliable payouts and a comprehensive range of payment options tailored to local preferences,” the study authors wrote.

Will US World Cup bettors stay engaged?

The poll also showed what’s important to bettors — trusted brands were at the top of the list globally, with 38% of respondents selecting that answer, followed by 33% choosing “quick and easy payouts.” In the U.S., respondents also prioritized brand trust (40%) followed by frictionless payouts (33%), but in Bulgaria and Peru, quick and easy payouts trumped all other answers.

Based on the results, the study authors surmise that the World Cup will “serve as a driver for betting growth across various markets. For operators, success will rely on meeting the needs of both new and returning players by providing trusted brands, instant payouts, and localized payment options that reduce friction and foster loyalty.”

Paysafe interprets the study results to mean that the World Cup will present global operators with a unique opportunity to sign up and retain customers. But an Optimove study released Jan. 13 suggests that while that theory may hold up in Europe or South America, in the U.S. the World Cup has previously been “treated … as a moment, not a season, with engagement peaking during the tournament and normalizing quickly in favor of domestic sports cycles.”