Penn Entertainment executives Thursday morning touted a coming integration for ESPN Bet, but kept details under wraps during a first-quarter earnings call. The company missed analyst revenue projections, but reported a per-share loss of $0.25, which was better than analyst projections of $0.29.

The tone was generally enthusiastic, as executives touched on the future of ESPN Bet, the progress of its Hollywood Casino apps, and new projects in the land-based casino sector.

Penn’s executives did not address the lawsuit filed Wednesday by activist investor HG Vora. During the fourth-quarter earnings call in January, Snowden said that either ESPN or Penn could choose to opt out of the ESPN Bet partnership at the three-year mark in 2026. Eighteen months in, that possibility looms.

“Both sides have the option at the third anniversary, if we haven’t hit a threshold level of revenue market share, to decide if they want to rework the deal or exit,” Snowden said Thursday. “And that hasn’t changed. So, we’re partners, we’re focused. We’re excited about what’s ahead of us. Let’s see where we are as we trend through the next couple of quarters.

“I think it will be not just obvious to us, but obvious to others as well, what happens.”

Snowden also said his team is “optimistic” about growth for digital sports betting and online gaming in the coming months, and during the question-and-answer session, shared that promotional spend for digital wagering is “higher” than on the iCasino side, which so far has been a stronger product. Penn rolled out its stand-alone Hollywood Casino gambling app last December, and is live in Michigan, New Jersey, and Pennsylvania.

Synergy between ESPN Bet, Hollywood grows

Penn has retail casinos in all three states and has been able to trade on brand recognition with its retail locations. Snowden said that 30% of new iCasino users are coming from ESPN Bet and 70% are coming from elsewhere. They include consumers who have not previously used the company’s digital platforms, dormant accounts, or are “just brand new to the entire ecosystem.”

“As I mentioned at the beginning, these standalone iCasino apps have been really good for us in that they’re 70% incremental,” Snowden said. “So very little cannibalization from the Hollywood offering that was within the ESPN Bet app.”

Consumers can access the ESPN Bet and Hollywood Casino platforms from the same app, allowing for cross-promotion. ESPN Bet users can also link their accounts to ESPN, which has been a focus for the company. Penn previously said it will continue to leverage that relationship and technology to build momentum on ESPN Bet.

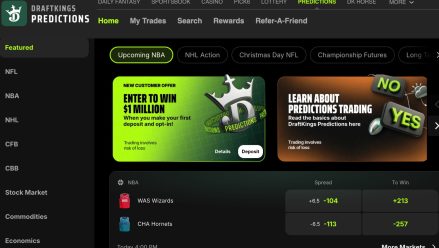

‘First in market integration’ coming

Thursday, Chief Technology Officer and Head of Interactive Aaron LaBerge teased a new sports betting product that he said he believes will be a “first in market integration” that is “very cool. And we think it will have a difference in terms of driving users and exposure to platform.”

Executives offered little information around the “bespoke” integration, but LaBerge said it is an “integration that’s going to be linked and associated with the content that you watch. So we have created different types of markets and processes for sharing that in real time with ESPN, which manifest itself in the product. So we think it’s the best in class and first of its experience as it relates to watching live events as it relates to bet integration. So we’re excited about the work we’ve done. And I think the world will too.”

Penn rolled out its latest product, “Mint Club,” in the middle of April. That product creates a more personalized betting experience, and customers can track bets within the “Scores” section of ESPN and use a filter to prioritize games they have bet on through ESPN Bet.

LaBerge said Mint Club customers are logging in 2.7 more times than the average user and placing 60% more bets weekly. He said they are “generating more handle” and “holding better.” Mint Club users are also betting more parlays, LaBerge said, which is an area in which ESPN Bet has lagged behind market leaders.

HG Vora lawsuit

One day ahead of the call, activist investor HG Vora, which has been pressuring Penn for months for changes, filed a lawsuit in the U.S. District Court for the Eastern District of Pennsylvania alleging that company directors are “violating shareholder rights” and “impermissably placing their interests” over the shareholders’s.

The group also reiterated that it believes that Snowden is driving Penn to fail, and cited several metrics that show the company’s digital wagering platforms, in particular, are far from successful.

HG Vora in January proposed three names to fill board seats. Penn executives countered by accepting two, and downsizing the board from eight to nine. HG Vora representatives, according to the filing, pushed back, but Penn refused to add the third nomination. Shareholders will vote on the nominations at or before a June meeting.

In a letter to shareholders at the end of April, Penn executives acknowledged that the company’s ESPN Bet platform continues to underperform.

By the numbers

According to its first-quarter results press release, Penn reported $1.67 billion in revenue for the first quarter, which was slightly below Wall Street estimates of $1.7 billion. Net income was down $3.4 million — $111.5 million vs. $114.9 million in the first quarter of 2024 — and adjusted EBITDA was $457 million.

Penn stock was little changed by the call. It opened at $15.60 Thursday morning and dipped to $14.84 after the call before bouncing up to $15.96 in the early afternoon.