At 1:14 p.m. ET Thursday, the world bore witness to Cardinal Protodeacon Dominique Mamberti announcing that the Cardinals had elected Cardinal Robert Francis Prevost as the newest pope. A little while later, Prevost, who took the name Pope Leo XIV, walked out onto the balcony of the Vatican as the 267th pope.

Pope Leo XIV was an upset victor of the conclave, and plenty of people made some money buying contracts on him to be elected pope at Kalshi.

An interesting wrinkle, however, when it comes to prediction markets, as compared to old-fashioned sportsbooks: Prediction markets do not necessarily close out positions immediately.

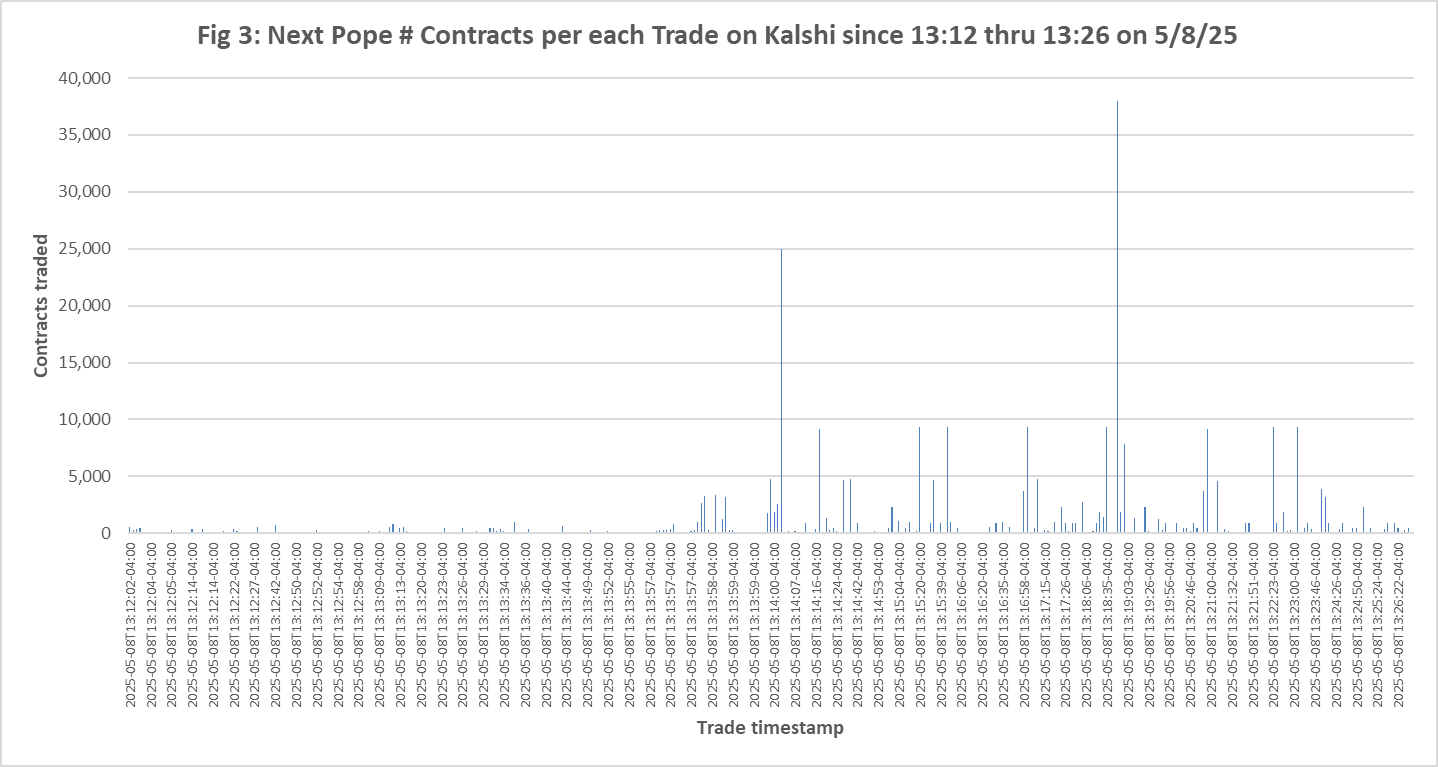

In fact, according to one observer who pulled public data, Kalshi executed over 350 trades on the “who will be the next pope?” market after Pope Leo XIV emerged on the balcony.

In fact, trades were happening up until 1:26, according to the data.

Which begs a question: Huh?

Meet the criteria

“Per CFTC regulations, to ensure we resolve our markets truthfully, Kalshi extensively verifies markets before closing them to make sure they meet the criteria for resolution laid out in the contract,” Jack Such, a Kalshi spokesperson, told InGame. “Often, markets will remain open past the time when the general public comes to a consensus on the answer, such as the papal election market or presidential election market. This is a feature of prediction markets, not a bug, as it allows information to be conveyed via pricing even before official resolution occurs.”

In short: Buyer beware when it comes to these markets, as they can — and apparently often — stay active well after the “news” is reported and/or known.

It was further explained that resolving a market incorrectly would be a nightmare scenario, and there is little downside to leaving a market open despite indications that the event has been resolved. Namely, the winners will still win, the losers would still lose.

As to who it could potentially benefit? Active, high-frequency traders who trade on the news.

A Kalshi representative also pointed out that sometimes markets move on unverified information. For instance, InGame was told a trader turned $2,000 into $100,000 a few months ago by figuring out there was a market that was basing prices off of a parody Twitter account.

Basically, there’s always some edge case if the market is wrong and moves the other way.

In the case of the papal announcement, there was a chance — albeit a small one — that the wrong name was announced. (See: Oscars 2017.)

Kalshi was additionally down for a short period of time during the tail end of the conclave, though no mention of this was made by Kalshi representatives as a reason why there were some late trades.

A Kalshi spokesman noted keeping a market open past the fact is something that happens often; for instance, the market for “next president” did not settle until Inauguration Day.