Prediction markets offering controversial sports events contracts continue to gain momentum in both the American sports betting and financial sectors.

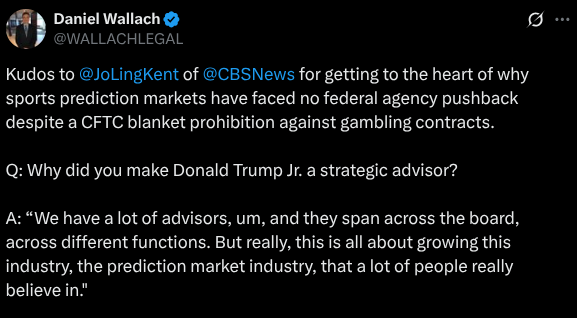

The gamification of everyday life has seemingly turned wagering on a game into a new asset class on platforms like Kalshi, which brandishes its federal certification as a designated contract market (DCM) by the Commodity Futures Trading Commission (CFTC) as a means to offer national sports betting, even in states that haven’t legalized since the fall of the Professional and Amateur Sports Protection Act in 2018.

Sports betting giants FanDuel and DraftKings are pivoting into the prediction arena, perhaps either sensing there won’t be federal pushback from the CFTC — under the exchange- and crypto-amenable Trump administration — or that their move would help fortify the new paradigm.

Industry-wide momentum can be assessed by the millions flowing into prediction market companies through partnerships or investments.

“I think investors are responding to what they perceive as a cultural inflection point and then a technological inflection point.”

Chris Grove, co-founder and general partner at Acies Investments

“I think investors are responding to what they perceive as a cultural inflection point and then a technological inflection point,” Chris Grove, the co-founder and general partner at Acies Investments, told InGame. “On the cultural side, there’s a sense that a critical mass of consumers are interested in not just having opinions about the world around them, but in monetizing those opinions. And not just in monetizing those opinions, but understanding the world through the lens of those monetized opinions in the aggregate.

“On the technological side, I think this represents a continued expression of interest in blockchain and crypto as enablers of new ways to securitize and to trade, whether that’s physical assets or whether that’s contracts like the ones you see on Polymarket and Kalshi.”

Plenty of cash has been flowing in, regardless of motivation.

Investments happening all over

Intercontinental Exchange (ICE), the company that owns the New York Stock Exchange, in October announced an investment of $2 billion into Polymarket, which is beta testing in the United States ahead of an imminent relaunch after it gained CFTC approval. The infusion was touted by ICE CEO Jeff Sprecher as a means to prioritize “tokenization” and create a “decentralized finance space.” Polymarket, after several investment rounds, is valued at around $9 billion.

Kalshi, vociferously defending its product in court, also announced in October that it had raised around $300 million in a funding round led by Sequoia Capital, Andreessen Horowitz, and Coinbase Ventures. The infusion valued Kalshi at around $5 billion. Kalshi launched sports event contracts in January, one month after the first by Crypto.com.

Grove said that while he was not privy to ICE’s motivations, he suspects that “it was a sense that there’s the stock exchange of yesterday, the stock exchange of today, and the stock exchange of tomorrow. And in many ways, Polymarket represents part of the stock exchange of tomorrow.”

Besides funding rounds, traditional sports betting companies FanDuel and DraftKings in recent months created partnerships or acquired companies that would allow them to get into prediction markets:

- FanDuel partnered with CME Group, the largest global provider of financial directive exchanges, to build a prediction market that could include sports events contracts.

- DraftKings purchased CFTC-certified DCM Railbird and plans to do the same.

“Both [FanDuel parent company Flutter and DraftKings] are positioned such that as publicly traded companies, you can make the jump as an investor, as an institution, or an analyst to say that they’re going to cash in in some way, shape or form when they feel that’s ready,” Sporttrade founder and CEO Alex Kane told InGame.

The partnerships go beyond just traditional sports betting companies and include the two biggest daily fantasy sports companies in the U.S. as well as a financial services company.

- Kalshi, Polymarket, and PrizePicks: A multi-year deal will allow users of PrizePicks, the first DFS site to attain futures commission merchant (FCM) status, to trade on Polymarket events, including sports, culture, and politics. PrizePicks Predictions launched on Nov. 21 using Kalshi sports markets.

- Underdog and Crypto.com: Underdog, which offers DFS and sweepstakes casino, became a technology partner with Crypto.com to offer sports event contracts in 16 states.

- Kalshi and Robinhood: Kalshi’s sports events contracts are integrated into the platform of Robinhood, an FCM.

Partners, investors predicting the future?

The partnerships appear predicated on multiple factors, but adding collaborators with existing in-house tech capabilities crucial to the process was central to several deals. Kalshi’s markets are so far appearing on three platforms. That includes Robinhood, which also takes markets from DirectEx. These connections also increase liquidity throughout the partner sites.

“That matters quite a bit,” Grove said. “I won’t say that liquidity is the only thing that matters, but for any exchange-driven product, it’s only as interesting as the volume that sits on that exchange. A party is only as fun as the people who are there.

“So there’s definitely a focus on liquidity, both for enabling greater breadth and depth of markets but also for improving the overall experience from a user perspective.”

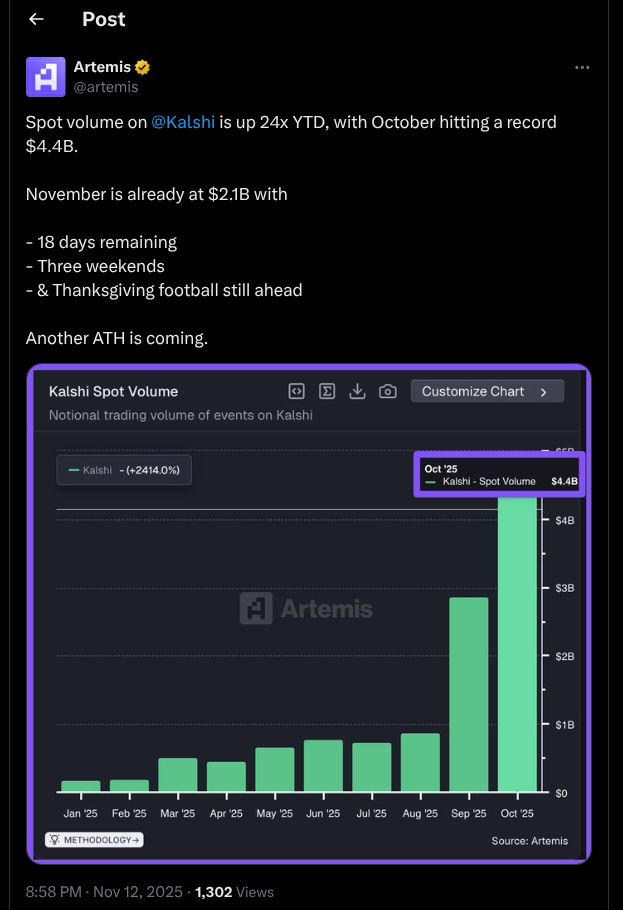

There is also the fact that these prediction sites keep posting huge numbers, with Kalshi’s trading volume around $4.4 billion in October amid an expansion to 140 countries. For perspective, the combined sports betting handle from 25 reporting states and numerous Sportsbook brands in September was $10.5 billion.

Will Mitting, the founder of the derivatives analytics platform Acuiti, told Markets Media: “Prediction markets are potentially on the cusp of significant institutional growth, which will drive liquidity and volumes on the market, as well as revenues for the venues and brokers that offer the contracts.”

Said a Bank of America analyst: “It’s as if [the Professional and Amateur Sports Protection Act of 1992] had been repealed with no state level legislation, no oversight requirements, and no gaming taxes. There are few businesses better than untaxed gambling.”

Courts, CFTC could render it all wasted

All of these investments and all of the positioning could seemingly be rendered useless if sports events contracts are eventually deemed illegal by the court system. While Kalshi has won significant legal battles this year, layers of state-level litigation remain active.

Courts could rule that sports event contracts constitute illegal gambling and could shut them down, forcing them to seek state licensure. Or that status quo could remain.

FanDuel and DraftKings, the U.S. sports betting duopoly in terms of market share, entered the fray despite warnings of retribution from state regulators in multiple states. The billions invested in their new rivals suggest that investors have an expectation of the outcome, especially given the inaction of the depleted CFTC, which is without a chairman and has just one of five commissioners spots filled.

Kane said it would be a “huge Rubicon to cross” for state regulators to follow through on the threat to pull licenses of companies involved in prediction markets. DraftKings and FanDuel ended their limited presences in Nevada after announcing their prediction market intentions.

“If these are truly people that are motivated by being risk averse,” he said of state gaming regulators, “then why would they take a licensee who has legitimized their authority, paid them in the case of DraftKings and FanDuel, and continue to pay them millions of dollars per month and go out of their way to throw that all away? I mean, within a day, the legislators are going to be like, “What did you just do? These guys were giving us $100 million a year, and you just kicked them out?’ ”

Grove expects Kalshi’s federal assertion to eventually appear before the Supreme Court. By the time it does, the U.S. sports betting model could be completely upended, backed by massive investments from gambling companies and financial institutions.

“I don’t know anyone who has a perfect record forecasting what the Supreme Court will do,” Grove observed. “I’m sure investors have a view, and I’m sure we can infer that that view is largely positive. But I think anything more than that is a tricky business.”

Grove said that while some would prefer not to compete with FanDuel and DraftKings, “on balance, I think everyone is likely more bullish about the opportunity following the entrance of DraftKings and FanDuel.”

Predicting future of prediction markets

Flutter CEO Peter Jackson, whose company owns FanDuel, said in a recent earnings call that it would continue injecting resources into the sector if it were enjoying ““great returns and paybacks” on an estimated $240 million to $350 million incremental EBITDA investment through 2026. DraftKings expects to spend $50 million in launching its market.

Investment activity has followed reports of sports events contracts comprising ever-expanding percentages of prediction markets’ volume. Upwards of 90% of Kalshi’s business has come through sports contracts since the beginning of the NFL season. Maintaining the inflow might depend on how well prediction markets can whet the interest of customers who came to speculate on sports.

“I believe you will see more of an equilibrium over time between sports markets and non-sports markets. The big question is, how long is the long tail here?” Grove asked.

“Because if there are only a handful of other categories that are offered on prediction markets, then the long tail is pretty short and the chances of finding another event contract that a sports fan might be interested in trading gets shorter. But as you move more into a world where you’ve got markets on everything, the chance of linking up that customer who comes in for a sports-focused trader with other events they might be interested in trading increases.”

“I just don’t see that toothpaste going back in the tube.”

Daniel Zimmermann, CEO and founder of Verse Gaming

There’s also the question, Grove said, of whether prediction markets are a novelty.

“And I don’t think anyone knows the answer to that question. But we do know that people like speculation and that the mainstream taste for speculation, at least in the U.S., seems to have done nothing but increase over the last several years,” he said. “So it’s not unreasonable to me to suggest that when people try a prediction market for one thing, they may find themselves using it for an array of other things over time.”

And in the process, create a new institution that will remain attractive to investors.

“When the New York Stock Exchange parent company puts $2 billion into you, you are now an institution,” Daniel Zimmermann, the CEO and founder of Verse Gaming, told InGame. “And I think Polymarket will be treated as such for the next 100 years. I think we now live in a world where you can bet on politics, you can bet on Spotify streams.

“I just don’t see that toothpaste going back in the tube.”