Robinhood is set to offer Kalshi’s event contracts on football within the popular stock-trading app, the company announced via press release Tuesday.

Football markets — covering both college and the NFL — will be added to the stock trading app’s “Predictions Hub,” where users can already bet on sports such as baseball as well as non-sporting events.

Robinhood says the markets will become available “in the coming days,” with contracts for the first two weeks of the college and NFL seasons going up first.

The sports event contracts on offer will be the same ones offered by Kalshi. Robinhood offers access to Kalshi’s contracts as a Futures Commission Merchant (FCM), but can’t create its own prediction markets. The two have been partnered since March, when the “Predictions Hub” launched.

Robinhood’s press release did not name Kalshi at any point besides in the legal disclosures section. The body of its release instead just mentioned that its markets were offered through “a [Commodity Futures Trading Commission] CFTC regulated exchange.”

Betting or ‘investing and trading’?

Robinhood seemed determined to present the products — which legally are considered swaps and regulated by the CFTC — as a financial product, rather than a form of sports betting. Whether the contracts are sports betting or a legitimate financial product has been the subject of significant debate, including multiple federal lawsuits.

“Football is far and away the most popular sport in America,” said JB Mackenzie, VP & GM of Futures and International at Robinhood. “Adding pro and college football to our prediction markets hub is a no-brainer for us as we aim to make Robinhood a one-stop shop for all your investing and trading needs.”

The release added, “Unlike sports betting, where the firm sets a line, event contracts leverage the power and rigor of financial market structure and are offered in a marketplace where buyers and sellers interact to set the price.”

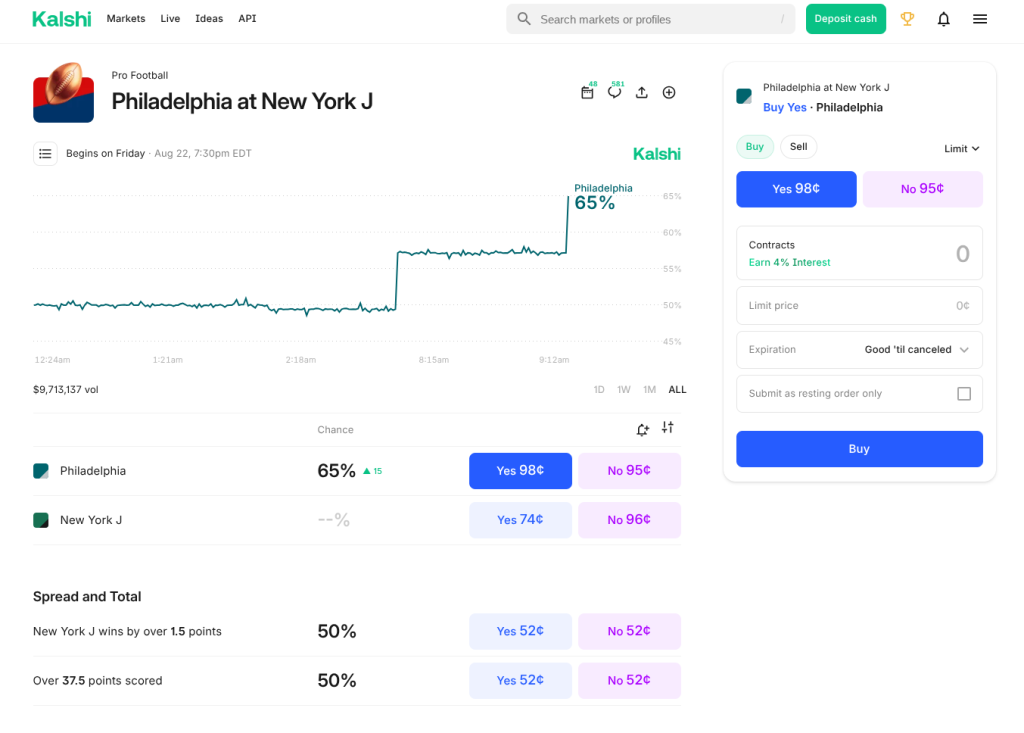

Kalshi offers spreads, totals

The announcement comes just one day after Kalshi self-certified to offer bets on point spreads, point totals, and touchdown scorers. Spreads and over/under bets are available on Kalshi for NFL preseason games, though touchdown scorer bets are not.

A Robinhood spokesperson told InGame that, at least for now, the platform was focused on offering trades on the “outcome” of games rather than these type of bets.

Users of Robinhood’s sports event contracts pay a one-cent fee on top of Kalshi’s own fees for every one-dollar contract traded. Because the Robinhood fee is flat — whereas Kalshi’s changes depending on the odds — it has a disproportionately large impact on bets with either a very high or very low probability of occurring.

Point spreads and totals may drive a particularly large amount of activity at Robinhood, as they may be more likely to stay close to 50:50 odds, where the one-cent fee is less of a burden.

Robinhood was half Kalshi’s volume in Q2

While Robinhood has already been offering access to Kalshi’s sports event contracts, the addition of football and the start of the college and NFL seasons are likely to lead to significantly more activity.

In a second-quarter earnings call July 30, Robinhood Chief Financial Officer Jason Warnick said that one billion contracts were traded on Robinhood during the three months ending in June. Each contract is valued at a dollar, meaning trading volume was around $1 billion. Given the one-cent fee per contract, this means that the business made $10 million in revenue from event contracts in the quarter. Warnick said a “large percentage” of this came from sports.

According to InGame analysis, $1 billion would be more than half of Kalshi’s trading volume during the three-month period.

The addition of Kalshi’s March Madness contracts to Robinhood’s predictions hub earlier this year spurred a major increase in sports volume on Kalshi.

While event contracts are still only a small share of Robinhood’s revenue, its status as an FCM means it has very few expenses, and so a large amount of its event contract revenue flows straight to the bottom line.