Nevada Democratic Sen. Catherine Cortez Masto and Mississippi Republican Sen. Cindy Hyde-Smith Friday re-introduced a bill that would eliminate the one-quarter of 1% federal excise tax on sports betting handle. It is the fourth bill targeting the excise tax filed in Congress this year. None have gotten a committee hearing yet.

The bill, titled the “Withdrawing Arduous Gaming Excise Rates Act” (WAGER Act), would add language to the end of Section 4402 of the Internal Revenue Code of 1986, which begins with “No tax shall be imposed by this subchapter” and currently lists parimutuel, coin-operated devices, and state-operated lotteries. The bill, which failed to gain traction in 2024, would add the phrase “sports betting not prohibited under state law or tribal compact” and goes on to define that as any wager not banned by a state or federally recognized Indian tribe.

In February, Nevada Democratic Rep. Dina Titus introduced a bill that would eliminate the excise tax, which she calls “discriminatory.” Titus and Pennsylvania Republican Guy Reschenthaler have introduced four bills to repeal the tax since the Professional and Amateur Sports Protection Act was repealed in May 2018. The tax was initially put into place to combat illegal gambling, and is currently directed to the general fund.

According to the Tax Foundation, the Internal Revenue Service does not make the amount of excise taxes available. But by aggregating state data on sports betting handle and revenue, the Tax Foundation estimates that $373 million was collected in 2024.

Other bills: Fund ICE or addiction recovery

Two other bills that would repurpose excise tax funds have also been introduced this year. Democratic Connecticut Sen. Richard Blumenthal and Democratic Oregon Sen. Andrea Salinas re-introduced the “Gambling Addiction Recovery, Investment, and Treatment” (GRIT) Act, which would earmark 50% of the excise tax for gambling addiction research and problem and responsible gambling initiatives. In June, Republican Ohio Rep. Mike Rulli introduced a bill that would redirect funds from the excise tax to fund Immigration and Customs Enforcement.

With a government shutdown looming in the coming weeks, it’s not clear why Cortez Masto and Hyde-Smith chose Monday to file the bill, although it could be a response to the rise of prediction markets. Hyde-Smith said in a press release that the black market and “new out-of-state prediction markets” have an unfair advantage over state-licensed sportsbooks. Neither offshore operators nor prediction markets pay state taxes, and neither are subject to the level of consumer protections imposed by every legal wagering state.

Sportsbooks are currently in the busiest part of their year — the NFL season started about 10 days ago, and the first college football game of the year was Aug. 23. Retail and digital wagering are legal in Nevada, and retail and on-site mobile betting are legal in Mississippi.

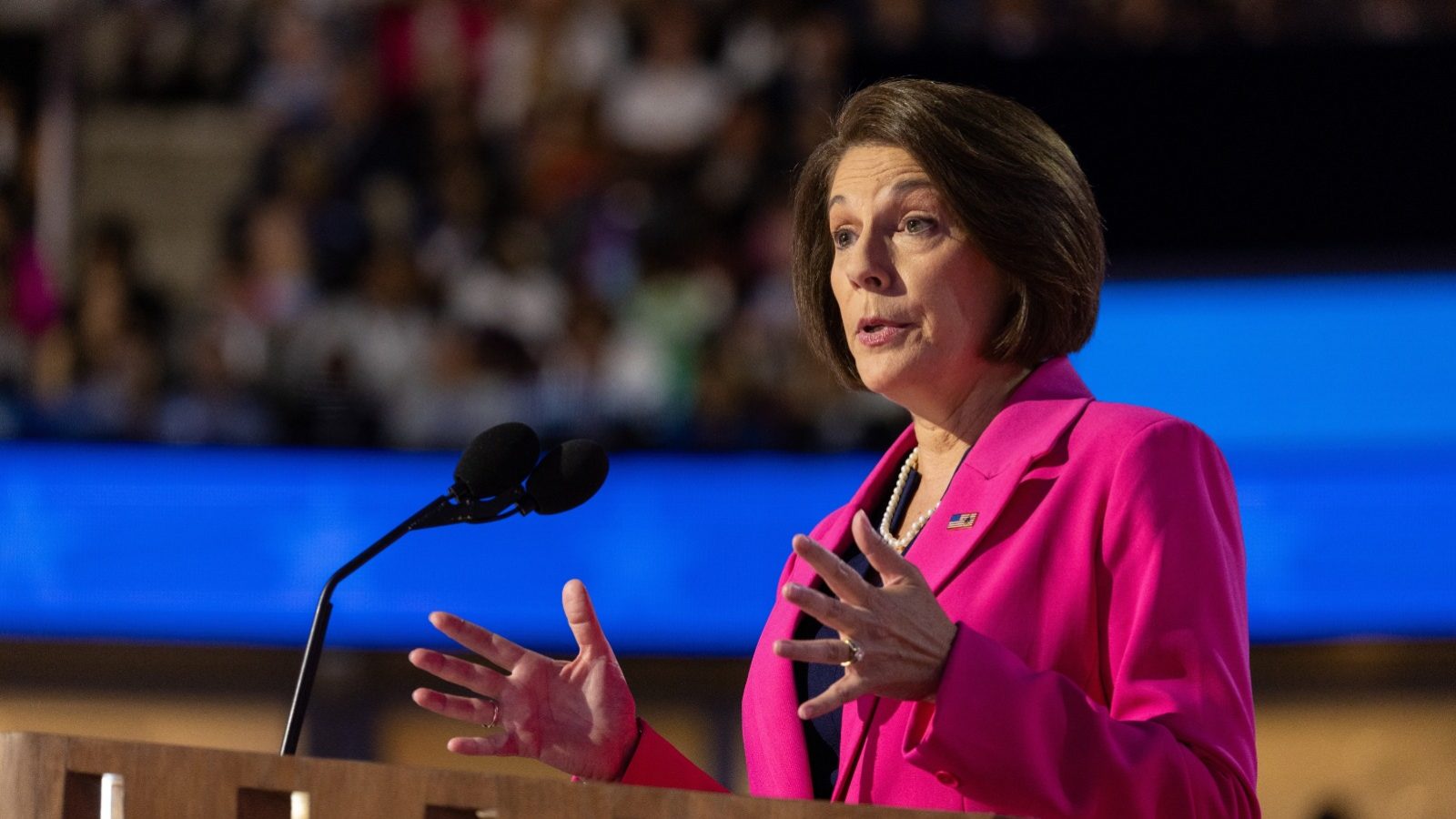

“In Nevada, legal sports betting is a thriving industry that adds to the world-class experience of watching our championship-level professional sports teams,” Cortez Masto said via press release. “It’s past time to exempt legal sports betting from outdated taxes that are actually incentivizing illegal sportsbooks. This is bipartisan, commonsense legislation that will help boost local economies across the United States.”