Jefferies analysts noted in a Field Position update Monday that although United States sports betting handle dropped in December for one of the few times ever, the incursion of prediction markets bearing on sports event contracts was likely not the cause.

And the underlying overall metrics, the report suggests, aren’t as dire as they seem for the legal sports betting industry, wrote James Wheatcroft, David Katz, and Matthew Copeland.

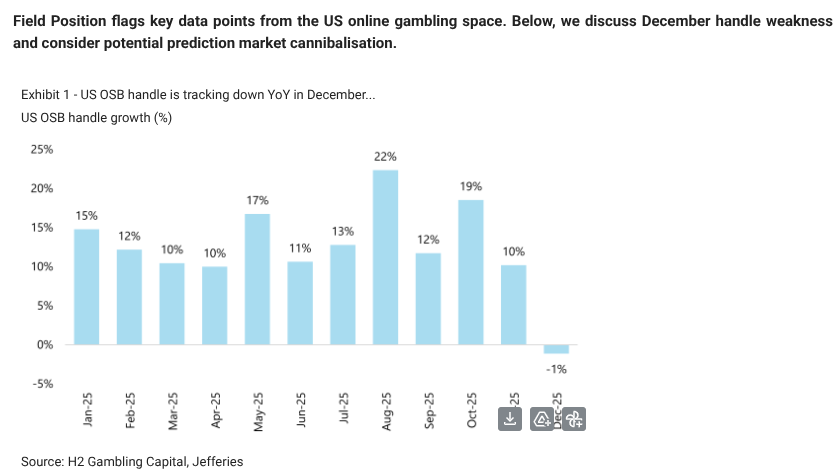

Sports betting handle experienced a -1% growth year-over-year in December, said Jefferies, plummeting from 10% YoY growth in November. August was the best month for sportsbooks in 2025, with 22% growth YoY.

According to Jefferies, December gross gaming revenue (GGR), though, still managed to track upwards by 5.4 points to 11.6% month-over-month for the entire market.

December handle figures continue to track downward this month for FanDuel, which, with DraftKings, soaks up as much as 80% of the U.S. sports betting market. Using early data, Jefferies reported that market handle down 5% year-over-year.

That said, margins are up 1.2 points to 12.4%, sending GGR up 23%.

User interest is high, however

Using FanDuel as its benchmark, Field Position noted that user activity remains strong, explaining that a dip in betting activity could be attributable to “December’s sports calendar, promotional environment,” and other factors. Jefferies noted an inventory of fewer NFL games as the regular season culminated, and determined that “games over the key Christmas window were less appealing.”

Market research firm Optimove reported that NFL bettors wagered less than they expected this season.

The NBA, NHL and college basketball regular seasons were apparently insufficient to make up the difference.

Two other contributing factors, according to Jefferies:

- Promotional spend: Sportsbooks reduced free bets sharply in December. FanDuel’s parent company, Flutter, notably trimmed spending on them around 20% year-over-year, and 50% month-over-month in Michigan and Pennsylvania “to levels at or near all-time lows.”

- Recycling: High sports margins entering December, Jefferies wrote, and in the first few weeks of January, impacted depositing and “wallet recycling,” which is the practice of moving money between multiple digital wallets.

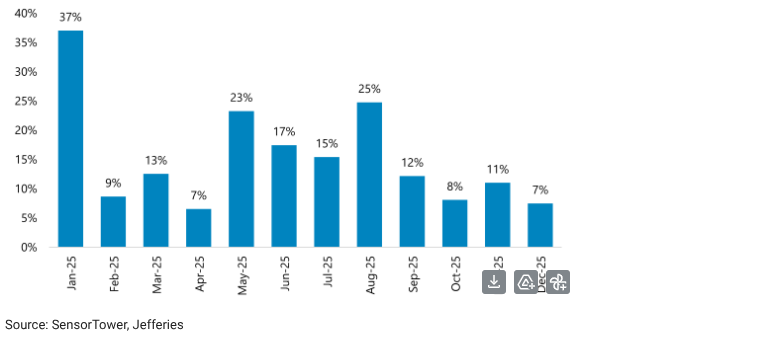

There appeared to still be interest in sports betting despite the dip in spending, though. According to Jefferies, sourcing the SensorTower app analytics platform, FanDuel grew its active users base by 7% in December.

More not bad news for sportsbooks

While trend lines for bettor interest through handle in decline were notable, so were the increase profits being gleaned by gambling companies and state taxing authorities.

The Field Position report noted: “Last week saw margins reach an all-time high for both the market (17.6%) and [FanDuel] (21.7%), which may drive a further recycling headwind to handle over the coming weeks, overshadowing a record GGR performance.”

InGame research shows that year-over-year, from 2024-25, U.S. handle dipped -2.45% over 25 reporting states.

- 2025: $9,694,582,114

- 2024: $9,938,074,989

- Difference: ($243,492,875)/-2.45%

Gross revenue, however, exploded over the same period by 100.31%.

- 2025: $1,122,327,237

- 2024: $560,297,752

- Difference: $562,029,485/100.31%

That represented a 93.43% year-over-year boost in state tax revenue.

- 2025: $296,689,818

- 2024: $149,515,789

- Difference: $147,174,029/98.43%

(These totals do not yet include Arizona, Colorado, Illinois, Kentucky, Missouri, Nevada, Ohio, Rhode Island, South Dakota, or Virginia)

Prediction market effect?: Negligible

Sportsbook handle doesn’t appear to have migrated to prediction markets, despite their recent gains in sports betting volume, according to Jefferies.

“Kalshi’s momentum appears to be slowing, rather than accelerating,” Jefferies observed, noting that its December volume was up just 6% month-over-month, as opposed to +54% and +32% in October and November, respectively.

So far, prediction markets have yet to fulfill both cannibalization criteria for Jefferies: a reduction in national sports betting handle, which has happened, and active users, which has not.

Chris Altruda contributed to this report.