At a time when multiple U.S. courts are examining binary swaps and the future of “sports event contracts” within prediction markets, a wider turf war has broken out in which a vast number of people appear bound to the idea that there’s a binary choice to be made between exchange-based platforms (e.g. Polymarket) and traditional mass market against-the-house sportsbooks (e.g. DraftKings).

The notion that prediction markets, with sports bets included, may upend the state-based sportsbook regime is not entirely unfounded. Also, the “establishment versus the young and exuberant guns” makes a useful foil for marketing campaigns. But the idea that sports event contracts are on the verge of completely devouring traditional sportsbooks is heavy on narrative and light on reality.

The truth is that state-based sportsbooks, led by the duopoly of DraftKings and FanDuel, which command a collective ~75% market share, have developed into same-game parlay (SGP) engines. That has become the core sportsbook product and the main driver of revenue and net profit. SGPs tile the sportsbook marquees and they’re the subject of most marketing emails and push alerts.

It’s a distinct sportsbook product from pregame straight bets and live betting, and most importantly — for a variety of reasons — very difficult to replicate at scale within the peer-to-peer exchange wagering environment. Sporttrade CEO Alex Kane has been shouting about this topic, so let’s look at it more closely and ask, why is this?

1) Consider the frequency and popularity of promotional offers around SGPs that recreational consumers routinely claim. Namely, the 15, 20, 30, or 50% “profit boosts” that make multi-legged longshots potentially more profitable and thus more palatable. They’re promoted especially frequently for island games. In an exchange environment with an anonymous taker on one side and an anonymous maker matched on the other for each trade, these profit boosts have no simple way to factor in.

2) There’s SGP “insurance,” where recreational bettors can salvage a $10 or $25 “free bet” when the moonshot inevitably loses. How would this get created and redeemed (likewise, the “bet and get” promotions) in an exchange environment?

3) Consider that in the traditional sportsbook realm, the house knows damn well who it’s dealing with. The recreational types and full-fledged donkeys will have no problem getting down multi-legged SGPs at somewhat attractive pricing. In an exchange environment, unless the user is opting to reveal his identity, the maker and perhaps institutional market maker will have more reticence offering a good price, blindly, to someone who might be actually sharp or part of a syndicate. In short, as a result, SGP pricing in the traditional sportsbook realm probably will run slightly more favorable for most users.

Exchange platforms have uncovered a method, for now, to offer “combos” resembling same game parlays. But the engine is a bit clunky, the betting menus are much smaller, and the promotional offers specific to SGPs are absent. The numbers bear this out: According to industry analyst Dustin Gouker, the handle for all parlays over the past 30 days (as of Dec. 10) at Kalshi is just under $300 million, or just over 5% of overall volume.

The point is, the core modern recreational sportsbook product is separate and distinct from what exchange platforms are mainly offering in the sports realm. And by extension, while they certainly stand to compete in some areas in sports (in particular on straights and live betting pricing), there is substantial room for exchange platforms and traditional sportsbooks to … well, co-exist.

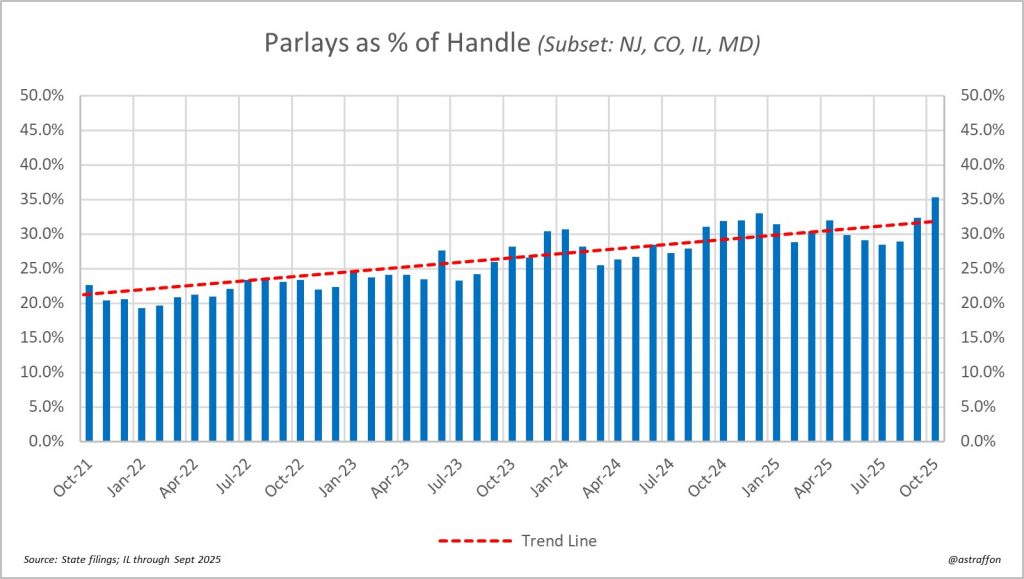

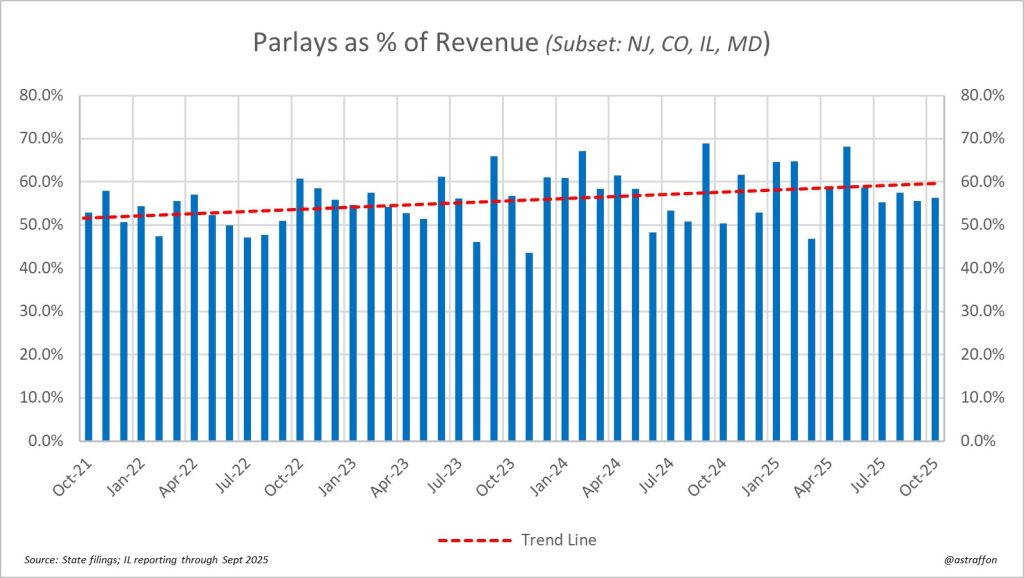

Growth of parlay handle and revenue

Over the course of the seven-plus years since the Supreme Court overturned the federal ban on legal sports betting outside Nevada, the volume of parlay wagering and specifically SGPs has steadily increased. While state filings do not reveal and I am not privy to the exact percentage volume of SGPs within the overall parlay umbrella, anecdotally, the number is high.

Take a look at these trendlines via Casino Reports and independent analyst Alfonso Straffon, showing parlay volume at regulated U.S. sportsbooks since 2021 and the percentage of overall revenue parlays comprise. They were almost 70% of revenue during one interval in September 2024:

Back in 2021 at the outset of this climb, some dopey reporter monitoring New Jersey sportsbooks observed the trend that, whoa, sportsbooks really wanted users to dive deep on parlays and SGPs. At the time, I framed this as a word of caution, thinking that players long-term would burn out their bankrolls too quickly and thus it was a poor strategy for the long-term health of the industry. I may have even been right on that note, but I underestimated the popularity of SGPs, their potential as a driver, and the desire of certain shareholders to see the structural hold increase into the mid-teens. Today, SGPs reside at the heart of sportsbook profit centers and have also penetrated the mainstream sports fan consciousness, thanks in part to a massive sum of marketing dollars.

Back then, FanDuel was far ahead of the pack as far as product quality and user experience, and also skilled at pricing in correlation to mitigate the house risk. DraftKings has since caught up, and the other mainstream books in the battle offer similar, competitive products and features.

But you get the idea: At this point in the evolution of U.S. sportsbooks regulated at the state level, SGPs and parlays are almost everything. (Attracting and maintaining a VIP clientele is the remainder of that “everything.”)

And by the way, which shops are probably best equipped to master the production of an SGP/combo engine within an exchange ecosystem? Probably the sportsbooks where most of the liquidity/marketing making will be provided in-house, as opposed to a more decentralized environment with many more market makers. And further, edge goes to the operators having more visibility into known users who are perhaps switching over from DFS or pick’em products, who will be better prepared to tailor bonuses and rewards to those users.

“The holy grail here, in my opinion, would be for an exchange product interface to look and feel as close as possible to a traditional sports betting product,” Straffon told InGame. “And operating a single dealer ‘exchange’ certainly makes that seem more possible as compared to a multi-dealer exchange.”

Fanatics, which has made its move into sports events contracts and prediction markets in partnership with Crypto.com, indeed has a product that more closely resembles a sportsbook interface than the prediction market look.

“If you look at their interface, it already looks multiple times better than what Kalshi has out there,” Straffon said. “I fully expect FanDuel and Draftkings to put out a product that will resemble their traditional sportsbook as much as possible. It’s through this product presentation and marketing savvy that they can end up giving the incumbent prediction markets a cold reality check.”

Now, traditional sportsbooks certainly stand to lose some business around straight bets (props or sides) or live trading/betting, or maybe lose the attention entirely of segments of the betting population. Maybe all of this competition from low-fee exchanges even improves pricing overall for … the consumer! Remember him?

The elephant

The great big unknown not yet addressed in this article is what the courts ultimately will decide with respect to the nature and legality of sports events contracts, and whether federal law via the Commodity Exchange Act preempts state sports betting laws, allowing sports contracts to trade lawfully nationwide on licensed exchanges. To borrow the refrain from the nominee for CFTC commissioner, Michael Selig: “These are very challenging interpretative questions that I will look to the courts on.”

At this point, nobody knows for sure which way the key legal decisions will go. There are legal actions underway in federal courts in multiple circuits and other actions proceeding in state court, most notably for now in Massachusetts, where one judge is exploring different theories involving preemption. The safe bet is that the Supreme Court, at some point but perhaps not until 2027 or even 2028 (a full 10 years after the Murphy v NCAA decision), will weigh in and determine the course of everything. It’s also possible that Congress — although polarized, inert, and on recess for much of 2025 — will weigh in at some point too.

Meantime, fears among sportsbook incumbents were great that prediction markets would siphon all the vibes as well as all the existing sportsbook clientele, including all of the untapped users in California, Texas, and other states yet to legalize sports betting. Perceptions of the changed playing field contributed to significant damage to leading U.S. sportsbook market capitalizations, and ultimately the key players joined the insurgents with their own prediction market plans. They even risked valuable state licenses in the pursuit and forfeited others.

FanDuel, DraftKings, and Fanatics also ditched the American Gaming Association, the leading casino/gaming industry trade organization whose mission was no longer compatible (and probably never was compatible) with their strategy. Each of those have since made acquisitions or partnerships, launched their prediction-style products, or soon will. Fanatics is off and running; FanDuel will be there soon alongside CME; and DraftKings Predict is on the tracks post-acquisition of Railbird and will join the party soon.

On top of all that, there are strong tax incentives for the incumbent sportsbooks to shift some of their business into the federal realm. Namely, there is the incentive to evade state taxes that are disproportionately higher in some of the busiest OSB states including New York and Illinois. This dynamic also potentially provides some leverage against additional states driving up the tax rate on sportsbook licensees, which several states did in 2025. But that is a topic for another time.

Here, for now, in short: State-based SGP-driven sportsbooks are humming along just fine. They mainly trade in and profit from dealing parlays. The whole ecosystem revolves around parlay boosts and mailers and alerts and perceived bargains. Exchanges inherently are not structured to operate in this way.

There is certainly one thing that sports event contracts and SGPs have in common: It’s all gambling. And Americans have a voracious appetite for gambling, although a very real backlash to the sheer volume of it all is in full bloom and should not be underestimated or left unattended. But as far as exchanges or traditional sportsbooks — the choice isn’t binary. There’s room enough on the road for both.

Just watch out for falling, adverse rulings.