Kentucky Republican Rep. Andy Barr July 23 filed what is now the third bill that seeks to roll back a limit on gambling-loss deductions included in President Donald Trump’s new tax law.

Text of Barr’s bill is not yet available on the Congressional bill-tracking website, but, like Democratic Rep. Dina Titus’s HR 4304, it has been assigned to the House Ways and Means Committee.

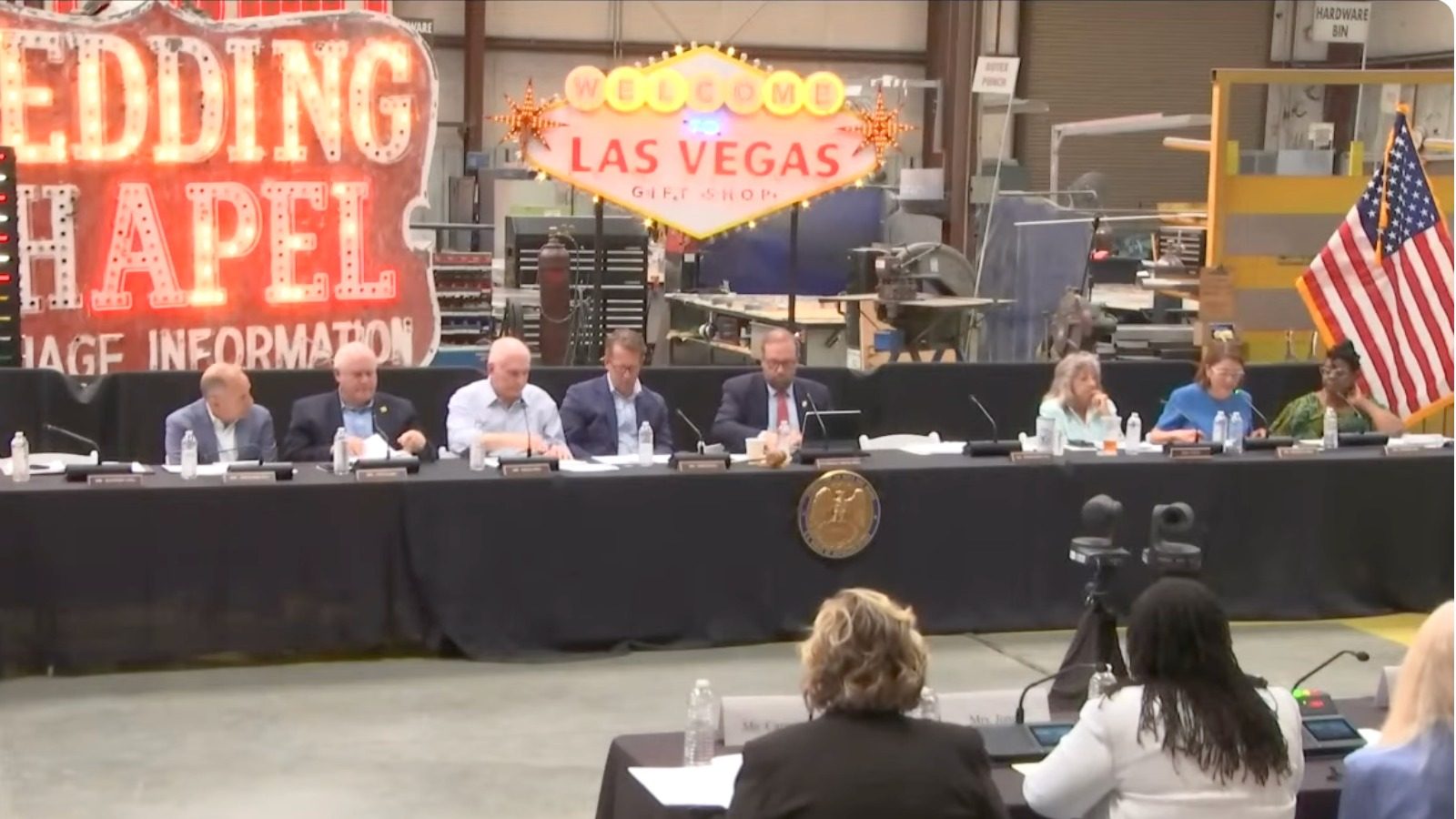

Barr is the first Republican to file a bill that would return gambling-loss writeoffs to 100%. He filed HR 4630 two days before the House Ways and Means Committee held a field hearing in Las Vegas and said it was committed to a bipartisan solution to the issue.

Called the “Winnings and Gains Expense Restoration Act of 2025” or WAGER Act, the bill differs from Titus’, which would amend the tax law directly by “striking ‘90%’ and inserting ‘100%.'” Barr’s bill reads:

“H. Con. Res. 14. (119th Congress) is amended by striking ‘for any taxable year’ and all that follows through ‘shall be allowed’ and inserting ‘for any taxable year shall be allowed.'”

That would mean a line in the sweeping federal bill stipulating that the maximum deduction “shall be equal to 90 percent of the amount of such losses during such taxable year” would be removed.

The bill would become effective Dec. 31.

The new tax law that Trump signed July 4 includes a provision that would reduce the amount of losses that gamblers can write off their taxes from 100% to 90%.

SEC. 70114. EXTENSION AND MODIFICATION OF LIMITATION ON WAGERING

LOSSES.

(a) In General.--Section 165 is amended by striking subsection (d)

and inserting the following:

``(d) Wagering Losses.--

``(1) In general.--For purposes of losses from wagering

transactions, the amount allowed as a deduction for any taxable

year--

``(A) shall be equal to 90 percent of the amount of such

losses during such taxable year, and

``(B) shall be allowed only to the extent of the gains from

such transactions during such taxable year.

``(2) Special rule.--For purposes of paragraph (1), the term

`losses from wagering transactions' includes any deduction

otherwise allowable under this chapter incurred in carrying on any

wagering transaction.''.

(b) Effective Date.--The amendment made by this section shall apply

to taxable years beginning after December 31, 2025.

The gambling industry has been vocal in its opposition, saying that some bettors would then be forced to pay taxes on losses — or driven offshore to bet to avoid taxation.

Friday at the field hearing, Titus used part of the five minutes she was allotted to speak to say that the current rollback to 90% might also cause some bettors to not report losses. Titus is not a committee member, but was invited because the hearing was held in her district.

Republican Committee Chair Jason Smith said that there is support on both sides of the aisle to return to the status quo, and Titus told him she is “glad to hear the chairman say he would work with us to undo the gambling deductions.”

Steven Horsford, the ranking minority member of the Ways and Means Committee, Friday told Smith that he wanted a “commitment” from Smith to move legislation forward.

Smith said: “I think that we’ll look at what avenues to continue to address the problem the Senate created.” But he did not make a clear commitment to action.

Senate bill also assigned to committee

It’s unclear whether Titus’ bill or Barr’s would move forward, or if they could be combined. Neither has a hearing date yet.

The third bill to roll back the gambling-loss deduction limit is in the Senate. Nevada Sen. Catherine Cortez Masto introduced S.2230 via unanimous consent in the Senate July 10, but it failed to advance, and has now been assigned to the Senate Finance Committee.

“They’d literally be paying taxes on money they don’t have. This makes no sense, and it will do irreparable harm to our country’s gaming industry if it takes effect, especially in Nevada,” Cortez Masto said at the time.