U.S. Rep. Dina Titus, a Nevada Democrat and co-chair of the Congressional Gaming Caucus (CGC), on Monday sent a letter to acting Commodity Futures Trading Commission (CFTC) Chairperson Caroline Pham asking her to release “all relevant communications from or about” Pham’s nominated replacement, Brian Quintenz.

The intended appointee of President Donald Trump and Kalshi investor and board member appeared to be gliding through his confirmation process until a recent series of setbacks.

An expected first subcommittee vote on his approval was scrubbed on July 21 when a Republican member of the Senate Committee on Agriculture, Nutrition, and Forestry was absent because of travel delays. Voting is expected to fall within party lines, with every Republican vote needed to confirm Quintenz.

Quintenz’s scheduled July 28 vote was also taken off the subcommittee’s agenda because, according to a spokesperson for the Republican majority on the committee, the White House asked for a voting delay.

The process was muddied further when a Freedom of Information Act (FOIA) request by The Closing Line industry newsletter uncovered communications between Quintenz and the CFTC that were held outside of official government channels. Quintenz promised in previous testimony to Congress that he would divest of his interest in Kalshi and not make decisions related to the company for a year should he be chosen to the lead the federal body that regulates it.

Wrote Titus in her letter to Pham: “Despite this pledge, a recent Freedom of Information Act request from The Closing Line indicates that Mr. Quintenz has sought information regarding Kalshi’s competitors and that he may be involved in agency decision-making prior to his Senate confirmation.”

Titus noted the impracticality of Quintenz avoiding rulings that impact Kalshi “considering the vast amount of regulatory and legal action concerning prediction markets.” She also observed that a toothless CFTC benefits Kalshi, which is waging a multi-front legal battle against cease-and-desist orders, not suffering any notable setbacks until a Maryland ruling last week.

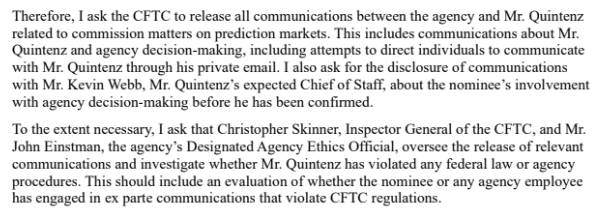

From the Titus letter:

Titus asks CFTC for broad Quintenz inquiry

Titus is requesting “an inquiry into whether Mr. Brian Quintenz has violated CFTC policies, any applicable federal statute, or his own ethical pledge prior to his Senate confirmation as Chair of the Commodity Futures Trading Commission (CFTC).”

Titus also questions CFTC moves that “have impacted Kalshi and its competitors. This includes settling lawsuits with Kalshi, approving new prediction market platforms, and closing relevant investigations.”

Titus hammered what she called the CFTC’s lack of transparency, notably its canceling of a public roundtable on prediction markets and its ignoring previous requests for information.