In the five years since legal sports betting went live in Washington, D.C., it would be fair to say that the market has undergone more changes than in any other U.S. legal sports betting jurisdiction.

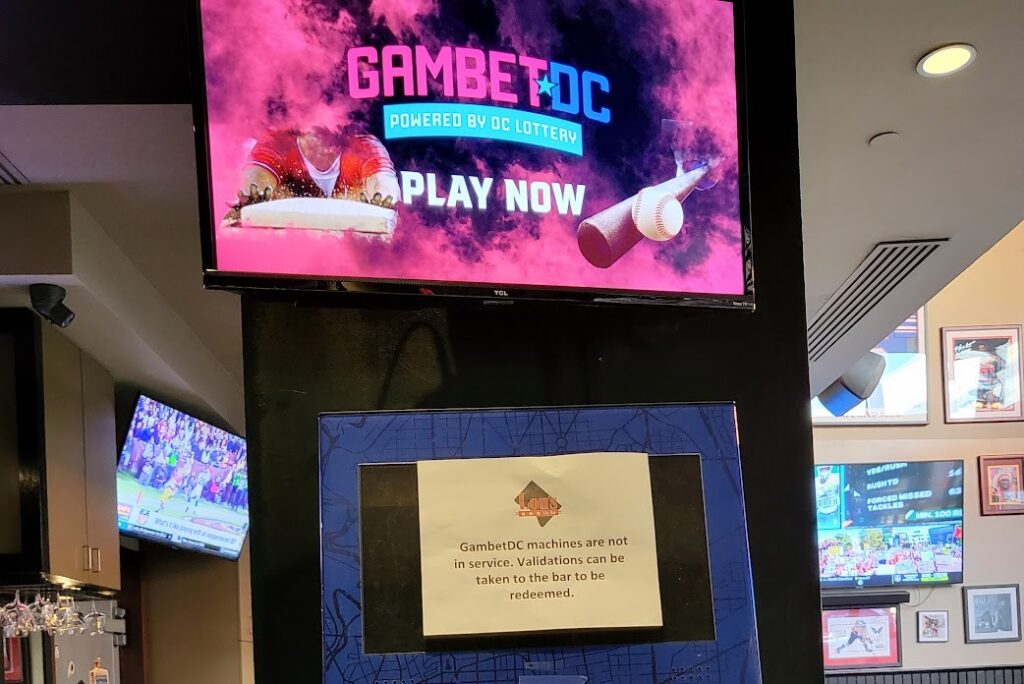

On May 28, 2020, the city’s Office of Lottery and Gaming (OLG) launched GamBetDC, a white-label platform developed in partnership with lottery vendor Intralot. Betting kiosks were later added at lottery partners throughout the city.

The launch was inauspicious. The U.S. — and most of the world — was about two months into hard COVID-19 lockdowns. Few sporting events were happening, and those in D.C. had access to one platform that was available citywide, with the exception of federal lands. The early reviews were many — and not all that varied.

John Pappas, a gambling consultant who lives in D.C., said the early days were frustrating.

“I distinctly remember, it was the night before The Masters and I couldn’t find any Masters markets available on the app,” he said of trying to place a bet in the first few years. “I thought maybe I wasn’t looking right, or they were hidden.”

In reality, the market wasn’t available.

Driving force behind legalization was dirty

Limited offerings were a key complaint. But consumers also complained about the high odds, functionality, broken kiosks, and where the app could be used. GamBetDC was available “citywide,” but D.C. has many pockets of federal land — from the National Mall to small museums — and sports betting is not legal in those places.

Geofencing, done by GeoComply, was made trickier by “exclusion zones” mandated around professional sports venues that had sports betting partners. For example, the William Hill Sportsbook (now Caesars) at Capital One Arena could offer digital betting within a two-block radius, so that area had to be geofenced. Similar areas were added as BetMGM launched betting through a partnership with the Washington Nationals, and FanDuel later did the same with DC United, which played at Audi Field.

Complaints surfaced early, and the public pushback came after the D.C. Council spent months considering what wagering should look like. Then-Finance Committee Chair Jack Evans pushed through a single-source scheme with Intralot — which had no sports betting experience — that ultimately was the biggest fail in U.S. legal sports betting history.

But even before GamBetDC launched, the D.C. Council unanimously voted to expel Evans, saying that he was doing the bidding of some of his private legal clients. Wrote DCist in 2019, “His decision to keep outside employment with a law firm that included clients with interests in D.C., followed later by a move to create his own consulting firm, led him into a thicket of ethical conflicts that started becoming public over the last 18 months.”

Oregon Lottery realized its mistake much faster

D.C. wasn’t the only U.S. jurisdiction to move forward with only one operator, but it was the only one to partner with a non-sports betting back-end provider, and one of only two to white label. The Oregon Lottery tried the same pathway with an SB Tech-backed model called ScoreBoard. Eighteen months in, Oregon’s lottery reassessed and made the decision to kill ScoreBoard in favor of using DraftKings as its front-facing platform. It was another year before the switch happened.

“There have been states that have rolled out a successful single-source product, but D.C. didn’t do it right from the outset,” said Pappas, who includes GeoComply and the iDevelopment and Economic Association among clients. “And the fact that so many people came to D.C. and said, ‘Here’s how you can maximize revenue,’ but they still chose to go with a single-source market. It was kind of baffling. Over the course of too many years, they came back and did what everyone told them to do.”

According to InGame records, in 2021, ScoreBoard took $332 million in bets resulting in $30.4 million in gross gaming revenue (GGR). The following year, with DraftKings as the front-facing platform for 11 1/2 months, handle was $498 million and GGR was $49.5 million.

Four years later …

In D.C., the decision to change took much longer. In January 2024, the D.C. Council started to seriously revisit the idea. With Intralot’s sports betting contract set to expire last July, Councilmember Kenyan McDuffie spearheaded a campaign for change. There were closed-door meetings and public hearings during which McDuffie pressured the OLG to consider something new.

Then-OLG chief Frank Suarez, now the president and CEO of the Connecticut Lottery, was resistant to change and vigorously defended GamBetDC — or at least the single-source model — in a series of contentious hearings. Then, in March 2024, Suarez announced it had approved an Intralot proposal to drop GamBetDC in favor of FanDuel. Intralot signed a deal for FanDuel to become the only operator in the nation’s capitol. As part of the deal, FanDuel paid the city $5 million as a “platform conversion fee” and took over operating expenses, estimated at $2-$4 million per year.

FanDuel launched April 15, 2024 and the results were stunning. In its first 30 days, FanDuel reported $5 million in GGR, an 887% increase over the same period the previous year. From that, FanDuel paid the city $1.9 million in tax revenue (based on a 40% tax rate). For comparison, the most amount of tax revenue that the District had taken previously for a full year was $9.7 million. Early numbers indicated that FanDuel would have surpassed that number within five months.

The arrangement took the D.C. Council by surprise, and FanDuel’s monopoly lasted only three months. While the Council applauded the change, it wanted more and ultimately voted to open the market, starting July 15, 2024. Since then, five operators have gone live or expanded their availability.

When the market opened, Caesars and BetMGM were able to remove the geofences around the sports venues with which they were partnered. DraftKings, Fanatics Sportsbook, and FanDuel (which exited the deal with Intralot and relaunched) joined the fray over the next few weeks and months.

The numbers say it all

The difference between GamBetDC and FanDuel as sole operators was stunning enough. But 10 months into a competitive market, the numbers are astonishing.

Between late May 2020 and and the end of 2023, the highest annual handle in D.C. was $216 million. With an open market for less than half the year in 2024, handle reached $460.9 million, and four months into this year, handle is $290.2 million, according to InGame data. Multiply that number by three, and District operators stand to take more than $870 million in bets in 2025 — and that is not taking into account that the NFL season is the most lucrative time of year.

For the city, the difference in revenue is stark. During the GamBetDC years, the city essentially got all revenue from the platform and topped out at collecting $9.7 million in 2022. In 2024, that number rose to $11.7 million. Through April, D.C. has already collected $7.2 million in tax. The current tax rate for mobile operators ranges between 10%-30%, depending on the class of license.

While McDuffie publicly led the push for change in D.C., operators had long been lobbying for a chance at the market. None more so than Brandt Iden, now the head of Fanatics Betting & Gaming government affairs department. At the time D.C. was legalizing, Iden was a state representative in the Michigan House. He authored a bill that simultaneously legalized retail and digital sports betting and iGaming. That bill passed in December 2019 and platforms went live in January 2021.

As a lawmaker, a single-source model was not on Iden’s radar — in part because it wasn’t an option under the Michigan constitution, but also because he doesn’t believe in it. When D.C. lawmakers began the push for change, Iden was working in the background.

“The most challenging part was convincing the Council that it would bring more money into the District,” he told InGame. “They knew GamBet was broken and they needed something new, but they weren’t convinced that an open market was the way to go. It was a lot of education that got us to where we needed to go. … We had very good data that showed that more revenue would come in, but this was the first market in which this (kind of change) was done.”

The gaming consultant firm Eilers & Krejcik, Iden said, provided good research, “but it was a leap. The Council took the time to study it, so I give them a lot of credit.”

D.C. Council ensured some money stays local

D.C. was the first U.S. jurisdiction to make finding a way to get local business involved in gambling expansion a priority. Under the sports betting law, 35% of operator expenditures must be with what are known as Certified Business Enterprise (CBE) companies. These are companies based in D.C., that employ D.C. residents, and use other D.C. businesses to support their own. Many state lawmakers question what economic benefit a state will get from a digital platform where operations are often based elsewhere. The D.C. Council used the CBE requirement as a kind of workaround to ensure that the city, local businesses, and residents would benefit.

Gambling companies operating in the District must honor that, and Iden said they were required to give reassurance that they wanted to get into the market and would use D.C.-based vendors or suppliers.

Doing so is easier for land-based venues, where employees can be hired for tasks like writing wagering tickets, servicing kiosks, and serving or making food. It can be a little trickier for digital businesses, but some use D.C.-based marketing firms, for example.

In-person betting at Capital One Arena a first

In-person sports betting went live two months after GamBetDC was birthed. It was in July 2020 that the first sportsbook in a pro sports venue anywhere in the U.S. opened. Now the Caesars Sportsbook, the location offered access to people both outside and inside the stadium.

The Caesars Sportsbook at Capital One Arena was long an anomaly. First, it was the only in-arena sportsbook in the U.S. for more than a year until FanDuel opened its then-Footprint Center location. In D.C., the next sportsbook at a pro sports venue — the BetMGM Sportsbook at Nationals Park — opened Jan. 31, 2022. Second, Caesars Sportsbook’s retail location often took more bets and reported more revenue than GamBetDC.

For example, in September 2020, the first month of the NFL season, the Capital One Arena sportsbook took $12.2 million in bets and GamBetDC took in $3.3 million, according to DC Lottery revenue reports. And in September 2022, the Caesars Sportsbook took in $5.7 million in handle compared to GamBetDC’s $3.2 million. There were four retail sportsbooks open in D.C. at that time, and combined handle for September 2022 was $9.6 million — three times what GamBetDC took.

“It was kind of bonkers we were seeing in D.C. that online revenue was less than retail,” Pappas said. “And that was literally the only market where the Caesars Sportsbook was outpacing the app that was available almost throughout the city.”

Lucky for Pappas, things have changed. He was able to bet on The Masters this year.