Fantasy sports app Sleeper is suing the Commodity Futures Trading Commission (CFTC) in federal court, alleging that the regulator that oversees prediction markets took “arbitrary and capricious” actions to block the business from gaining the approvals needed to offer sports event contracts.

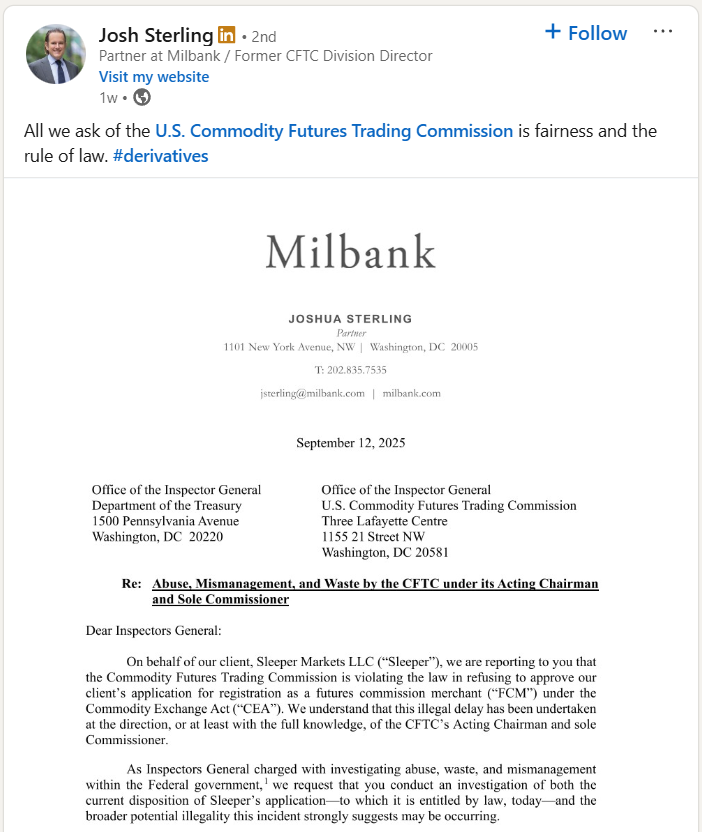

The lawsuit – filed Monday in the U.S. District Court for the District of Columbia – follows a letter from Sleeper’s legal team to the Office of the Inspector General, which accused the CFTC of acting unlawfully in holding up Sleeper’s application for approval with the National Futures Association (NFA).

In the complaint, Sleeper lays out the issues it raised in its letter. The fantasy app currently has a pending application with the NFA, submitted in May, to be a futures commission merchant (FCM).

SleeperAs an FCM, Sleeper would be able to offer its customers access to contracts made by a designated contract market (DCM). The most well-known FCM in the world of prediction markets is Robinhood, which offers its customers access to Kalshi’s markets.

The NFA is a self-regulatory body for businesses offering commodity futures or swaps. All FCMs registered with the CFTC must be members of the NFA, and the CFTC has effectively delegated responsibility for FCM approval to the NFA since 1984. Typically, once approved by the NFA, a business is granted FCM status by the CFTC almost immediately.

The Commodity Exchange Act (CEA) says that “Any person desiring to register as a futures commission merchant, introducing broker, floor broker, or floor trader hereunder shall be registered upon application to the Commission,” unless they meet certain disqualifying criteria. Those criteria include felony convictions, bans from working in the securities market or certain kinds of bankruptcy, none of which appear to apply to Sleeper.

However, Sleeper alleges that the CFTC did not follow these procedures when it came to its own application.

Sleeper: CFTC stepped in to stop approval

The complaint says that on Aug. 28, the NFA informed Sleeper that its application for FCM status was complete and that it was prepared to approve the application by Sept. 4.

However, it adds, “on information and belief,” that the CFTC told the NFA not to approve the application.

This, Sleeper claims, was due to “unspecified concerns harbored by the Commission regarding the propriety of certain types of derivatives that are or will be listed on DCMs.”

Sleeper has not yet announced the DCM, or DCMs, with which it plans to partner and offer contracts from.

All DCMs are regulated by the CFTC, and go through a much longer application process that is fully overseen by the CFTC. Sleeper’s complaint says that because of this, taking action against Sleeper for contracts listed by a DCM is not a reasonable course of action.

“Any reasons the CFTC may have for its unauthorized interference in NFA’s registration approval are completely misdirected,” it says.

CFTC counsel denies getting involved

The complaint says Sleeper has been in contact with Acting CFTC General Counsel Meghan Tente, who does not appear to agree with the company’s characterization of events.

Sleeper says that on Sept. 5, Tente told Sleeper that the Commission believed its NFA application was not complete, and that the Commission had not received Sleeper’s application materials from the NFA.

After Sleeper’s lawyers wrote a letter to Acting CFTC Chair Caroline Pham about “the CFTC’s treatment of its application and the conflicting representations it had received from the Commission and NFA,” Tente responded, denying that the CFTC had instructed the NFA not to approve the application.

Sleeper says it mentioned to NFA CEO Tim Sexton and General Counsel Tim Elliott that its understanding was that the application was being held up due to CFTC interference and says that these comments were not disputed.

However, it does not mention any NFA staff directly saying or agreeing that the CFTC held up the application, nor does the complaint reveal the source of the information that led it to believe the CFTC had stepped in to prevent approval.

Sleeper CEO: CFTC ‘picking winners, losers’

Sleeper argues that the CFTC is not just acting contrary to the CEA, but also denying the business its Fifth Amendment right to due process.

It called on the court to issue an injunction “prohibiting CFTC from interfering with NFA’s rendering of a determination on Sleeper’s application,” and to declare that Sleeper is eligible to register as an FCM.

It also called for the court to rule that the CFTC’s actions are “arbitrary and capricious,” and asked for “other relief as appropriate.”

In a press release Monday announcing the lawsuit, Sleeper CEO Nan Wang accused the CFTC of “picking winners and losers” in the prediction markets space.

“The CFTC’s unlawful actions present an unfair competitive hurdle to a growing U.S. industry,” Wang said. “This is about more than just one app. It’s about whether these innovative new American markets are truly governed by transparent and fair rules, or by a single decision maker picking winners and losers.”

Sleeper’s Sterling in CFTC chair mix

Sleeper’s lead counsel in the case is Josh Sterling, a partner at Milbank LLP. Sterling has also represented Kalshi in its lawsuits against the states of Nevada, New Jersey, and Maryland.

Last week, Semafor reported that the White House was vetting Sterling for the role of chair of the CFTC, after Brian Quintenz’s nomination appeared to stall.

Sterling has been strongly in favor of prediction markets offering sports event contracts, and argues that only the CFTC may determine if an event contract is against the public interest.

Speaking at the National Council of Legislators from Gaming States (NCLGS) Summer Meeting in July, Sterling attracted controversy when he appeared to dismiss the idea that a prediction market like Kalshi would bear responsibility for customers facing excessive losses.

“People are adults, and they’re allowed to spend their money however they want. And if they lose their shirt, that’s on them,” he said at the time. “I mean, that would be obvious, right?”

Other OSB, fantasy operators have applied

Sleeper is not the only sports betting or fantasy sports business to have applied to join the NFA.

DraftKings submitted an application in 2024 before withdrawing it in April of this year. However, it then submitted a new application in June, which remains pending.

Underdog submitted an application in April, which has still not been approved, but the business found another way into the world of sports event contracts. It partnered with Crypto.com – a registered DCM – as a “technology provider” earlier this month, and offers the contracts in 16 states.

PrizePicks is the only major fantasy or sports betting business to have received NFA approval, and is now registered with the CFTC. It announced it had received CFTC-registered FCM status Tuesday, just a day after European lotteries giant Allwyn Entertainment bought a majority stake in the business. PrizePicks has not yet launched sports event contracts, or announced which DCM it might partner with.