Welcome to the InGame review of Kalshi vs. Polymarket. Kalshi and Polymarket have emerged as the two most prominent prediction markets in the gambling space. Both platforms offer unique experiences and market options.

We’re here to take a deep dive into both Kalshi and Polymarket to help you determine which one is right for you. There’s quite a bit to go through, so let’s dive into our Kalshi and Polymarket comparison.

Kalshi vs. Polymarket comparison

Here’s a look at Kalshi vs Polymarket at a glance, with some key information for anyone interested in these prediction markets:

| Factor | Kalshi | Polymarket |

|---|---|---|

| US Legal Status | Says it’s legal to trade in all 50 states because it’s CFTC-regulated as an exchange, not a sportsbook. Some states are fighting that. | Blocked U.S. users for years, but it bought a CFTC-licensed exchange (QCEX) so it can relaunch in the U.S. under regulation. Rollout is in progress. |

| Funding options | Normal fiat: bank transfer/ACH, debit card, Apple Pay / Google Pay, wire; now also supports crypto deposits. | USDC on Polygon. You on-ramp with card / bank / Apple Pay via MoonPay or Coinbase, then trade in stablecoin. |

| Fees | Fees vary between 2-4% based on contract size and result. | Polymarket does not charge any deposit or trading fees |

| Max bet size | Typical retail cap is around $25K exposure per market; higher limits exist for bigger accounts. | No hard per-market cap. You can size as deep as the order book will fill you. |

| What you can bet on | U.S. sports (NFL, NBA, golf, etc.) plus macro/economy, elections, and policy outcomes. Sports volume is now a huge driver. | Sports (incl. combat sports, global football), politics, tech drama, celebrity, geopolitics — basically whatever’s in the news cycle. |

| Depth / liquidity | Has hit ~$1B+ traded in a single week and tens of millions on single events (e.g. The Masters). | Regularly posts hundreds of millions+ per month and has done multi-billion dollar months around big political / cultural events. |

What is Kalshi?

Kalshi is a prediction market platform that was founded in 2018 and launched in 2021. Users can trade and enter contracts based on the outcomes of certain events. It’s not just a sports platform, as users can make predictions on awards, political elections, and cultural events.

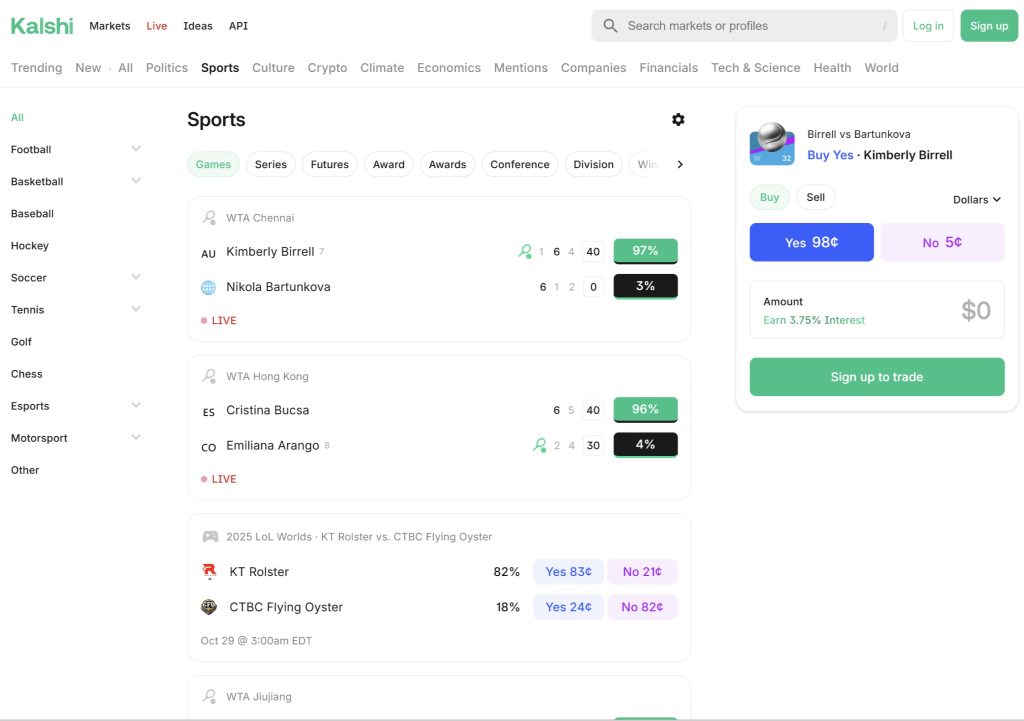

Users can find the specific liquidity on each market listed clearly below each prediction option. Each Kalshi market also has a graph detailing the activity on each option, outlining trends and chances over time, and your potential payout is displayed before the contract is official. The homepage also offers hundreds of markets that refresh constantly, and the abundance of options is certainly a plus.

There’s also a welcome bonus, too. New Kalshi users can receive a $10 bonus after making $100 in trades, as long as they sign up with an eligible referral code. Just sign up through one of our links.

On the other hand, there are some drawbacks. Your prediction must draw action going the other way before it’s accepted by the system. For some markets with high liquidity, this isn’t an issue. However, for smaller or more niche markets, this can be annoying.

What is Polymarket?

Polymarket, meanwhile, went live in 2020 with a focus on offering prediction markets for world events. While the company is headquartered in New York, however, it has not been live in the United States since 2022, following the settlement of a lawsuit filed by the Commodity Futures Trading Commission.

That status could change soon, though. Polymarket has stated it’s working hard ahead of a possible relaunch in all 50 states. If that happens, Americans will be able to enjoy one of the world’s premier prediction market websites.

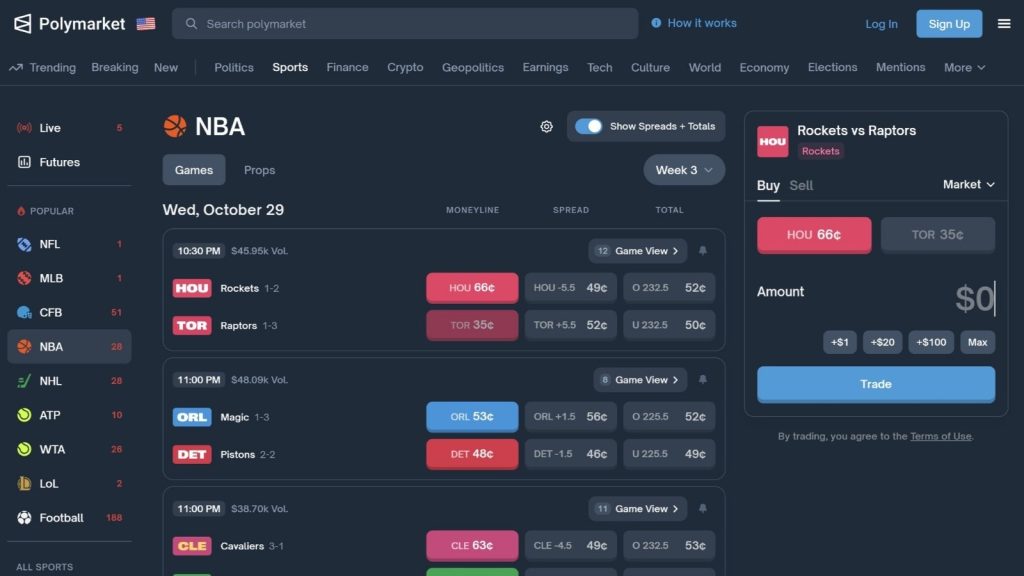

There are plenty of reasons to recommend Polymarket. The site itself is significantly faster than Kalshi, and unlike its competitor, Polymarket does not charge any trading fees. Sports markets include live betting on games in the U.S. and abroad. Another big draw is the site’s focus on politics and world affairs, which feature markets on election outcomes.

The biggest disadvantage with Polymarket is the lack of responsible gambling protections for customers. The lack of an upper limit on wagers may appeal to high-rolling users, but the absence of deposit limits and self-exclusion features is a major issue. Polymarket has also gotten negative publicity for some of the markets it offers, including one incident involving the Titan submersible disaster in 2023.

How do prediction markets work?

Prediction markets like Kalshi and Polymarket work differently from traditional sportsbooks. Users enter into contracts at specific odds, and prices move with new information and liquidity. When an outcome is known, the contracts are settled. You’ll either win money at the rate in your contract(s), or you’ll lose your initial stake.

The biggest difference between prediction markets and sportsbooks lies in the options they offer. While retail and online sportsbooks offer point spreads and totals, prediction markets tend to focus more on outcomes (similar to moneyline bets). You can find point spreads and totals if you look hard enough, but those take a backseat to wagers focusing on straight-up wins and losses. In addition, prediction markets usually do not offer options such as parlays and teasers.

Many prediction markets also provide “order book” functionality, allowing users to set their own prices and trade directly with traders (rather than a traditional “house”). Customers can then enter into agreements to buy or sell contracts on any market at the rates they choose, provided both parties agree. Much like standard prediction market contracts, these get settled when official outcomes are known.

For prediction markets to function, they require liquidity in each individual market. This means all contracts are financially covered regardless of the outcome. When a contract on one side is entered into, it must be “filled” by either equal value on the other side or a trader willing to sell at a specific price. As more money is placed on one option, prices will change. Generally speaking, the more money wagered on a particular option, the less one may stand to collect if they are right (similar to parimutuel wagering in sports like horse racing).

How do Kalshi and Polymarket compare for sports markets?

Both Kalshi and Polymarket offer extensive sports contract options on games, award races, and other certain outcomes. The platforms cover all major sports, with a variety of international and niche options to boot.

The two platforms offer contracts on games across football, baseball, basketball, and hockey, meaning there’s no shortage of markets to pick from. Users can also buy or sell both “yes” and “no” contracts, offering an abundance of options to choose from.

Polymarket, however, has more readily available point spreads and totals, which gives them an edge for players looking for the experience of a traditional sportsbook. Kalshi’s offerings highlight “win or lose” contracts, and those offer shorter potential payoffs if you’re picking favorites. Spreads and totals do exist on that platform, but it takes a few extra clicks to find them.

You’ll notice more liquidity in markets for popular games. NFL and college football markets, in particular, are very popular, as are other major sports during their respective playoff and championship rounds. Special events such as the Ryder Cup, World Cup, and Kentucky Derby can also attract markets where you could find plenty of value for your contracts (the more interest there is, the easier it will be for your contract to be filled).

Prediction market bonuses, promos, and incentives

As mentioned, Kalshi offers a $10 bonus to new users after completing their first $100 in contracts. No bonus code is needed to be eligible for this incentive.

Polymarket currently does not offer a bonus, as it is unavailable in the United States. However, that may change if plans to relaunch come to fruition. Check back often to see if there’s a new Polymarket bonus code.

Prediction markets also offer referral and loyalty programs similar to those of online sportsbooks. Kalshi, for instance, offers a Volume Rebate Program that benefits high-volume users, and all customers can earn referral bonuses. When new users sign up through links from those they know and enter at least 100 contracts, both the new user and the referring user earn $10 bonuses.

Access, payments, and verification across prediction markets

From a banking standpoint, some prediction markets handle custody, transfers, and financial matters differently. Kalshi’s system is centralized, meaning it houses your contracts and the funds used to buy and sell them. Its system includes age and location verification and is structured as a more traditional exchange (akin to traditional sportsbooks, such as DraftKings and FanDuel).

As a result, Kalshi accepts debit cards, bank transfers, wire transfers, and crypto for both deposits and withdrawals. Do note that withdrawals via bank transfer may take several business days, as the platform uses a third-party service to complete those transactions. Also, withdrawals to linked bank accounts are subject to $2 fee.

Polymarket, however, is a decentralized platform, which is a significant difference. Here, funds are held by a user’s wallet, and transfers and settlements are recorded in smart contracts on the blockchain. Polymarket uses USDC, a “stablecoin” backed by the American dollar, traded on the Polygon blockchain network.

If and when Polymarket relaunches in the United States, you’ll be able to use a Visa or Mastercard to buy USDC. However, you cannot use either of those methods to fund your Polymarket account directly, and when you withdraw, you must do so to your crypto wallet. These transactions are recorded almost immediately, though you may be subject to fees from other platforms as you turn your cryptocurrency into cash.

Trust, rules, and support

While Kalshi’s legal battles have been front-page news, the company has built an interface designed to foster confidence and trust among prediction market customers. It verifies all users, states the limits associated with each market, and is overseen by the CFTC. Users can feel confident that their transactions are safe and secure.

Reports of Kalshi’s customer support are mixed. Users generally appreciate the prompt responses from the Kalshi team when issues are escalated, and those with problems can voice them in multiple ways (such as email and live chat) to humans working in that department. However, the Better Business Bureau does not accredit Kalshi, and other users have reported platform glitches, app reliability issues, and, in some cases, delays with withdrawals.

Polymarket, meanwhile, has some work to do in this regard upon a relaunch in its home country. As a decentralized platform, the company itself does not manage or execute the smart contracts that include transactions and market resolutions. If you’re a believer in cryptocurrency and blockchain, this isn’t a big deal. However, users who aren’t familiar with those concepts or oppose them may see this as an impassable obstacle.

Furthermore, reviews of Polymarket’s customer service trend negatively. While users can raise issues via live chat and a Discord server, many complaints focus on a lack of responsiveness and an inadequate support structure.

Which is best between Kalshi and Polymarket?

We recommend Kalshi for those looking for structure and a system that’s set up to be regulated. The rules of engagement are very clear; all users must go through a verification process, and mechanisms are in place to teach those who are new to the scene.

Polymarket, meanwhile, may be best for crypto-savvy prediction market customers if it goes live again in America. The abundance of options is impossible to ignore, and the site is generally much faster than Kalshi. Furthermore, sports bettors looking for point spreads and totals are much more likely to find them at Polymarket, where they’re displayed more prominently than at Kalshi.

Both Kalshi and Polymarket, though, have their own unique strengths for prediction market enthusiasts of all kinds. Over the last few years, both sites have exploded in popularity for the breadth and depth of their options. Whether you’re looking for sports, politics, or culture markets, chances are you’ll find something on one or both of those platforms.

Frequently Asked Questions (FAQ)

Are prediction markets legal?

As of now, yes. Kalshi operates in all 50 states, pending several live court cases. Polymarket, meanwhile, is planning a relaunch after shutting down U.S. operations in 2022 as part of a settlement with the CFTC.

Can I bet sports on Kalshi and Polymarket?

Yes, you can enter into sports contracts on both platforms. Kalshi spotlights “win or lose” contracts, but point spreads and totals are available with a few extra clicks. Polymarket spotlights spreads and totals a bit more, but U.S. customers cannot use that platform yet.

When will Polymarket go live in the United States?

It’s too soon to tell. Polymarket received approval to relaunch in September of 2025, and the CFTC has certified numerous documents from the company. However, no formal “go live” date has been announced yet.

What fees do Kalshi and Polymarket charge?

Kalshi charges a small trading fee and a $2 withdrawal fee to bank accounts. Polymarket does not charge any trading or deposit fees.