Welcome to the InGame prediction market glossary. I decided to create a glossary because prediction markets are different from traditional sportsbooks, and I kept encountering unfamiliar terms as I dove into the emerging world of event contracts.

While the terms below can have different meanings, all definitions in this glossary are within the context of prediction markets unless noted otherwise. I also added examples when a more detailed description would help add context.

InGame prediction market glossary

This guide will help you become conversant with prediction markets and event contracts. It includes definitions and examples inspired by reputable online glossaries, along with independent research. If you have any suggestions or feedback, please feel free to drop me a line at [email protected]. We at InGame love hearing from our readers.

A

Arbitrage – Taking advantage of the price difference between two contracts, whether on the same platform or a competitor platform, to lock in a guaranteed profit.

Example – A Yes event contract is listed at 50% on Kalshi. Crypto.com has No for the same event listed at 48%. If you buy both Yes and No you have spent 98 cents (50 + 48). No matter the result, you are guaranteed to profit 2 cents, since you spent 98 cents and the winning contract pays out $1.

Ask – The price at which a seller is willing to sell a contract

B

Bid – The price at which a buyer is willing to purchase a contract

Example – If you’d like to buy a contract on Kalshi, you will see prices for two outcomes: Yes and No. The number next to each outcome is the bid price because you’re “bidding” on the contract as the buyer.

Binary – A contract that only has two possible results. On prediction markets, the result is Yes or No. There is no other possible outcome. While there are exceptions, just about every contract available on prediction market platforms is binary.

Blockchain – A decentralized ledger that stores records across a network. Each transaction is a “block” that is listed in order, creating a “chain.” Records cannot be altered and are permanently recorded.

Example – Polymarket uses the Polygon blockchain network to record all the contract transactions made on its platform. This way, everyone can see every transaction because all the records are anonymous and public. Not every prediction market platform uses blockchain technology, but it is an efficient method to manage transactions that many users are familiar with.

C

CFTC – Commodity Futures Exchange Commission. The CFTC is the primary federal regulator for all the prediction market platforms operating in the US.

Contract (see Event Contract) – An agreement between a buyer and seller related to the outcome of a future event. The platform operator (Kalshi, etc.) acts as an intermediary between the parties. Contracts are priced between $.01 and $.99 and are worth $1 if the predicted event occurs. Some operators offer $10 and $100 contracts, but most are $1.

Counterparty – The other side of a contract. If you’re a buyer, the counterparty is the seller. If you’re a seller, the counterparty is the buyer.

D

Designated Contract Market – According to the CFTC, Designated Contract Markets (DCM) are “exchanges that operate under the regulatory oversight of the CFTC. DCMs may list for trading futures contracts based on any underlying instrument.” Most prediction market platforms have been approved by the CFTC to operate as a DCM.

E

Event – Something that happens in the future. Every market listed on a prediction market platform is tied to an event that will occur in the future.

Event Contract – An agreement between a buyer and seller related to a future event. Event contracts are traded on prediction market platforms, which act as the middleman, facilitating the contract and ensuring the winning party receives the proceeds.

Exchange – A company that provides a platform with rules and regulations in place to facilitate the buying and selling of event contracts. Buyers and sellers use the exchange to trade with each other. The exchange manages the logistics related to pricing and executing of the contract and ensures both parties can settle the contract at the appropriate time. Exchanges earn revenue by either charging users a fee to buy and sell contracts, taking the excess spread when the two sides of a contract add up to more than 100%, or both.

F

Future(s) – A contract related to an event that takes place in the future

Futures Commission Merchant (FCM) – An entity or individual set up to accept orders related to futures contracts. FCMs are members of the Futures Industry Association, but aren’t always licensed and regulated by the CFTC.

H

Hedging – Buying or selling additional contracts to reduce the risk related to an existing position

Example – A trader has 1000 Yes contracts priced at 65 cents. His exposure is $650, and he can make $1000 if his position pays off. He wants to hedge his position to shield himself from losing all his money. He sees a price change and buys 250 No contracts at 40 cents, which cost him $100. Now he has paid $750 total, but his maximum loss will be $500 ($750 cost – $250 profit), down from his original $650 exposure. He will earn $250 total profit ($1000 profit – $750 cost) if the 1000 Yes contracts pay out. His maximum potential profit has been reduced, but so has his maximum potential loss.

L

Limit order – The maximum amount a buyer is willing to pay or accept for a contract. Buyers can set a limit order, and if a seller is willing to fill that order within a certain timeframe, the contract is agreed to. Likewise, sellers can set a limit order that is only filled if a buyer agrees to the price.

Liquid (liquidity) – A metric that shows how much the trading of contracts affects the price. A liquid market means that the price doesn’t move much at all. In an illiquid market, each trade causes the price to move one way or the other.

M

Market – An offering on an event contract platform. There can be many markets connected to an individual event, like an NFL football game. A market can also be connected to just one event, like an election. Thousands of markets are available on all the biggest prediction market platforms.

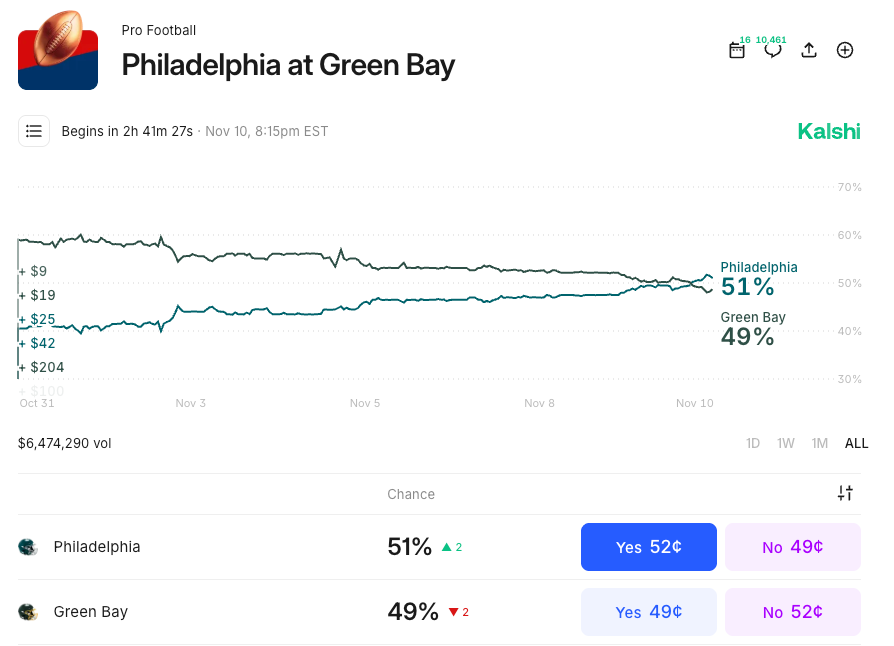

Example – Green Bay is playing Philadelphia in a big Monday Night Football game. In the screenshot below, the market is which team will win the game and includes four contract options.

The same game has additional markets connected to it. The second screenshot shows two more markets: whether Philadelphia will win by over 2.5 points and whether over 44.5 points will be scored.

Market maker – A market maker creates liquidity in the market by continually being the counterparty to someone who wants to trade. Market makers are the other side of the contract that a market taker initiates.

Market price – The price at which a contract is currently trading. The market price of a contract almost always fluctuates, sometimes going up and down significantly within seconds. The market price is driven by demand for the contract. If there is more demand, the market price will go up. If demand lessens, the price will go down.

Market taker – A market taker is someone who accepts a listed contract price. They do not determine the price; by “taking” the listed price, they are the one who initiates the trade by agreeing to pay a certain price for a contract.

O

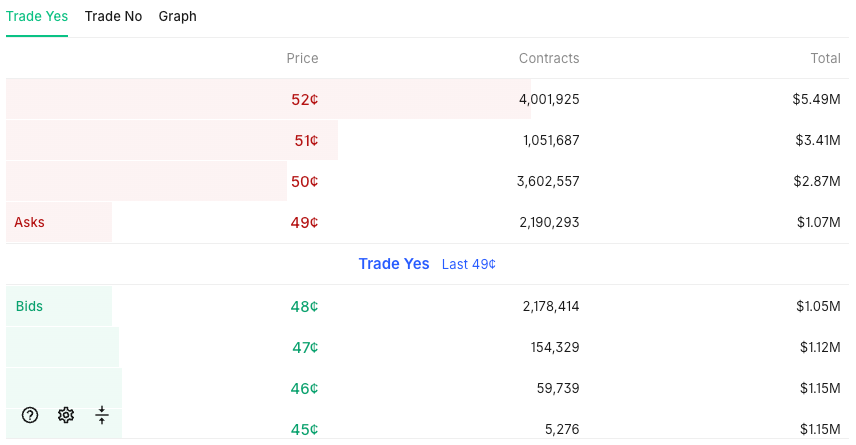

Order book – Exchanges often display an order book for each market, which is a list of buy and sell orders updated in real time. This is a great tool for price discovery and to see what traders are willing to pay for contracts related to the event.

Outcome – The result of an event. When the outcome of a future event is officially determined by a platform, the contracts resolve accordingly. In any sporting event, when the game or season is over, the outcome is determined. Contracts on the winning team or individual are paid out because the outcome resolved in their favor.

P

Payout – The amount of money transferred to users with “winning” contracts. Payout is determined by the outcome of an event. All contracts are “cleared” by the platform, and payout occurs at a predetermined time after the event has officially ended.

Platform – A web-based exchange that facilitates event contract trades between users. Kalshi, Polymarket, and Crypto.com are the biggest prediction market platforms in the industry. The companies are federally regulated neutral parties that only match buyers with sellers.

Position – An open contract is a position in the market.

Example – A user has 100 Yes contracts priced at 54%. That is her position. If she sells her contracts, she has liquidated her position. If she buys more contracts for the same event at a different price, she has added to her position. If she buys 100 Yes contracts in a different market, she has two positions, one for each market.

Prediction market – The exchange of contracts related to the outcome of future events. Buyers and sellers buy contracts that “predict” a future event. The market is all the contracts bought and sold related to the event. A platform such as Kalshi or Polymarket uses its online platform to offer prediction markets on thousands of different future events.

Probability – The likelihood of an event occurring. In prediction markets, it is measured as a percentage between 1 and 99.

R

Resolution (see Outcome) – After an event has concluded and the outcome has been confirmed by the operator according to the published rules listed on the event page, the event is resolved to either Yes or No. The resolution is the official determination of the outcome of the event.

S

Settlement – When an outcome has been confirmed by the operator according to the public rules, the next step is settlement. This is when all contracts deemed to have “won” are paid out. The settlement occurs when holders of said contracts receive their funds from the operator.

Slippage – The difference between the price a user agreed to when an order is placed and the actual price when the contract is processed by the operator. Slippage occurs when the market is volatile and prices are changing very quickly. Slippage can work both ways; prices can become more favorable to the buyer or less favorable depending on the price movement.

Example – If you’re watching an NCAA basketball game and the favored team gets behind early, you see the price shift and want to buy some Yes contracts on the favored team at a better price. You try to get your order in while the favored team is going on a 10-0 run, but by the time a counterparty agrees to take the other side of your Yes contract, the price has moved. The slippage was 5 cents between the time it took for you to place your order and the time it was filled.

Spread – The difference in price between the bid (buyer) and ask (seller) price of a contract. This may not be readily apparent because there is just one price listed for a Yes or No contract, but the Order Book displays the spread for each market listed on an operator’s platform.

Example – An upcoming NBA game was attracting a lot of volume. The prices were moving, but the spread was staying consistent at just one cent. Traders weren’t far off on the price for a contract related to the outcome, which means the market was liquid and efficient.

Stablecoin – A cryptocurrency pegged to an asset, usually a major currency or commodity. Polymarket uses the USDC stablecoin for all transactions on the platform. It is directly pegged to the US Dollar.

T

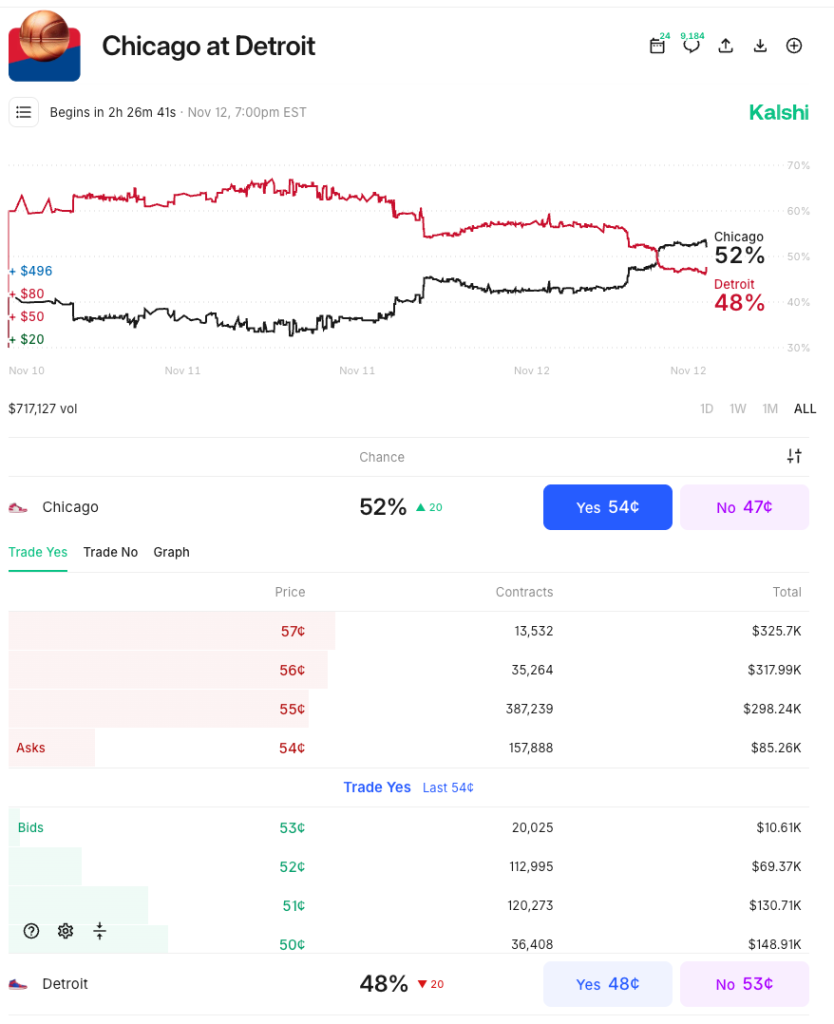

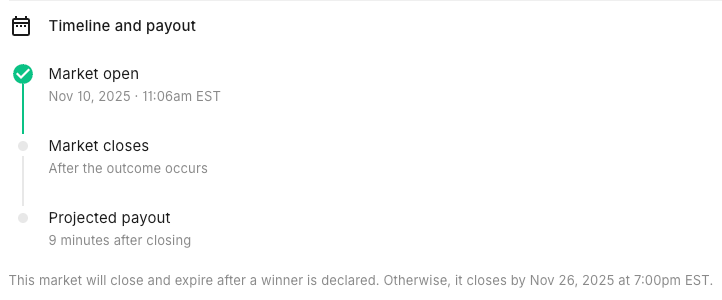

Timeline – The dates during which a market is open and trades can be executed. The timeline for an event begins when the market opens and ends when the payout occurs. See the screenshot below for an example of a timeline.

Trade – The act of buying or selling an event contract on a prediction market platform. Buyers and sellers trade contracts on a regulated platform.

V

Volatility – How much the buy and sell prices in a market go up or down over a certain amount of time.

Volume – The total dollar amount of contracts traded in a market over a certain period of time.

Prediction market glossary sources

The definitions on this page are my own, but I drew from several online sources during my research for this glossary. To dive deeper into the world of prediction markets or to check my work, I recommend checking out the following financial glossaries.