An Arizona congressman on Monday issued a letter directed to the acting chairwoman of the Commodity Futures Trading Commission (CFTC), Caroline Pham, raising concerns about a new partnership between Kalshi and CNN, calling it “outright dangerous.”

Republican Congressman Abe Hamadeh (AZ-08), whose district contains parts of Phoenix and Surprise, writes that constituents have “raised alarm bells about a media company with a long-documented record of partisan manipulation now positioning itself to influence and profit from geopolitical events in real time.” Hamadeh claims that the partnership is not merely “inappropriate” but “outright dangerous.”

Announced on Dec. 2, the stated intention of the partnership between the burgeoning prediction markets platform and the cable news organization is to enhance CNN’s coverage with “fresh, data-based angles from which to explore and better understand the world around us,” according to CNN SVP of Strategic Partnerships and Business Development Sam Felix.

CNN will not be paying Kalshi to license Kalshi’s data as part of the exclusive arrangement, Axios reported. Per Tarek Mansour, CEO of Kalshi, whose company and markets will gain broad visibility across CNN platforms including within CNN Chief Data Analyst Harry Enten’s reporting, CNN will “look to establish itself as the most authoritative source of information about the real-time probabilities of major cultural and political future events.”

Meanwhile, Rep. Hamadeh and some of his constituents have a much different perspective on CNN and its credibility, and likewise he takes a dim view on the marriage of Kalshi, real-money wagering, and the infusion of Kalshi data into CNN’s reporting.

“No other major media outlet has attempted such a partnership, and for good reason: it creates a built-in structural conflict of interest that allows an influential news organization or foreign adversaries to shape outcomes for financial or competitive advantage,” Hamadeh writes, adding later that CNN has “faced persistent concerns regarding accuracy, impartiality, and narrative framing.”

‘I have questions’

Kalshi and its chief rival (for now) Polymarket have forged other media or quasi-media partnerships in recent months. In November, both Kalshi and Polymarket struck a partnership with Google Finance in which market data will help populate AI-generated responses to certain queries. In October, Kalshi odds were integrated into Bloomberg terminals. Yahoo Finance has also begun to incorporate Polymarket markets and pricing, while Time magazine is partnering with a platform called Galactic, which is licensed by the CFTC as a designated contracts market (DCM) to facilitate exchange trading.

“The situation is chilling, and I have questions,” writes Congressman Hamadeh regarding the CNN-Kalshi tie-up. Hamadeh focuses on one section of the Commodity Exchange Act pertaining to “contracts involving war, gaming” or those “contrary to the public interest,” including markets “vulnerable to manipulation or capable of influencing underlying events.”

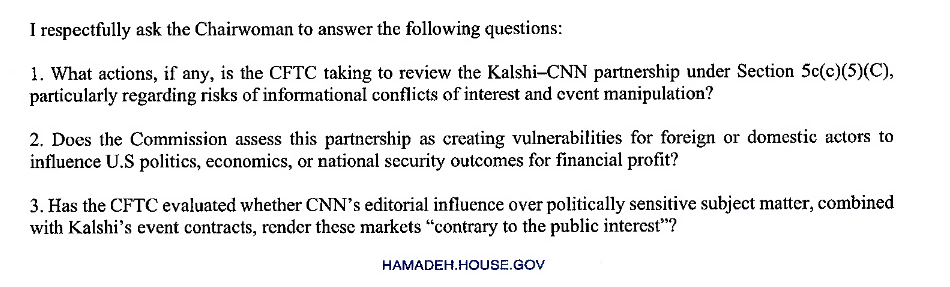

“I want to know what actions the Commodity Futures Trading Commission is taking to review the Kalshi–CNN partnership under Section 5c(c)(5)(C),” he writes, “particularly regarding risks of informational conflicts of interest and event manipulation. We need to know if the Commission is assessing this partnership to see if it is creating vulnerabilities for foreign or domestic actors to influence U.S politics, economics, or national security outcomes for financial profit.”

That clause appears to pertain to the offering of certain contracts — rather than put some limitation on a media integration between a licensed exchange and a media entity.

Hamadeh goes on to suggest that bad actors may attempt to manipulate markets, using CNN as a conduit.

“I am not surprised that a media entity that has faced persistent concerns regarding accuracy, impartiality, and narrative framing would allow the potential for foreign governments, domestic political groups, or adversarial actors to escalate tensions, manipulate narratives, and pressure institutions in order to profit through Kalshi’s event-contract platform,” he writes.

As prediction market company valuations have soared during the course of 2025, trading volume increased, especially in the sports realm, and many observers have raised concerns over the potential for both rampant insider trading as well as market manipulation.

One controversy around a war-related market occurred on Polymarket on Nov. 15. The question centered on the Russia-Ukraine war and a market involving a possible advancement by Russian forces. To settle the market, Polymarket — which has the necessary licensing but is not yet fully active in the U.S. — depended on a map created and curated by the Institute for the Study of War (ISW), a Washington, D.C. think tank. Here is what ensued:

“It has come to ISW’s attention that an unauthorized and unapproved edit to the interactive map of Russia’s invasion of Ukraine was made on the night of November 15-16 EST,” read a release from ISW. “The unauthorized edit was removed before the day’s normal workflow began on November 16 and did not affect ISW mapping on that or any subsequent day.”

The market apparently settled based on the alteration and, according to Responsible Statecraft, ISW “quietly removed the name of one of its Geospatial Researchers as a creator of the daily Ukraine maps published by ISW and took his name off the website,” and reported that the person had been fired.

State of CFTC

Currently the CFTC has only one commissioner, Pham, following the resignations this year of commissioners Summer Mersinger, Christy Goldsmith Romero, and Kristin Johnson. On Nov. 20, the Senate Committee on Agriculture, Nutrition, and Forestry voted to advance Michael Selig’s nomination to become the new chair of the agency. A full Senate vote on confirmation has not yet taken place.

To date, the CFTC has been largely silent on the activities of various licensed exchanges, even within its clear remit with respect to markets offered and other components of the 23 Core Principles and requirements for DCMs. Hamadeh appears to be going a step further, urging the agency to assess and regulate a media entity that is partnered with a DCM, potentially opening up First Amendment concerns.

The congressman concluded with four questions for Pham, and has requested a written response within 30 days.

Last week, the House Committee on Agriculture held a “stakeholder perspectives” session to discuss reauthorization of the CFTC, a process that potentially could involve clarifications about or changes to the agency, its staffing, and how it regulates.