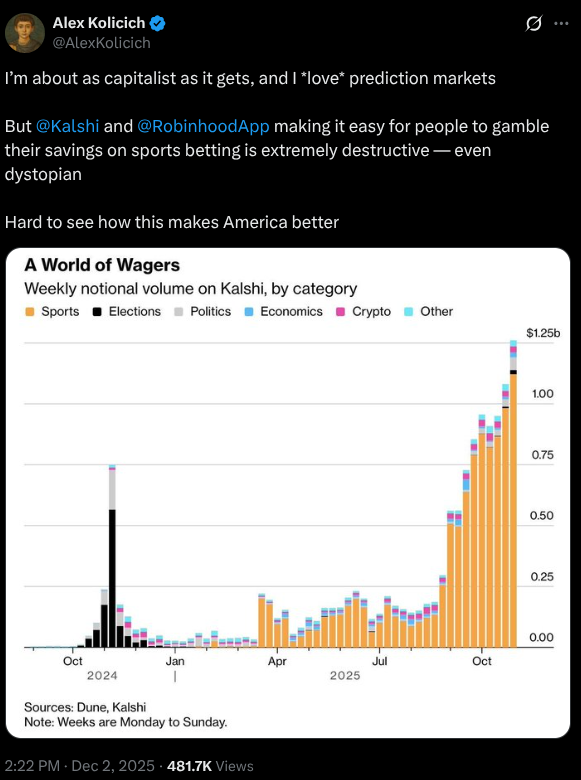

Everything is a gambling market now. Sports. Weather. Wars.

Everything is becoming a bankroll. Digital wallets. Crypto. Savings.

Prediction and exchange markets like Robinhood, and likely others in the future, commingle the bet and the funding source in a convenient app form made to make every whim actionable with a few taps. The kids are apparently into it. The companies that want to cater to this coveted young demographic are counting on it.

“My God, that sounds horrifying,” Prof. Joshua Shuart, a gambling expert at Sacred Heart University in Connecticut, told InGame. Shuart said an “astounding” percentage of his students – most of whom are upperclassmen of legal betting age – wager on sports, with prediction markets being more popular with those interested in finance.”

Mingling these spaces, he said, is fraught with concerns.

But prediction markets and exchanges having been building out this new reality for months. Said Kalshi attorney Josh Sterling at the National Council of Legislators from Gaming States [NCLGS] conference in July: “Every company out there that I represent, even the ones that I don’t, are trying to build the everything app on their phone because that’s how people aged 25-35 view their portfolio. They want to trade stocks, zero data expiry options, crypto, FX, events, horses. You name it, they want to trade it because they view that as their financial portfolio. So this isn’t your mom or your dad calling E.F. Hutton to trade stocks at $20 or whatever. This is people trading anything and everything that they can.”

Sometimes, to excess.

Elliott Rapaport, the CEO of the Birches Health gambling addiction recovery platform, told InGame that “constant access to gambling or gamification plays a major role in how quickly problems can escalate.”

“We see patients from all facets of gambling, trading and video gaming,” he said. “We see everyone from individuals who are engaged in traditional online casino, online slots, online lotto, online sports betting. But then we also see individuals who are engaged in financial trading, whether that’s through prediction markets or through traditional stock markets, and in many ways, the gamified nature with some of the very large online trading platforms, including cryptocurrency.”

Traditional gambling companies like DraftKings, Corey Gottlieb, its chief product officer told InGame, are devising ways to lump more gambling products into one app. But that approach doesn’t engender the concern from industry insiders and observers of the one-stop app of the future that Sterling described.

This, they say, might all end up very badly, particularly for young gamblers or speculators, or players with addictive predilections. Quick access to savings or investments for use as gambling funds, without the responsible gambling firewalls employed by sportsbooks, they add, make for catastrophic possibilities.

“It’s exciting for that developer, sure, but any of the all-in-one stuff is just a horrible issue,” Shuart continued. “[But] you’re just asking for problems, especially when you’re talking about either people who are in need of money or have some expendable money.

“On one hand, it’s so cool. We grew up as people who stood up and walked across the room and changed the channel [before] the remote control. Now can do everything [on a phone]. You just tap and you’re like, ‘Oh, here I am in my 401k.’ Like that’s that just blows my mind.”

There is concern from within the industry, also.

“It’s something I’m very concerned about, personally,” Sporttrade founder and CEO Alex Kane told InGame. “We are really concerned about the unchecked nature of this. And I do agree, mixing 401k and any sort of speculation, not a good idea. A lot of it exists already. Not to point fingers, a lot of it exists already.”

There are incentives to tread carefully. If operating in a manner that’s potentially less corrosive to customers isn’t worthy enough, there’s the protection of a bottom line in an industry that’s booming. Kane speculates the sector would generate only about 60% of potential revenue if it was “completely reckless.” He also envisions the possibility of something enduring with the proper guardrails. Key among them, most observers say, is preventing the quick liquidation of financial accounts for use in wagering on the wares of these expansive apps.

Sporttrade, which describes itself as a regulated prediction market for sports betting, and is seeking a designated contract market (DCM) license with the Commodity Futures Trading Commission (CFTC), does not mingle finance and wagering.

“All we can do is try and encourage and advance a responsible and sustainable market structure,” Kane continued. “I just sincerely hope the adults in the room come forward and say, ‘We don’t need people taking $100,000 in retirement money to bet on the Eagles. We don’t need slot spins. We don’t need to do all this ridiculous marketing, making people bet every single day.

“We don’t need to do that. Let’s build great products that people love and then have them use them responsibly.”

Schwab CEO Rick Wurster, who has said he is amenable to eventually producing a prediction market, sees sports event contracts as troublesome for younger investors.

“I hope as an industry, we’re able to tell the story to clients about the difference between gambling and investing,” Wurster said during his keynote speech at the Schwab IMPACT conference in Denver in November. “I just don’t want young people in our country that think that betting on the Monday Night Football game is equivalent to being invested for the long term in stocks and bonds.”

Merging of speculation, betting continues

Meanwhile, prediction markets continue to measure themselves as much by their ambitious and controversial event contracts as by their investment successes. The machinations of their young, monied and bold leaders don’t radiate concern over the welfare of their customers. At the same NCLGS conference in Louisville, Ky., Sterling proclaimed: “People are adults, and they’re allowed to spend their money however they want. And if they lose their shirt, that’s on them.”

But the speed with which they can do it, and the things they can lose their shirts on are increasing. Just the like the amount of apps offering these opportunities.

Speaking at the Citadel Securities Future of Global Markets Conference in December, Kalshi founder and CEO Tarek Mansour said: “You know, ‘Kalshi’ is ‘everything’ in Arabic. The long-term vision is to financialize everything and create a tradeable asset out of any difference in opinion.” Kalshi doesn’t currently offer the investment component of buying stocks or cryptocurrency like Robinhood and Crypto.com, but Coinbase, a crypto market, plans to begin offering stock purchasing and prediction markets soon.

Kane said the cost advantages for brokers of a single-deposit location will continue to make multi-use apps attractive. He hopes that the value that these markets have amassed — Robinhood has a market capitalization of $103.6 billion — will incentivize responsible growth.

“I really believe that these companies, Robinhood and others, you’re getting what the [first version] looks like, but V2? V3?,” Kane pondered. “They’re going to grow up and they’re going to continue to do things really responsibly, because they’re going to prioritize sustainability over a quick land grab.

“Because if [business] goes away … think about what that would mean for the enterprise value of a stock like Robinhood, if this just went away tomorrow. Not good. And so there’s actually a dollars and cents reason as to why this should be done responsibly. And all we can do at Spottrade trade is try to be a leader by example. And hope that other people feel the same way.”

Sporttrade’s responsible gambling tools include self-exclusion from betting, cooling-off periods, and limits on spending, wagering time, and deposit amount.

Day traders vs. bots, hedge funds

Future “everything app” speculators, flitting through their sports bets and stock portfolios, will not necessarily be hustling against like-minded young investors. They could become fodder for professionals proliferating these kinds of exchange apps, Daniel Zimmermann, the CEO and founder of Verse Gaming, a sports prediction app, said. In an AI-powered and bot-manipulated future trading environment, or one underpinned by insider traders, they might not stand a chance.

“For better or worse, we are entering a world where my betting activity is going to become Dan’s hedge fund,” Zimmermann said. “I’m going to be out there on the market, just like you do with your stocks that you would like to invest in, but I’m going to be out there in the arena, trading against literal hedge funds, who market-make for these platforms.

“That was something that was going on in some form or fashion with sportsbooks with each other in the past. But this is a whole new ballgame where you might actually be trading against, in a year or less, DraftKings through a prediction market. So not only is pricing going to get extremely sharp, it’s going to be a profession. It’s still going to be gambling, but I think the level of skill required is going to actually make a meaningful difference.”

Zimmermann said because of the speed with which prediction markets have expanded, with minimal pushback from an understaffed CFTC, establishing guardrails is “going to be left to the nerds like us for the first couple of years.” With the rise of sports events contracts in 2025, prediction markets have routinely “self-certified” new bet types, even expanding into parlays. The CFTC, which has jurisdiction to review and disallow these new offerings, did not push back on any of those sports markets last year.

Zimmermann wonders if the next wave of one-stop app customers will actually be loyal to just one app, whether it be Robinhood, which launched in 2013, or an expected roster of competitors.

“Generally speaking, what platform someone places their bet on, I think operators care way more about that than the users do,” Zimmerman said. “I think a lot of users see different apps as means to an end of their ultimate goal, which is betting on something they care about. You saw this with Robinhood, kind of making stock trading cool and accessible for the common man.

“I do think it’s almost a trope at this point, there being an everything app. But I think there’s a real chance, for the first time in our lives, this decade actually has multiple everything apps. And the mindshare battle for those apps will be tens of billions of dollars spent and wagered.”

A potential high cost, experts say, on multiple fronts.