Robinhood’s launch of Kalshi parlays has helped turn them into a serious part of Kalshi’s business, with combo bets making more money in fees for the exchange last Sunday than non-sports events have ever made in a single day.

Parlays are still a dramatically smaller portion of Kalshi’s business than they are for leading sportsbooks. However, they have gone from a fringe item to a significant contributor to the exchange’s overall fee revenue on the days of major NFL games.

The day of the conference championship games set new records for overall volume and fee revenue on Kalshi, based on InGame’s analysis of Kalshi’s fees. Users traded $543.1 million worth of contracts in total and the exchange made $5.46 million worth of fees. Of that volume figure, $505.8 million, or 93%, was on sports.

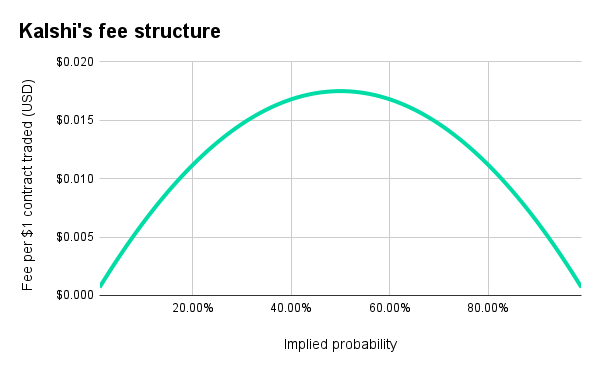

The fees measured here are “taker” fees. Kalshi also charges “maker” fees for resting orders that are accepted by other traders, but these only exist on some markets and are often canceled out by fee rebates for large market makers or incentive programs for smaller ones. For parlays in particular, it is likely that all market makers would be receiving some form of rebates or incentives.

On the week of the games, Robinhood, which offers access to Kalshi’s sports contracts through its “predictions hub,” started offering access to Kalshi parlays. Even without parlays, Robinhood had been responsible for the majority of trading volume on Kalshi.

It appears that Robinhood had a noticeable effect on parlay activity when it launched, as parlay volume surged to record highs, easily breaking the previous records set on Christmas Day.

Parlay fees top daily non-sports record

Fees from parlays on Sunday came to $546,275.

Parlays brought in almost 10% of Kalshi’s fee revenue on the day of the conference championship games, a 42% increase from the previous Sunday, or a 19% increase from the record set on Dec. 25.

The figures represent a dramatic increase from Kalshi’s early weeks of parlay revenue. On the first NFL Sunday after Kalshi rolled out parlays, the bets brought in less than $1,000 worth of fees.

The amount Kalshi made on fees on parlays alone on Sunday was significantly more than the exchange’s average daily fee revenue in August, before the start of the NFL season led to a dramatic increase in trading activity.

On the day of the conference championship game, parlay fees on Kalshi were higher than non-sports fees for the exchange for any day in its history, which peaked at $498,942 on Election Day 2025, Nov. 4, including the New York City mayoral race. Non-sports fees would have been much higher — well into the millions of dollars — on the day of the 2024 presidential election, but Kalshi removed fees for election trades at the time as a promotional effort.

Parlay handle likely topped $11 million

Parlay volume came to $124.1 million, more than a fifth of Kalshi’s total volume for the day. However, volume arguably overrepresents the level of parlay activity on Kalshi, because most users can only bet on “yes” outcomes on these bets and the bets tend to be at longer odds.

If a user places a $1 parlay on a sequence of events priced at 1% odds, this counts as $100 of volume, because their counterparty, usually an institutional market maker, has staked $99 on the parlay failing to hit. As a result, it is likely not the best measure of parlay activity.

However, unlike most types of trades on Kalshi, it is possible to calculate the equivalent handle on Kalshi parlays. As Fifty Cent Dollars Substack author Adhi Rajaprabhakaran noted in October, parlay handle can be calculated by simply looking at the volume on the “yes” side.

On Saturday, parlay handle exceeded $5 million, despite no NFL games taking place that day. On the day of the NFC and AFC Championship Games, parlay handle hit the eight-figure mark for the first time, at $11.6 million.

Parlay handle cannot be easily compared to handle from other types of bets on Kalshi, because most markets allow users to buy and sell both “yes” and “no” sides of a trade.

While the Robinhood integration coincides with a week-on-week rise in volume, it is not clear how much of the rise is directly due to Robinhood, as Kalshi does not break that down. The increased attention on conference championship games and the general trend of rising parlay activity on Kalshi likely also contributed to the increase.

Robinhood charges a flat one-cent fee for every dollar traded on top of Kalshi’s variable fee. In practice, this means that fees for bets at longer odds, which most parlays are, make up a particularly large share of the original stake. Thus, most parlays on Robinhood, especially those with a large number of legs, are extremely poor value for the bettor.

Though Robinhood’s partnership with Kalshi has been lucrative for both companies, the stock-trading app plans to create an exchange of its own. Robinhood last year bought an exchange that is already registered with the Commodity Futures Trading Commission (CFTC). It will continue to offer access to Kalshi markets, but the proprietary exchange is likely to be its main focus for trades on major events, such as NFL playoff games.

Sportsbooks still dwarf Kalshi in parlay activity

However, the total is still tiny compared to the sportsbook industry. State-regulated sportsbooks made more than $1.6 billion in total revenue last January and have been setting revenue and handle records during the 2025 NFL season, while data from states that report parlay revenue suggests that those bets make up the majority of sportsbook revenue.

That would suggest parlay revenue from sportsbooks this January could approach $1 billion, with revenue likely concentrated on NFL playoff game days.

The real financial beneficiaries of parlays, though, may be market makers, who can price the bets at shorter odds than their real probabilities and make money when the bets resolve to “no.” The quick request-for-quote process that Kalshi uses for parlays means that few parties have an opportunity to compete to offer the best price, and parlays are a reliably high-margin product for sportsbooks.

The identities of the market makers on the other side of Kalshi parlays are not known. However, one of Kalshi’s major overall market makers is Kalshi Trading, which is owned by the parent company of the Kalshi exchange. If Kalshi Trading is a market maker on parlays, it may make additional revenue from these bets on top of the fees it receives. Other large Kalshi market makers include Susquehanna International Group.

If market makers are earning a similar hold on parlays to sportsbooks, which usually hold upwards of 15% of parlay handle according to Casino Reports data, they would have made well over $1 million on Sunday.

The rise of parlays also appears to be dragging down Kalshi’s fee revenue as a percentage of volume. Kalshi charges fees that vary, depending on the odds of the contract, in order to prevent fees from being an exceptionally large share of a traders’ stake or potential winnings. In practice, this means that fees as a share of volume are higher for bets at close to 50% odds and lower for bets closer to 1% or 99%.

Before the start of the NFL season, Kalshi’s fees as a percentage of overall volume was right around 1%. During the season, this percentage rose to around 1.2%, as more sports bets are at close to 50% odds. However, the average fee rate has tipped back toward 1%, thanks in part to the increase in parlay bets at longer odds.

Parlays likely to set more records on Super Bowl Sunday

Parlay volume and overall volume are likely to set new records on Super Bowl Sunday. Ahead of the game on Feb. 8, Kalshi also got a boost to volume as Coinbase also went live with its offering of Kalshi contracts.

The continued rise of parlays, a major source of revenue for sportsbooks, on Kalshi has increased questions about the extent to which the prediction market is taking business away from sportsbooks, or whether it is simply adding to the size of the market.

This week, Needham analyst Bernie McTernan told CNBC that he believed prediction markets could be an “asset” for DraftKings and FanDuel’s parent Flutter Entertainment.

“In regulated markets, we still think online sportsbooks offer a better sports product,” he said, adding that he believed that prediction markets’ main advantage is unlocking new markets, both geographically and in terms of non-sports bets, which he said have significant room to grow.

FanDuel and DraftKings appear set to launch their own prediction market parlays ahead of the Super Bowl. Their prediction market partner CME self-certified a multi-leg football contract with the Commodity Futures Trading Commission (CFTC) Tuesday.